On March 6, 2024, The U.S. Securities and Exchange Commission’s (SEC) sustainability rule for climate risk disclosures was released. The bill, also called “The Enhancement and Standardization of Climate-Related Disclosures,” dictates that publicly listed companies in the US must provide detailed reports on their climate risks and emissions with enforcement beginning in 2025.

The finalized SEC rule, outlined in an extensive 800-page ruling, not only sets the stage for consistency, comparability, and reliability in climate reporting but also equips investors with crucial decision-making information.

This in-depth analysis of the final rule breaks down the document’s key points, mandatory reporting requirements, reporting timing, and implications for businesses across the broader economy. We also address the anticipated complexities of compliance and provide guidance on best reporting practices.

On-Demand Webinar: Navigating SEC’s New Climate Regulations

A Deep Dive into the SEC Sustainability Rule

The SEC sustainability rule is a pivotal regulation for climate risk reporting and action in the US. It requires any publicly listed company to incorporate comprehensive and transparent climate-related data into their public filings. The following is what the SEC expects companies to report to investors in their disclosures.

Reporting on Greenhouse Gas Emissions

- Large Accelerated and Accelerated Filers must now report Scope 1 and 2 emissions data if such information is of material importance. Smaller filers are exempt from reporting emissions. Scope 3 emissions are not required.

- These filers are also expected to obtain limited assurance on their emissions, with higher expectations set for LAFs, which require reasonable assurance, beginning in 2034.

- The SEC has made provisions for emissions reporting companies, allowing them the flexibility to include their emissions data in their 10-Q (20-F for non-domestic reporters) filings, providing an additional three-month grace period to share their emissions calculations.

Compliance with SEC Climate Regulations: Disclosing Risks and Strategies

As mandated by the SEC’s climate regulations, all companies must disclose any material* climate-related risks affecting their operational, strategic, or financial standing. Here is an overview of the climate risks they must share:

- Declaration of Climate Targets: Companies must communicate any climate-related goals or commitments that are financially material.

- Carbon Offset Financial Details: Companies must share financial information, including costs and expenditures required for carbon offsets if they are a material component of a company's climate goals.

- Financial Disclosure for Physical Climate Risks: Companies must share any costs, expenditures, and losses incurred from dealing with direct physical risks attributed to climate change, such as wildfires or extreme weather conditions. These must be disclosed when they exceed a certain fiscal threshold — 1% of the company's turnover before tax.

- Adherence to TCFD Principles: These regulations require companies to adopt a rigorous reporting methodology in accordance with the Taskforce on Climate-related Financial Disclosure standards. This methodology includes identified climate risks, their potential impact on finances, strategies for risk mitigation, and the governance mechanisms established to manage these risks.

*SEC materiality definition is “a substantial likelihood that the disclosure of the omitted fact would have been viewed by the reasonable investor as having significantly altered the ‘total mix’ of information made available.” Companies should conduct a materiality assessment to evaluate their climate-related risks, carbon emissions, and costs appropriate to determine their reporting requirements for disclosure.

How the SEC Sustainability Rule Affects Company Disclosures

The SEC Climate disclosure rule will affect a wide range of companies in U.S. stock markets, demanding rigorous and transparent climate reporting. The size of each public company determines its compliance timeline.

Implications for Various Registrants

- Large Accelerated Filers (LAFs): With public floats above $700M, these large companies will be the earliest to comply, starting their climate risk disclosures in 2026 and emissions reporting in 2027, with a phased approach to achieving assurance, beginning in 2030 with limited assurance and ending with reasonable assurance in 2034.

- Accelerated Filers (AFs): Companies with public floats ranging from $250M to $700M will submit their first climate risk reports in 2027 and begin emissions reporting in 2029, with limited assurance beginning three years after that.

- Non-Accelerated Filers (NAFs): Smaller firms with a valuation below $75M will undertake climate risk reporting from 2028 onwards.

- Smaller Reporting Companies (SRCs): These companies, with financial profiles like NAFs, will mirror their reporting timelines.

- Emerging Growth Companies (EGCs): New market entrants with annual revenues below $1.235B will align with SRCs and NAFs in their reporting obligations.

The SEC Sustainability Rule Reporting Roadmap

The SEC sustainability rule for climate disclosure establishes a roadmap for companies to disclose climate-related information over the coming decade, as follows:

- 2024: The SEC approved its climate rule on March 6, 2024.

- 2025: LAFs will be at the forefront of reporting, starting to gather climate data in 2025 for their initial 2026 reports.

- 2026: AFs start collecting data for their own climate reporting, while LAFs publish their first disclosures and begin emissions data collection.

- 2027: This year marks the first disclosure of climate risks for AFs, LAFs to report emissions data, and smaller entities to start their climate data collection.

- 2028: NAFs, SRCs, and EGCs join the reporting efforts with their first climate disclosures while AFs collect emissions data.

- 2029: AFs will share their first emissions data reports in 2029.

- 2030-34: LAFs plan to obtain limited assurance by 2030 and reasonable assurance by 2034, with AFs on track for limited assurance in 2032.

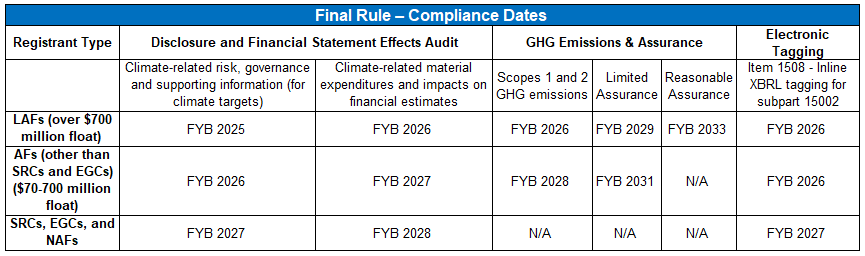

1 As used in this chart, “FYB” refers to any fiscal year beginning in the calendar year listed. 2 Financial statement disclosures under Article 14 will be required to be tagged in accordance with existing rules pertaining to the tagging of financial statements. See Rule 405(b)(1)(i) of Regulation S-T.

Attestation Directives under the SEC Sustainability Rule

Mandated Climate Data Attestation Schedule

The SEC sustainability rule for climate disclosures enforces an assurance schedule in which LAFs and AFs must obtain limited assurance for Scope 1 and 2 emissions. The mandate starts in 2030 for LAFs and 2032 for AFs. The rule further dictates that LAFs obtain reasonable assurance from 2034 onwards.

Optional Climate Data Attestation Transparency

The SEC mandates that filers who obtain attestation voluntarily must disclose certain information about the assurance process. This encompasses the assurer’s identity, standards adopted, a condensed report of the findings, assurance level, and any conflict of interest between the filer and the assurance provider. This provision implies an expectation from the SEC for a broader uptake in assurance services that goes beyond the mandatory requirements.

Private Companies and the SEC Sustainability Rule: A Forward-Looking Approach

The SEC sustainability rule for climate disclosures, while designed for public companies, will inevitably trickle down across the economy and affect private companies as well. It will impact non-public companies in the following ways:

- Climate Risk Data Collection: As public companies report on material climate risks in their value chains, private companies in the supply chains of larger public ones will increasingly find themselves part of the climate data collection ecosystem and be asked for their emissions performance data.

- Climate Disclosure Standardization: The SEC’s climate-related disclosure mandate will set a new precedent for what companies should share. This new TCFD-aligned reporting mandate will become the gold standard for voluntary disclosures.

- Streamlining for IPO: Private companies that proactively adopt aspects of the SEC’s climate-related disclosures now will navigate future IPO processes more effectively.

- Competitive Sustainability Edge: By taking a proactive stance on climate-related disclosures, private companies can differentiate themselves, appealing to a broader base of sustainability-focused investors and customers.

- Anticipating Broader Regulatory Requirements: The SEC's Climate Rule is far less rigorous than California’s SB 253 and 261 rules, which require public and private companies to share Scope 1, 2, and 3 and climate risks beginning in 2026. This underscores the importance of private companies beginning to align now with these new standards, regardless of their intent to remain private or go public.

Strategies for Mastering SEC Environmental Compliance

Most publicly traded companies already report climate-related data, with 98% of the S&P 500 and 90% of the Russel 1000 already sharing something. However, the climate information they currently share is limited, and for most companies, the SEC’s rule represents new reporting challenges.

Proactive preparation will be key to mastering the SEC’s rule for climate disclosure, especially for those with a reporting timeline beginning in 2025. Below are important steps companies should take to align with the SEC’s climate disclosure requirements:

- Regulatory Clarity: Begin by understanding your company's specific SEC climate compliance obligations, including whether you must report just climate risks or GHG emissions and the timelines for disclosure and assurance.

- Examine Current Practices: Examine your climate reporting today and determine what enhancements to processes, systems, and technologies are needed to comply with the SEC's climate rule.

- Climate Risk Strategy Formulation: Build a robust plan to identify, assess, and mitigate any climate risks that could materially affect your business operations or financial health. Make sure to record all processes, as they should also be disclosed.

- In-depth Materiality Assessment: Conduct thorough financial materiality assessments to ensure every material climate risk and relevant Scope 1 and 2 emissions are being reported.

- Reporting System Enhancement: Establish robust data collection and reporting strategy to ensure precise emissions tracking. This is crucial for LAFs and AFs that are mandated to report their Scope 1 and 2 emissions, but it can also help other companies assess climate risks.

- Assurance and Attestation Planning: Collaborate with expert CPAs to lay the groundwork for upcoming attestation requirements. This is mandated and essential for LAFs and AFs and a sound approach for firms opting for voluntary assurances.

To prepare for the SEC sustainability rule for climate disclosure, it is essential to begin early, particularly for those with reporting obligations beginning in 2027. Considering the challenges of compliance and the reputational and legal risks associated with falling short of the requirements, having a trusted SEC and sustainability expert in your corner will also be important.

Withum’s Sustainability and ESG Services Team brings proficiency in SEC reporting, comprehensive climate risk assessment, and emissions calculations. Our extensive experience with assurance engagements positions us to ensure your adherence to the SEC sustainability rule for climate disclosure.

Contact Us

Our Sustainability and ESG Services Team can help you understand the SEC regulations that apply to your organization and help ensure compliance with the new requirements.