Who Actually Owns that Private Foundation?

Several days ago, a very troubling story hit the newswires. Its seems that former San Diego mayor Maureen O’Connor got herself into a pickle, allegedly gambling, winning and losing over $1 billion over a ten year period. This gambling addiction amounted to the unfathomable sum of almost $300,000 per day! (For a discussion of the tax consequences, see Tony Nitti’s tax blog.) Very sad. According to the New York Times, Ms. O’Connor ended up “……eventually liquidating her savings, auctioning her belongings, selling off real estate, borrowing from friends and taking more than $2 million from a charity set up by her late husband, a fast-food tycoon.”

It was the last part of that sentence, about raiding the charity, that caught my eye. Pure and simple, what she did was steal. More technically stated in the private foundation world, it was extreme “self-dealing”.

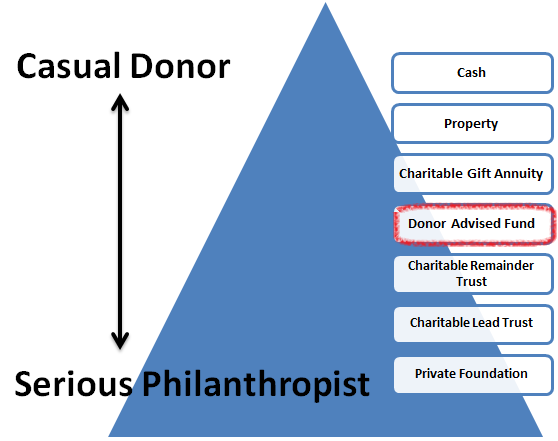

The private foundation (PF) is a wonderful tool for high net worth individuals and families to amass assets to fund charitable endeavors. Similar to the PF is its more accessible cousin, the donor advised fund (which I blogged about earlier this week.) But, the very basic underpinning of these tools is that, once a donor has funded them, the donor no longer owns the assets and the assets can no longer be used for his/her private benefit. Period.

Now, Ms. O’Connor’s situation is admittedly a whopper (or, perhaps more correctly, a Jumbo Jack®, since her late husband, Robert O. Peterson, founded the Jack-in-the-Box fast food chain). Unless you have a really warped sense of right and wrong, it is pretty obvious that taking money from a private foundation and using it to gamble is not particularly kosher (nor is a Jumbo Jack®). But, what about more subtle acts of self-dealing?

These rules are complex and should be examined on a situation-by-situation basis. The takeaway is that all those involved with PF’s should be aware of the potential for abuse and should take corrective action before any issue escalates. Let’s take a quick look at three not-unusual self-dealing circumstances:

- Suppose that you make a legally binding pledge in your own name to endow an academic chair at your alma mater. Can you fulfill that pledge with a grant from your private foundation? The answer, most likely, is a resounding NO! According to the IRS, using a private foundation’s assets to satisfy a donor’s legally enforceable charitable pledge is an act of self-dealing and not permissible.

- What about hiring a family member to manage the foundation? Self-dealing? Yes, virtually by definition. Permissible? POSSIBLY. Hiring a “disqualified person”[1] may work as long as the compensation and any expense reimbursements are reasonable under the circumstances and paid for services related to carrying out the foundation’s exempt purpose. Safe to say, it is not reasonable to pay your idiot son-in-law a six figure salary to act as the janitor for the office of the family foundation. But it may be reasonable to pay your MBA-credentialed daughter to manage the affairs of the foundation at a rate comparable to that paid by a similar organization under like circumstances. It is very important to never lose sight of the old adage: Bulls and bears make money while pigs get slaughtered.

- Can you provide an all-expense paid retreat for the members of the board of your family foundation at an exotic locale? Probably not because there would presumably be a large percentage of personal pleasure in such an excursion. Better to hold the retreat as a rundown Motel 6 in Scranton, PA in the dead of winter – it would certainly be hard to prove under those circumstances that the expenses were anything but reasonable. Also better to ask the question beforehand than to get penalized afterward.

Now, of course, there may be ways around some of these speed bumps – as we all know, most everything in the tax world is a lovely shade of gray as opposed to stark black or white. And it is certainly difficult to endow a private foundation and not feel like you still have an ownership interest. But the fact is, PF’s work the way they do in order to safeguard their charitable purposes as much as possible. This requires stringent rules and a minefield of penalty taxes. [2] Since PF’s are a creation of the government, the government is within its rights to regulate their usage through the imposition of these taxes and, when things get too out of hand, through criminal prosecution as well.

Apparently, that fact was lost on Maureen O’Connor.

disqualified person is generally any person who has a vested financial interest in a PF

including substantial contributors (as defined),

foundation managers, anyone owning more than 20% of an entity that is a substantial contributor,

family members of any of the preceding individuals, or

entities that are owned more than 35% by the individuals described above.