Single

DEDUCTION AMOUNT:

$14,600

Married Filing Jointly

DEDUCTION AMOUNT:

$29,200

Head of Household

DEDUCTION AMOUNT:

$21,900

2024 Tax Brackets and Rates

Taxable Income Over

| Rate | Single | Married Filing Jointly | Head of Household |

|---|---|---|---|

| 10% | $0 | $0 | $0 |

| 12% | $11,600 | $23,200 | $16,550 |

| 22% | $47,150 | $94,300 | $63,100 |

| 24% | $100,525 | $201,050 | $100,500 |

| 32% | $191,950 | $383,900 | $191,950 |

| 35% | $243,725 | $487,450 | $243,700 |

| 37% | $609,350 | $731,200 | $609,350 |

2024 Long-Term Capital Gains Tax Brackets

Taxable Income (Including Capital Gains) Over

| Rate | Single | Married Filing Jointly | Head of Household |

|---|---|---|---|

| 0% | $47,025 | $94,050 | $63,000 |

| 15% | $47,026 – $518,900 | $94,051 – $583,750 | $63,001 – $551,350 |

| 20% | $518,901 | $583,751 | $551,351 |

Year-End Tax Strategies for Individuals

General Income Tax Planning

- Postpone income until 2024 and accelerate deductions into 2023.

- Doing so may enable you to claim larger deductions, credits, and other tax breaks for 2023 that are phased out over varying levels of adjusted gross income (AGI).

- Postponing income is desirable for taxpayers who anticipate being in a lower tax bracket next year due to changed financial circumstances.

- Long-term capital gain from sales of assets held for more than one year is taxed at 0%, 15% or 20%, depending on your taxable income. If you hold long-term, appreciated capital assets, and are in the 0% rate bracket, consider selling enough long-term assets to maximize the 0% rate in 2023.

- The 3.8% net investment income (NII) tax will apply depending on your modified adjusted gross income (MAGI) and NII for the year. You should consider ways to minimize or eliminate (e.g., through deferral) additional NII for the year, while trying to reduce MAGI other than NII.

- The 0.9% additional Medicare tax applies to individuals for whom the sum of their wages received with respect to employment and/or self-employment income exceeds a threshold amount ($250,000 for joint filers, $125,000 for married filing separately, and $200,000 in other cases). Employers must withhold the additional Medicare tax from wages in excess of $200,000, regardless of filing status or other income. Thus, you can minimize the additional Medicare tax by deferring income to 2024.

- Consider asking your employer to increase withholding of state and local taxes (or you can pay estimated state and local tax payments) before year-end to pull the deduction of those taxes into 2023. Remember that state and local tax deductions are limited to $10,000 per year until 2026, so this strategy is not a good one to the extent it causes your 2023 state and local tax payments to exceed $10,000.

- Consider relocating your residency and domicile for the purpose of reducing or eliminating your state income taxation. For example, common states where people move to reduce state income taxes are Florida, Texas, Wyoming, and Nevada.

- Consider increasing the amount you set aside for next year in your employer’s health flexible spending account (FSA).

- If you were in a federally declared disaster area, you may want to settle an insurance or damage claim in 2023 to maximize your casualty loss deduction. Confirmation regarding whether the damaged area is categorized by the IRS as a federal casualty loss or qualified disaster loss is important to avoid the 10% AGI limitation. A taxpayer can make an election to deduct a disaster loss in a federally declared disaster area for the year before the year in which the loss occurs. A calendar-year taxpayer who suffers a disaster loss in 2023 has until October 15, 2024 to make this election to deduct the loss for 2022.

Capital Gain Planning

- Should I sell stocks/bonds now or wait for the new year? Capital gain rates are always top of mind, especially for those with substantial unrealized gains or business owners looking to sell their businesses. An increase in capital gain rates, even by a few percentage points, could make the difference between selling now or later.

- With the volatility of the market many have seen a decrease in the value of their stocks. If there is a decision to sell loss stock in the 2023, individuals should remember that capital losses can be used only to offset realized capital gain and an additional $3,000 of ordinary income each year.

- While individuals might be motivated to sell stock during 2023 to capture the capital loss and purchase the same stock at a lower cost, the wash-sale rule could apply. The wash-sale rule prohibits selling an investment for a loss and replacing it with the same or a “substantially identical” investment within 30 days before or after the sale. If you do have a wash-sale, the loss will be deferred until the replacement investment is sold.

Estate Tax Planning

To give or not to give? The estate tax is once again becoming a hot button issue even with the lifetime exemption currently set at $12.92 million (and $13.61 million in 2024). The question is whether any gift given now that uses up the exemption will be grandfathered if there is a future reduction in the exemption amount (as there is currently expected to be in 2026). The IRS has issued favorable regulations preventing a claw back of the amount unless the taxpayer retained a significant amount of control after the transfer. If you have not done so already and are comfortable surrendering control of assets to the next generation, it might be a good idea to take advantage of the $12.92 million per individual lifetime exemption in 2023, or $25.84 million for a married couple.

Tax-Advantaged Accounts

- It may make sense to convert all or part of your eligible retirement accounts (e.g., traditional IRA) to a Roth IRA before year-end. However, such a conversion will increase your AGI for 2023, and possibly reduce tax breaks that are tied to AGI (or MAGI).

- Consider taking versus delaying required minimum distributions (RMDs) from your IRA or 401(k) (or other employer-sponsored retirement plan).

- The IRS announced it will not impose penalties on failures to take specified RMDs for the 2023 taxable year in relation to inherited IRAs.

Charitable Gifting

- Consider bunching charitable deductions in 2023, or making contributions to a donor-advised fund, so you increase your charitable deduction and therefore your itemized deductions fall above the standard deduction. The benefit on a donor-advised fund is that you can deduct the charitable contribution this year and allocate charitable funds from the donor-advised fund to individual charities in later years.

- Consider donating appreciated securities rather than selling such securities and donating the cash proceeds. This approach eliminates the capital gain tax you would pay on the sale and provides a deduction for the charitable contribution.

- Alternatively, consider selling depreciated securities from your portfolio to harvest the tax losses and then donating the cash proceeds. By doing so, you can recognize a tax loss that can offset any capital gain for the year or up to $3,000 of ordinary income, and you will receive a charitable deduction for your cash donation.

- Make gifts sheltered by the annual gift tax exclusion before the end of the year. The exclusion applies to gifts of up to $17,000 made in 2023 to each of an unlimited number of individuals. The annual exclusion increases to $18,000 in 2024.

- Consider making 2023 charitable donations via qualified charitable distributions from an IRA. When you reach age 70½, the amount of the contribution is neither included in your gross income nor deductible as an itemized deduction and the amount of the qualified charitable distribution reduces the amount of your RMD, which can result in tax savings.

- In 2023, individuals can make a deductible cash contribution of an amount up to 60% of their AGI. Deductions for non-cash assets held more than one year are limited to 30% of AGI.

Business-Related Planning for Individuals

QBI Deduction

- Businesses operating as sole proprietorships, partnerships, S corporations, and some trusts and estates may be entitled to a deduction of up to 20% of their qualified business income (QBI). If a qualifying taxpayer’s taxable income exceeds a threshold amount, then the deduction may be limited based on: whether the taxpayer is engaged in a specified service trade or business (SSTB, which includes businesses such as law, accounting, health, or consulting); the amount of W-2 wages paid by the trade or business; and the unadjusted basis of qualified property (such as machinery and equipment) held by the trade or business. The 2023 threshold amount is $364,200 for married filing joint returns and $182,100 for single returns.

- Taxpayers may be able to achieve significant savings with respect to the QBI deduction by deferring income or accelerating deductions to fall under the relevant threshold (or be subject to a smaller phaseout of the deduction) for 2023. Depending on their business model, taxpayers also may be able to increase their QBI deduction by increasing W-2 wages before year-end.

- The QBI deduction is scheduled to sunset as of December 31, 2025. With the QBI deduction sunsetting and individual income tax rate increasing to 39.6% at the same time, taxpayers could see their effective federal income tax rates increase as much as 10%.

2023 Year-End Tax Planning Resources

Withum’s Year-End Tax Planning Resource Center is a one-stop-shop for annual tax planning tips for individuals and businesses, legislative and regulatory changes and other tax-saving opportunities.

SALT Deduction Limitation Workaround

- Several states have passed legislation to circumvent the $10,000 state and local tax (SALT) deduction limitation (36 states in total including NJ and NY). In addition, New York City is allowing eligible entities to circumvent the SALT deduction limitation for taxable years beginning on or after January 1, 2022.

- The IRS has confirmed that pass-through entity tax (PTET) elections are effective workarounds to the SALT deduction limitation and allow businesses to fully deduct state and local taxes from their taxable income.

- State income tax refunds related to PTETs may create taxable income at the federal level. Careful consideration and planning should take place when electing PTET payments and the impact of individual withholding and estimated tax payments.

State Tax Credits

- States offer various tax credits and incentive programs aimed at attracting businesses, stimulating investment, and retaining businesses currently operating within their borders.

- Determining the best market for your business to incorporate and/or operate is a critical decision — do not overlook the tax credits and incentives that may be available.

- Common opportunities from states and/or localities may target:

- Small and mid-size businesses

- Innovative businesses

- Job creation

- Capital investments

- Angel investors

- Specifically targeted industries, such as technology, manufacturing, agriculture, or film

- Geography, such as distressed zones, enterprise zones, or tax-increment finance districts

- Energy credits

- Not-for-profits

Contact a member of Withum’s Tax Services Team to start planning as year-end approaches.

Year-End Tax Strategies for Businesses

The corporate tax rate is currently a flat 21% rate. There is also a 15% corporate alternative minimum tax (CAMT) based on book income for companies with average annual adjusted financial statement income exceeding $1 billion.

Limits on Deduction of Business Interest

Every business, regardless of its form, is generally subject to a disallowance of a deduction for net interest expense in excess of 30% of its adjusted taxable income (ATI). The interest expense limitation is applied at the partnership level but flows through to the partners and reduces the partner’s outside basis in their partnership interest. The interest expense limitation is applicate at the C and S corporation levels, remaining at the entity level until excess taxable income can be generated to utilize interest previously disallowed.

A taxpayer may reduce the amount of disallowed interest by increasing the amount of capitalized interest, which is not subject to disallowance. Several provisions under the code, including sections 263(a), 263A, and 266, require or allow taxpayers to capitalize interest to inventory or property. Please work with your tax advisor for future planning.

Exemptions from the limitation on business interest deductions:

- An exception from these rules applies for taxpayers (other than tax shelters) with average annual gross receipts for the three-tax year period ending with the prior tax year that do not exceed $29 million.

- Real property trades or businesses can elect out of the provision, but they must use ADS to depreciate nonresidential real property, residential rental property, and qualified improvement property (and ADS generally has longer recovery periods than MACRS). Any asset with a class life of less than 15-years can still be depreciated using MACRS and take advantage of bonus depreciation (which is 80% in 2023 and 60% in 2024).

- An exception from the limitation on the business interest deductions is also provided for floor plan financing (i.e., financing for the acquisition of motor vehicles, boats, or farm machinery for sale or lease and secured by such inventory).

- Expansion of small businesses that are able to use the cash (as opposed to accrual) method of tax accounting. To qualify as a small business, a taxpayer must, among other things, satisfy a gross receipts test. For the 2023 taxable year, the gross receipts test is met if using the preceding three-year testing period, the average annual gross receipts do not exceed $29 million. Cash method taxpayers may find it easier to shift income between tax years, e.g., by deferring billings until next year or by accelerating expenses such as paying bills early.

NOTE: If a taxpayer can meet the small business gross receipts test, other advantages include not being required to follow UNICAP, being allowed to utilize a simplified method to track inventory, and not being required to utilize the percentage for completion method for long-term contracts. Please discuss with your Withum Tax advisor.

- Consider making expenditures that qualify for the liberalized business property expensing option.

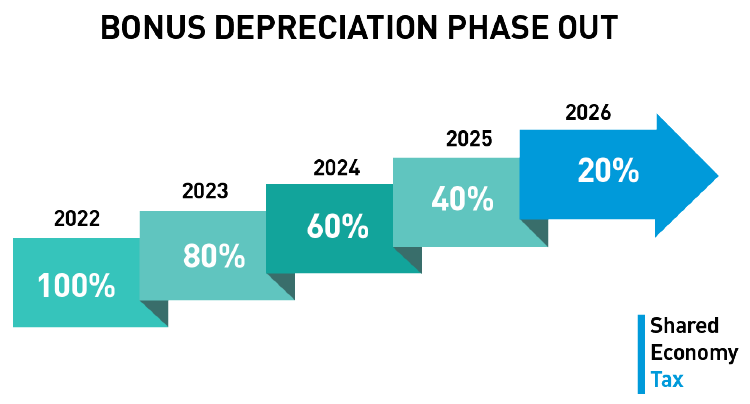

- Bonus Depreciation – For property placed in service during 2023, the bonus depreciation percentage has decreased from 100% (in 2022) to 80%. The depreciation percentage will continue to decrease 20% each year until bonus depreciation is no longer available for property placed in service in 2027. Planning should occur with your tax advisor on how to optimize bonus depreciation.

- Section 179 Expensing – Section 179 allows taxpayers to completely expense qualified assets in the year of purchase, instead of having to depreciate them over time. The total section 179 deduction for 2023 is limited to $1,160,000. In addition, the amount of section 179 deduction is reduced by the amount of section 179 property placed in service that exceeds $2,890,000. Therefore, a section 179 deduction is not allowed for a taxpayer who placed more than $4,050,000 of section 179 property into service in the 2023 taxable year.

- Expensing is generally available for most depreciable property (other than buildings), off-the-shelf computer software, and business-use vehicles (though restrictions apply).

- Expensing is also available for “qualified improvement property” (generally, any interior improvement to a building’s interior, but not for enlargement of a building, elevators or escalators, or the internal structural framework), as well as roofs, HVAC, fire protection, alarm, and security systems.

- The expensing deduction is not prorated for the time that the asset is in service during the year. Thus, property acquired and placed in service in the last days of 2023, rather than at the beginning of 2024, can result in a full expensing deduction for 2023.

- Section 179 expensing, unlike bonus depreciation, can give rise to state income tax benefits.

- De Minimis Safe Harbor Election – Also known as the book-tax conformity election, this election is an administrative convenience that allows businesses to deduct small-dollar (i.e., up to $2,500 or $5,000 per invoice) expenditures for the acquisition or production of property that otherwise would have to be capitalized, other than amounts paid for inventory or land. The election must be reflected for financial accounting purposes or the books and records of the company as well.

- Cost Segregation Benefits – Cost segregation is a strategic tax savings tool that allows companies and individuals who have purchased, constructed, expanded, or remodeled any kind of real estate to immediately increase their cash-flow by accelerating their depreciation deductions and deferring their federal and state income taxes. Cost segregation is recognized as an engineering-based tax study accepted by the IRS. The primary goal of cost segregation is to identify, segregate, and reclassify the various building related assets from either nonresidential real property (39 years) or residential rental property (27.5 years) to a shorter depreciable tax life (e.g., 3, 5, 7, 15, or 20 years). The reclassification of these assets into the shorter depreciable tax lives allows you to take an immediate deduction (80% bonus depreciation) in 2023. However, remember that the 80% bonus depreciation will be reduced by 20% in each year until it disappears completely in 2027. Therefore, if you are planning any type of real estate transaction… the time to pull the trigger is now!

Other cost segregation services include:- Look-back studies to recapture depreciation deductions from prior tax years without amending your tax return

- Repair and maintenance studies

- Section 179D studies relating to energy-efficient commercial buildings

- Purchase price allocation studies

- Income Acceleration and Estimated Tax Payment Planning – Certain corporations (other than large corporations) that anticipate a small net operating loss (NOL) for 2023 and substantial net income in 2024 may find it worthwhile to accelerate just enough of their 2024 income (or to defer just enough of their 2023 deductions) to create a small amount of net income for 2023. This will permit the corporation to base its 2024 estimated income tax installment payments on the relatively small amount of income shown on its 2023 tax return, rather than having to pay estimated taxes based on 100% of its much larger 2024 taxable income.

- Consider whether to elect into bonus depreciation for the 2023 taxable year

- To reduce 2023 taxable income, consider deferring a debt cancellation event until 2024

- To reduce 2023 taxable income, consider disposing of a passive activity in 2023 if doing so will allow you to deduct suspended passive activity losses

- Employee Retention Tax Credit – Employers who experienced a greater than 50% reduction in gross receipts in any calendar quarter in 2020, relative to the same calendar quarter in 2019, or a greater than 20% reduction in gross receipts in any of the first three calendar quarters in 2021, relative to the same calendar quarters in 2019 (or greater than 20% reduction in Q4 2020 relative to Q4 2019), may be eligible to claim the employee retention credit (ERC). The ERC amount is a maximum of up to $5,000 per employee for the 2020 taxable year, and up to $7,000 per employee per quarter in the first three calendar quarters of 2021. In addition to the gross receipts decline, an employer can also claim the ERC if it was subject to a governmental order that limited its travel, commerce, or group meetings due to COVID-19.

- ERC Recovery Startup Business – Businesses that began carrying on a trade or business after February 15, 2020, had average annual gross receipts of less than $1 million, and do not qualify under the gross receipts or full or partial suspension of operations tests, can receive an ERC of up to $50,000 for each of Q3 & Q4 2021 (max credit of $100,000 for 2021).

- Research and Experimental (R&E) Expenditures (Section 174) – Starting in 2022 and continuing in 2023, companies are required to amortize their R&E costs over five years (and fifteen years for research conducted outside the U.S.), instead of deducting them immediately each year. This change requires companies to perform a detailed analysis on what costs fall under section 174 for capitalization versus section 162 as an immediate ordinary and necessary business expense. The amount of R&E costs that require capitalization is generally more expansive than the types of expenses included in the R&D credit under section 41.

The IRS released Notice 2023-63 to provide additional guidance surrounding section 174 expenditures. It is effective for tax years ending after September 8, 2023. Businesses should work closely with their tax advisor to understand and properly apply this new guidance, and consider providing public comment regarding possible future exceptions for small businesses, an adjustment of the software development definition, and the ability to exclude government-funded research from section 174.

While Withum is monitoring Congress closely to see if a year-end tax extender bill can pass that would allow for R&E expenditures to be immediately deductible. All 2023 estimated tax payments should be made assuming section 174 capitalization will be required for the 2023 taxable year.

- 1% Stock Buyback Excise Tax – The Inflation Reduction Act of 2022 included a new provision requiring covered corporations to pay a 1% tax on the fair market value of any corporate stock that they redeem after December 31, 2022. A covered corporation is a domestic corporation that has stock traded on an established securities market. Based on the current language, the definition of a covered corporation could apply to domestic special purpose acquisition companies (SPACs).

Although the deadline for completing reporting and payment obligations related to the excise tax has been delayed, the IRS issued Announcement 2023-18 to provide that taxpayers will still be required to complete these obligations when the forthcoming regulations are published. The timing of when the tax will be due depends on the publication of the regulations. The Announcement states that Treasury and the IRS expect the forthcoming regulations to require taxpayers to keep complete and detailed records to accurately establish the amount of their stock repurchases and to keep these records as long as their contents may become material. Accordingly, taxpayers should continue to remain diligent and monitor developments relating to the excise tax.

- Section 1202 Stock - For certain C corporations satisfying an active trade or business requirement, shareholders that hold original issuance stock for more than five years can be eligible to have gain on the sale of such stock excluded from tax to the extent of the greater of $10 million or 10 times their original tax basis.

Cash Incentives for Clean Energy Investments

One of the most significant changes stemming from the Inflation Reduction Act of 2022 is the ability for not-for-profit and for-profit entities to convert their clean energy credits to cash. For-profit entities can apply clean energy credits against their federal income tax due. If no federal income tax is due, most clean energy credits can be carried back three taxable years or forward 22 taxable years. However, for-profit entities that would like to monetize a credit quickly can conduct a one-time transfer (i.e., sale) of select clean energy credits to an unrelated party for cash under section 6418.

While in previous taxable years, not-for-profits were limited to capturing the cash benefits related to clean energy credits directly, unless they had unrelated business income tax, under the Inflation Reduction Act of 2022, all not-for-profits are incentivized to invest in clean energy infrastructure through the direct payment program regardless of tax liability. The newly created direct payment option under section 6417 generally allows tax-exempt entities and state or political subdivisions to receive a cash tax refund for applicable credits.

The Inflation Reduction Act extended and modified nine existing federal credits and introduced eight new federal credit opportunities.

Some of the credit highlights include:

- Qualified Commercial Clean Vehicles (NEW) - A credit can be claimed for clean vehicle purchases between 2023 and 2032 for an amount not exceeding $7,500 per vehicle (with a gross vehicle less than 14,000 pounds) or $40,000 (for all other vehicles).

- Alternative Fuel Vehicle Refueling Property/Charing Stations (MODIFIED) - A credit can be claimed up to 30% of the cost basis for qualified clean-fuel vehicle refueling property located in an eligible census tract. The maximum credit increased from $30,000 to $100,000 and is now applied on a per-property basis under the modified law (as opposed to per-project basis).

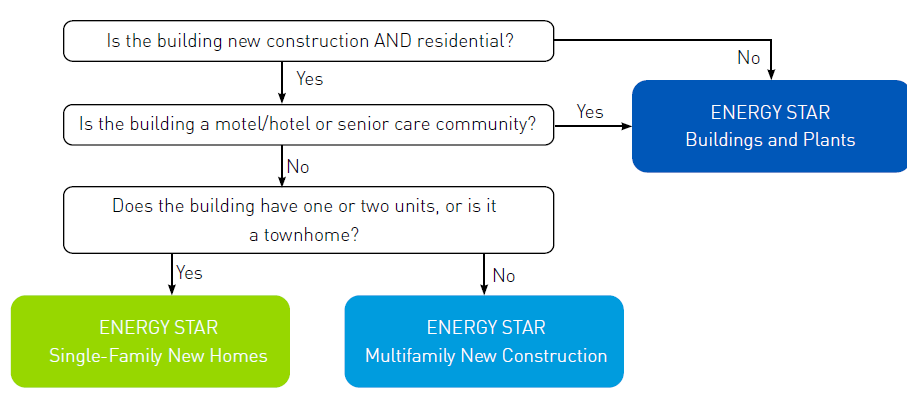

- Contractor Energy Efficient Home Credit (MODIFIED) - The maximum credit allowable to contractors for the construction of new energy-efficient homes was increased from $2,000 to $5,000. In addition, the law was modified to allow a credit for the construction of Energy Star multifamily new construction, with a maximum credit of $5,000 provided.

- Energy Tax Investment Credit (MODIFIED) - The credit was extended to energy projects that begin construction before January 1, 2025, and the list of energy projects that qualify was expanded. Solar energy projects, qualified small wind energy projects, and qualified fuel cell properties are still viable, but energy projects were expanded to include energy storage technology, qualified biogas property, and microgrid controllers. In addition, the credits obtainable can be as high as 50% of the cost basis if the prevailing wage and apprenticeship, domestic content, and energy community requirements are met.

- Advanced Manufacturing Production Tax Credit (NEW) - The IRS provides a new credit for eligible components related to solar energy, wind, inverters, qualifying batteries, and applicable critical minerals if produced in the U.S. The amount of the credit varies based on the component being manufactured. For-profit businesses can elect for this credit to be refundable over a five-year period, even when no federal tax liability exists (i.e., start-up companies).

- Advanced Manufacturing Production Tax Credit (NEW) - The IRS provides a new credit for eligible components related to solar energy, wind, inverters, qualifying batteries, and applicable critical minerals if produced in the U.S. The amount of the credit varies based on the component being manufactured. For-profit businesses can elect for this credit to be refundable over a five-year period, even when no federal tax liability exists (i.e., start-up companies).

Contact Us

For more information on this topic, reach out to Withum’s Tax Services Team to discuss your individual situation as year-end approaches.

Disclaimer: No action should be taken without advice from a member of Withum’s Tax Services Team because tax law changes frequently, which can have a significant impact on this guide and your specific planning possibilities.