A Case for Stock Diversification – Update

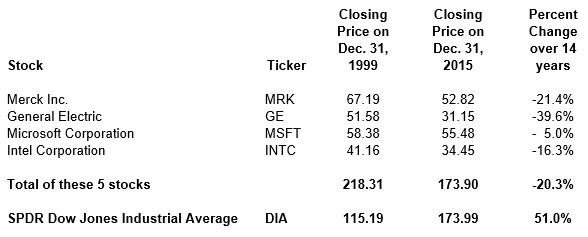

Following, is a comparison of four stocks on the Dow Jones Industrial Average (“DJIA”) that were also on that index on December 31, 1999, and were lower at the end of 2015 than 1999. This is an update of a comparison posted on Jan 22, 2014.

The Dow Jones Industrial Average index is comprised of 30 stocks that are considered the bluest of the blue chips. While the index as reflected in the price of the exchange traded fund (Ticker DIA) increased 51% during this period, these four stocks dropped 20.3% during this 16 year period. The losses ranged from 5.0% to 39.6% and were actually a drag on the index because without them the DJIA increase would have been greater. The prices were adjusted for splits. All of these stocks paid dividends during this period that are not included so the losses were actually less for those with investments in these companies.

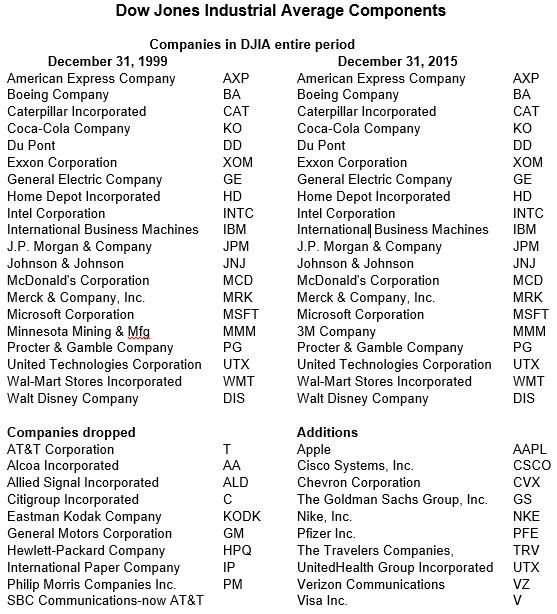

This is a clear illustration of the importance and benefits of diversification. While the four stocks dropped, the other twenty-six as a group had a respectable gain. Also, a point of interest is that Cisco that was added since December 31, 1999 had a humungous loss during this 16 year period dropping from $107.13 to $27.16. Pfizer was also added and was virtually flat with a 16 cents loss. Further AT&T was on the list two years ago but was replaced by Apple dropped from $48.75 to $34.41 for a 29.4% loss during the 16 years.

The lesson from this is that diversification is a sound strategy!

The December 31, 1999 and 2015 DJIA components were as follows:

How Can We Help?