Accounting Standards Update (“ASU”) 2022-04 Liabilities – Supplier Finance Programs (Subtopic 405-50): Disclosure of Supplier Finance Programs is effective for fiscal years ending on or after December 15, 2022, which means it is effective beginning with fiscal years ending on December 31, 2023. The purpose of this ASU is to provide information in the form of note disclosures sufficient to enable users of financial statements to understand the nature, activity during the period, changes from period to period, and potential magnitude of an entity’s supplier finance programs.

This ASU only applies to buyers participating in a supplier finance program. It does not apply to the supplier or the finance provider. The ASU does not affect the recognition, measurement or financial statement presentation of obligations covered by supplier finance programs.

What Is a Supplier Finance Program?

A supplier finance program, also known as reverse factoring, payable finance, or structured payables arrangement, allows a buyer to offer its suppliers the option to receive payment in advance of the invoice’s due date. The invoice is paid by a third-party finance provider or intermediary on the basis of the invoices that the buyer has confirmed as valid.

The way the programs generally work is, first the buyer enters into an agreement with a finance provider or an intermediary, such as a bank, to provide the financing. Then, the buyer will purchase goods or services from one of its suppliers (vendors) with the promise to pay at a later date, and the buyer receives an invoice (trade payable) from the supplier, which contains all the payment terms. The buyer then approves the invoice and provides the validated invoice to the finance provider. The finance provider then offers the supplier the option to receive payment prior to the due date at a discounted price. The supplier then has two options: (1) accept the discounted price and receive the payment early, or (2) receive payment from the finance provider on the due date at the full invoice price. No matter which option the supplier chooses, the buyer pays the finance provider the full amount due on the invoice on the day the invoice is due.

Depending upon the terms of the arrangement, a supplier finance program can have the following benefits:

- The supplier receives payment sooner, thereby reducing the credit risk.

- The finance provider earns income in the form of an early payment fee, which is the difference between the invoice amount and the discounted payment amount, or the finance provider can extend the payment terms for an additional fee.

- The buyer may be offered part of the early payment fee when the supplier chooses the early payment option.

Not sure if you have a supplier finance program? If there is a commitment to pay a party other than the supplier for a confirmed invoice without offset, deduction, or any other defenses to payment, this is a good indication that you have a supplier finance program.

What Are the Required Disclosures?

ASU 2022-04 requires the buyer in a supplier financial program to disclose the following items for each annual reporting period:

- The key terms of the program, including, but not limited to:

- A description of the payment terms, including payment timing and the basis for its determination.

- Assets pledged as security or other forms of guarantees provided for the committed payment to the finance provider or intermediary.

- The amount of obligations outstanding at the end of the reporting period that the entity has confirmed as valid to the finance provider or intermediary under the program (that is, the amount of obligations confirmed under the program that remains unpaid by the entity) and the following information about those obligations:

- Where those obligations are presented in the balance sheet. If those obligations are presented in more than one balance sheet line item, then the entity shall disclose the amount outstanding at the end of the reporting period in each line item.

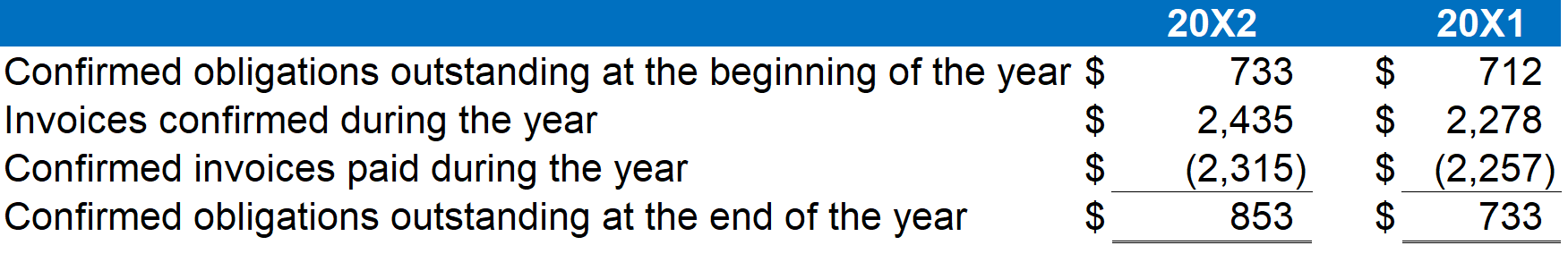

- A rollforward of those obligations showing, at a minimum, all the following:

- The amount of those obligations outstanding at the beginning of the reporting period.

- The amount of those obligations added to the program during the reporting period.

- The amount of those obligations settled during the reporting period.

- The amount of those obligations outstanding at the end of the reporting period.

- For interim reporting periods, the following is required to be disclosed in each interim reporting period:

- The amount of obligations outstanding that the entity has confirmed as valid to the finance provider or intermediary under the supplier finance program at the end of the reporting period.

In the initial period and/or year of adoption, the disclosure requirements noted above are to be presented for all balance sheets presented, with the exception of the rollforward information above.

When drafting the disclosure, it is crucial need to consider the level of detail necessary to satisfy the disclosure requirement. If there is more than one supplier finance program, then the information may be aggregated, but not to the extent that the useful information is obscured by the aggregation of programs that have substantially different characteristics.

Example Disclosures

The examples below do not cover every aspect of the key term of a program that should be disclosed by a buyer entity, nor do the examples cover every disclosure requirement.

Key Terms of the Supplier Finance Program

Under a supplier finance program, Entity A agrees to pay a bank the stated amount of confirmed invoices from its designated suppliers on the original maturity dates of the invoices, an annual subscription fee for the supplier finance platform, and service fees for related support. Entity A or the bank may terminate the agreement upon at least 90 days’ notice. The supplier invoices that have been confirmed as valid under the program require payment in full within 90 days of the invoice date.

Roll Forward

The rollforwards of Entity A’s outstanding obligations confirmed as valid under its supplier finance program for years ended December 31, 20X2, and 20X1, are as follows (in thousands):

Contact Us

For more information on this topic, please contact a member of Withum’s Assurance and Accounting Services Team.