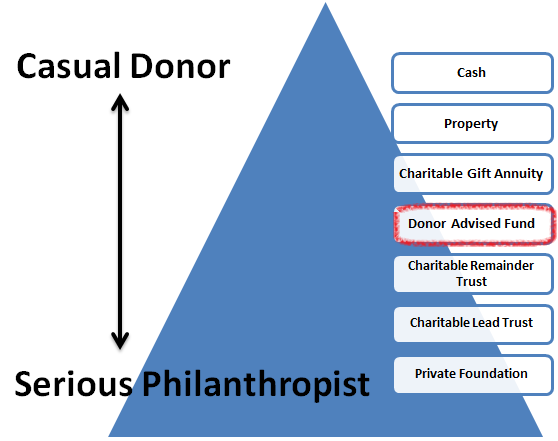

Tools & Techniques 101: The Donor Advised Fund

Moving down the Philanthropic Continuum, we come to one of my favorite tools in the charitable toolbox, the Donor Advised Fund (DAF). Often referred to as the “poor person’s foundation” (but in a good way), the DAF enables the donor to accelerate charitable contributions into the current year without necessarily making grants to any public charities in that year. DAF’s work very well in a whole range of circumstances but to me, they are tailor-made for the following situations:

- Case 1: The potential donor is faced with a significant liquidity event (sale of a business, exercise of stock options, large bonus, etc.) and is looking for a way to shelter some of that income. S/he has always been charitably inclined but has never engaged in more than some current annual giving and does not know exactly where s/he wants to ultimately donate the funds. Using a DAF provides a current year deduction coupled with the luxury of time to figure out the exact future distribution of funds.

- Case 2: Charitable giving is an important part of the donor’s life and s/he wants to ensure that she always has funds to give away. Using a DAF as s charitable savings account enables her to make her deductible contribution today while deferring the ultimate giving until later in life. Meanwhile, assuming reasonable returns, the funds grow tax free, providing more assets.

- Case 3: A young couple wants to simulate the formalities of a private foundation in order to instill the culture of philanthropy in its children. A DAF is the perfect vehicle providing structure with minimal administrative burdens (no tax return, no excise tax, no required minimum distributions, etc.)

Here’s how it works:

- There are numerous sponsoring organizations of DAF’s including commercial vendors like Schwab, Fidelity, and Vanguard and not-for-profit organizations such as the Jewish Communal Fund, the American Endowment Foundation and the New York Community Trust. You choose the fund that works best for you taking into account investment choices, fees, account minimums, minimum subsequent investments and administrative services and conveniences. The one common thread is that every one of these organizations is a “501(c)(3)” tax exempt charitable organization (or affiliate of the commercial advisor).

- You make your irrevocable, tax deductible contribution to the DAF and claim credit for it in the year made. (Some of these DAF sponsors accept gifts as low as $5,000.) You do not get any further deduction for grants made from the fund. The funds are no longer yours, although you retain advisor status over them.

- Typically you can name your fund, although you cannot use the word “foundation” in the title. Therefore, the “Smith Family Charitable Fund” would be acceptable but the “Smith Family Charitable Foundation” would not.

- Unlike a private foundation, there is no requirement to make annual grants from the fund, so you can defer your distributions until far in the future. Future generations of family members can assume advisory roles at the appropriate time to direct the ultimate disposition of the assets.

- There is no separate tax return requirement or required bookkeeping. The DAF sponsor does it all for you.

- In any one year, the deduction for cash contributions made to your DAF cannot exceed 50% of your adjusted gross income (AGI). Noncash contributions are limited to 30%. Excess amounts are carried over and deducted over the next 5 years, subject to the same income limitations each year. Contrast this to private foundations, which are subject to a lower limitation of 30%/20% of AGI.

- There is a legal fiction that holds this all together – when it comes time to make a grant, you stand in an advisory role, merely recommending the grant to the DAF sponsor. The DAF sponsor is responsible for the due diligence and technically does not have to honor your request. More realistically, however, as long as you are recommending a grant that falls within the DAF sponsor’s guidelines (typically a grant to a domestic 501(c)(3) organization), the DAF will make the grant in the name of your fund.

In a future post, we will discuss the pros and cons of private foundations vis-à-vis DAF’s. For right now, suffice it to say that donor advised funds work best for philanthropists with a need to control the timing of their charitable contributions and who desire a charitable pocketbook to help them support public charities that they find worthy. Private foundations are more suitable for those who want to engage in the business of philanthropy. Because of this, these tools are not mutually exclusive and each has its place at the table.