Are you taking advantage of the Research & Development Tax Credit? As one of the largest and most broad corporate tax credits available, there’s a good chance your business qualifies. Our R&D Tax Credit Services Team can determine your organization’s eligibility and maximize the amount of savings you can receive.

What is the R&D Tax Credit?

The Research & Development Tax Credit is one of the largest dollar-for-dollar federal and state corporate tax benefits in the Internal Revenue Code. Over 30 states offer R&D credit, and businesses are eligible if they participate in activities involving the design, development, and improvement of products, software, or processes. There’s no limit on the amount that can be claimed on each return, and the credit can be back-dated to the previous year or rolled-over to the following year.

Do You Qualify for the Research and Development Tax Credit?

R&D Tax Credits can be rewarded for many tasks being performed by all types of taxpayers, including but not limited to: Pharmaceuticals, Aerospace and Defense, Banking/Insurance, Retail, Manufacturing, Financial Services, Small Tech start-ups, etc. To be eligible for the R&D tax credit, companies must meet these minimum qualifications, even if they are not taxable:

- Incurred Gross Receipts For Five Years Or Less

- Realized Less Than $5 Million In Gross Receipts in The Year The Credit Is Taken

- Incurred Qualifying Research Activities and Expenditures

- Participated In a Qualified Payroll Program

The R&D Tax Credit for small businesses

With the recent introduction of the R&D payroll offset, qualified small businesses are able to elect to apply the R&D credit towards their payroll tax liability rather than their income tax. This is a major new development, allowing many taxpayers that normally would not qualify for the R&D Tax Credit (due to insufficient bottom-line Taxable Income) to investigate their potential benefit (with Withum’s Assistance). Withum’s R&D Tax Specialists are here to keep you updated and informed on everything related to the Research and Development Tax Credits.

How to Uncover Your Potential R&D Tax Benefits

The R&D Tax Services Team specializes in determining your full eligibility through an R&D Tax Credit study —a careful analysis that looks at qualifying activities and expenses.

An R&D Tax Credit study involves generally 2 main areas:

- Quantitative (or the numbers ultimately required to be filed with the tax return)

- Qualitative (or the supporting documentation).

Uncovering this data for specific taxpayers is a unique skill that should be performed by qualified tax professionals. Our R&D Tax Credit team has performed R&D studies (as well as supporting those claims on audits) for all industries, and have been battle-tested in all types of client and IRS environments.

In order for an activity to qualify for the Research and Development Tax Credit, it must meet each part of the follow 4-part test:

1. Technological in Nature Test

2. Permitted Purpose Test

3. Technical Uncertainty Test

4. Process of Experimentation Test

Computer Software developed for internal general and administrative functions are subject to three additional “high threshold of innovation” R&D credit tests.

1. Innovation Test

2. Significant Economic Risk Test

3. Commercially Available Test

How to Identify Qualified Research and Development-Expenditures

The best way to maximize your credit amount is to work with R&D tax specialists. However, this list can be a quick pulse check to determine your minimum credit eligibility.

You Pay Wages to Employees

Wages paid to employees who are developing or improving technology and products. These are Box 1 W-2 Wages for employees who directly perform, support or provide first-level supervision of the R&D.

You Invest in R&D Supplies

Supplies used in qualified research, including tangible property (other than land and depreciable property).

You Utilize 3rd Party Contractors

3rd party contractors who are paid to develop or improve technology and products. However, the taxpayer must retain substantial rights in the results, whether exclusive or shared.

You Rent or Lease Computers

Rental or lease cost of computers includes payments made to cloud service providers that are related to hosting software under development.

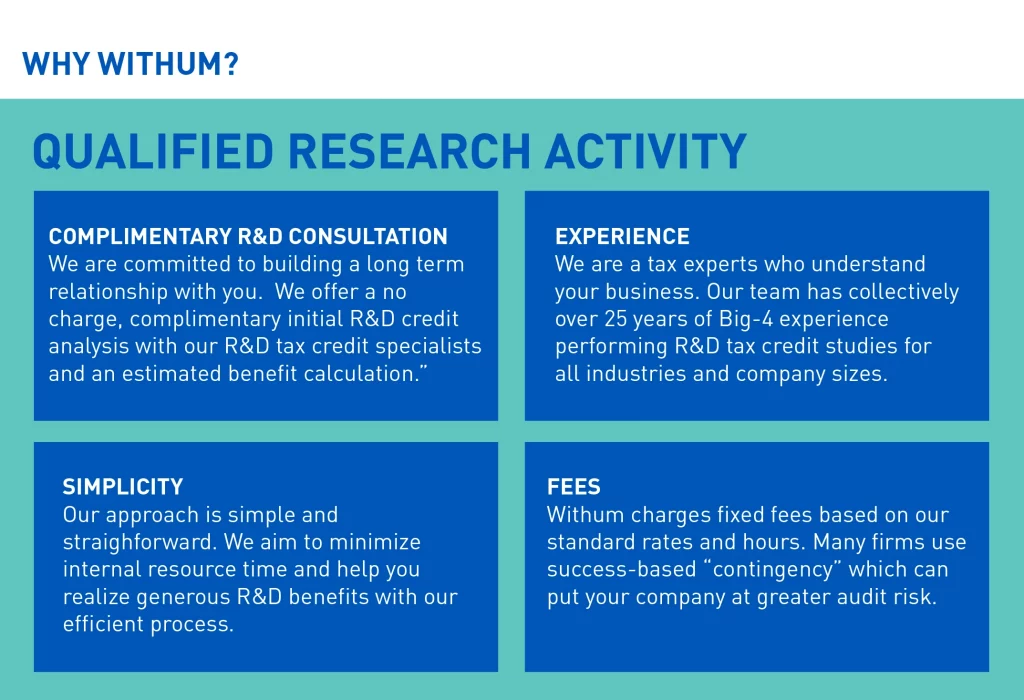

Why choose Withum for R&D Tax Credit Consulting Services

At Withum, our R&D Tax Credit Services Team takes a four-part approach to helping organizations maximize their benefits.

Contact Us

For more information or to discuss your business needs, contact Withum’s Tax Services Team.

Leadership

Insights

Research & Development Tax Credits for the Food & Beverage Industry

The R&D Tax Credit is a tax incentive that can be applied as a dollar-for-dollar offset against a company’s tax liability if they engage in activities related to the design […]

NYC Biotechnology Tax Credit: A Refundable Financial Incentive for Life Science Companies

The NYC Biotechnology Tax Credit offers a valuable financial incentive to investors and owners of qualified biotechnology companies. This credit can offset various taxes including business corporation tax, general corporation […]

Could You Benefit from a R&D Tax Credit Analysis?

With the continued requirement to amortize 2023 R&E expenditures, more companies are finding themselves in a position to pay income taxes. This is primarily because NOLs incurred after December 31, […]