An Interest Charge Domestic International Sales Corporation (IC-DISC) is a tax-exempt, domestic corporation set up to receive commissions on qualified export sales. It must have its own bank account, keep separate accounting records and file U.S. tax returns. It does not need to have an office, employees or tangible assets nor is it required to perform any services.

Tax Benefit

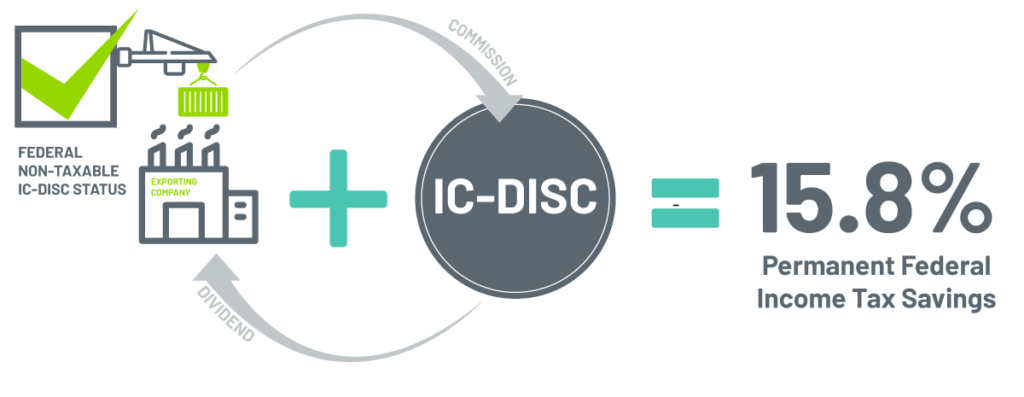

15.8% permanent tax savings by converting ordinary income into qualified dividend income (subject to NIIT).

How Does an IC-DISC Work?

- Owner-managed exporting company qualifies for and creates a tax-exempt IC-DISC

- Exporting company pays IC-DISC a commission on the sale of qualified export property

- Exporting company deducts commission from ordinary income taxed at rates up to 39.6%

- IC-DISC pays no tax on the commission income

- Shareholders of an IC-DISC must pay income tax on dividends at qualified rates up to 23.8%

- Results in a 15.8% permanent tax savings

What is Qualified Export Property

- The property must be manufactured, produced, grown or extracted in the United States:

- conversion cost incurred in the U.S. constitute 20% of COGS

- there is substantial transformation in the U.S.

- the operation in the U.S. is generally considered manufacturing

- The property must be sold for direct use outside the U.S.

- The property must have a maximum of 50% foreign content

Who Qualifies for the IC-DISC?

- Manufacturers & distributors that directly export their products

- Manufacturers & distributors that sell products that are destined for use overseas

- Architectural and engineering firms who work on projects that will be constructed abroad (even though the work is performed in the United States.)

- Pass-through entities and privately held corporations

ONE

Exporting company creates new entity and elects federal non-taxable IC-DISC Status

TWO

Exporting company pays commission to IC-DISC realizing a 39.6% Federal tax deduction*

THREE

IC-DISC pays qualified dividend to exporting company taxable at 23.8%*

Contact Us

For more information or to discuss your business needs, please connect with a member of our team.