In November 2023, the US Department of Labor (DOL) released its Audit Quality Study, which found that a “significant number of employee benefit plan audits were deficient.” The study also revealed a correlation between the number of employee benefit plan audits performed by a CPA firm and the quality of the audit work. The report further stated that audits conducted by the American Institute of Certified Public Accountants (AICPA) Employee Benefit Plan Audit Quality Center members had a significantly lower deficiency rate.

To ensure that plan participants and beneficiaries are not put at unnecessary risk, Employee Benefit Plan (EBP) sponsors should choose a qualified CPA firm with the expertise to perform an audit in accordance with professional auditing standards. To determine whether the CPA has the qualifications to perform your plan’s audit, it is recommended to consider the number of employee benefit plans audited by the firm every year and determine if the firm holds an active membership in the AICPA’s Employee Benefit Plan Audit Quality Center.

Uncovering Insights and Key Findings

According to research conducted by ERISApedia.com, as of January 8, 2024, 4,711 audit firms are doing 95,156 benefit plan audits. Of the 4,711 audit firms currently performing plan audits, 1,687 firms (35%) are auditing more than five plans. Only 581 firms (12%) are found to be performing 25 or more plan audits. There are 1,716 firms (34%) that only audit one plan.

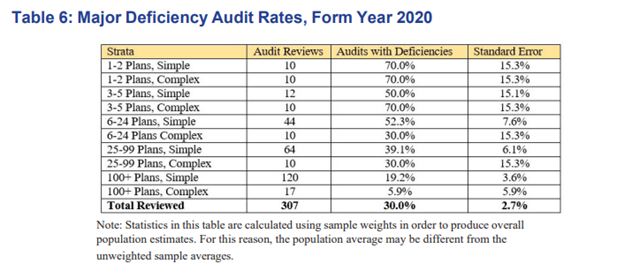

The following table from the DOL report outlines the findings, which show that the deficiency rate varied based on the number of plans audited by the audit firm and the correlation between the number of plan audits and the quality of the audit work. Firms performing 1-2 plan audits had a deficiency rate of 70%, while firms that audited more than 100 plan audits had deficiency rates of 19.2% for simple plans and 5.9% for complex plans.

Planning Opportunity for Plan Sponsors

Employee benefit plan sponsors should review the findings from the DOL study and evaluate the qualifications and experience of the plan’s audit firm. Between plan years 2021 and 2022, 1,371 CPA firms had a net increase in plan audit count, meaning they gained more plan audits than lost. Notably, 38% of these firms were already conducting more than 20 plan audits. It has created an opportunity for CPA firms with competency and capacity in the field of EBP audits to improve service and increase new client satisfaction as plan sponsors are migrating to firms with expertise in performing plan audits.

Withum’s dedicated Employee Benefit Plan Services Team audits approximately 1,100 retirement plans each year, including Single, Multiemployer Plans, and Multiple Employer Plans, with the number of participants ranging from 100 to over 600,000. We provide the industry expertise and innovative solutions you need to Be in a Position of Strength.

Contact Us

For more information on this topic, please contact a member of Withum’s Employee Benefit Plan Services Team.