2014 Financial Benchmark Charts and Graphs

To be used for illustrative and educational purposes.

No recommendations are made or should be inferred from the information presented.

Past results are no indicator of future performance.

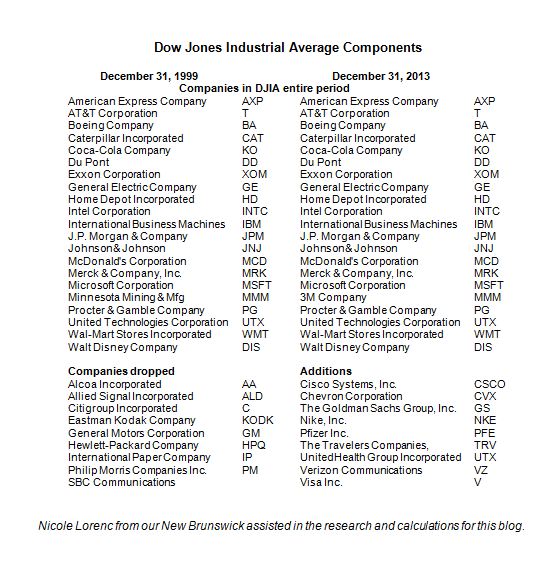

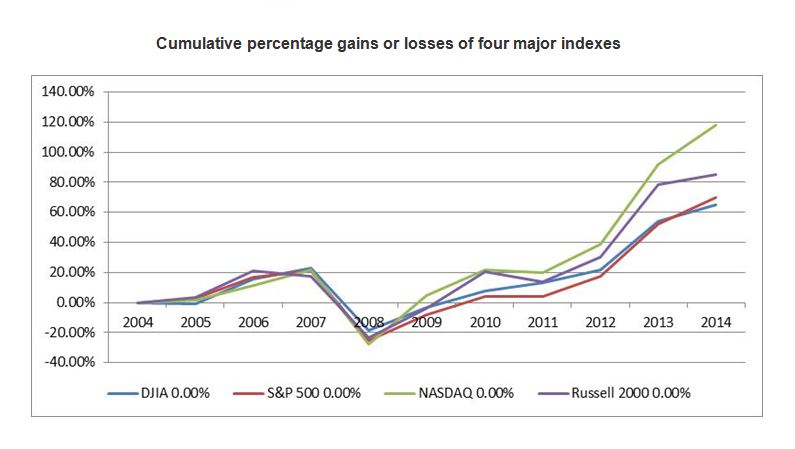

These charts continue an annual tradition I started ages ago to use when I do financial planning with clients. The charts show the 10-year annual and cumulative percentage gains or losses of the major stock market indexes, interest rates, currencies and gold. Also shown is a comparison of an investment 10 years ago in the Dow Jones Industrial Average (DJIA) compared to an investment in a 5-year Bank CD that was rolled over when it came due into another 5-year CD.

10 year financial benchmark performance of

major stock indexes, interest rates, currencies and gold

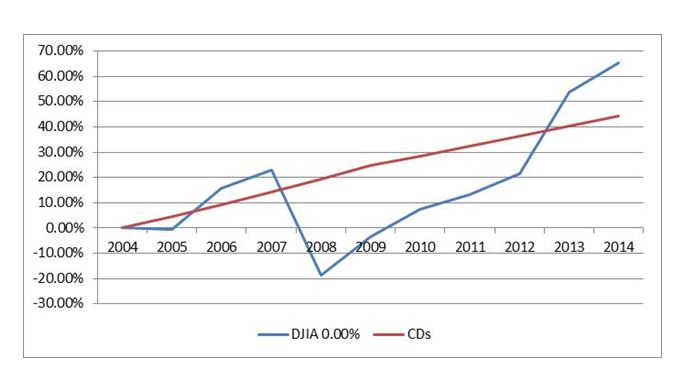

Ten year comparison between the DJIA and Bank 5-year CDs

This graph compares the 10 year DJIA performance and two 5-year CDs with one purchased at beginning of 10-year period and the other rolled over for another 5-year period when the first CD came due. The CD rate was 4.5% at the beginning of the period and 3% on Jan 1, 2010. Note that the strategy which seemed good previously might not have to be relooked at considering the low rate environment. However, this strategy has consistently held up for those seeking complete safety from default. Further, to find the 2.25% 2014 year end CD requires some thorough searching. Note also that except for the initial run up in the DJIA it took nine years for the DJIA to surpass the cumulative return on the CD. If the CD strategy was laddered with a new 5-year CD purchased each year the results would be different.

How Can We Help?