The Journal Summer 2015 Issue

Overview of Outbound Reporting

Overview of Outbound Reporting

[author-style]Mark Farber, CPA, Partner[/author-style]

After these cases were brought, however, it became clear that the problem might better be solved by prevention rather than by prosecution. This is how the Foreign Account Tax Compliance Act (FATCA) was born. FATCA seeks to improve detection and further discourage tax evasion by implementing a new reporting and withholding system. In addition to FATCA, harsh penalty provisions were applied to most global information reporting requirements, and there is now an increased focus from the Treasury and IRS on all of these global information reporting requirements.

Although the U.S. tax regime is based on self-assessed tax, the IRS continues to expand third-party information reporting requirements with the aim of ensuring that taxpayers file complete and accurate income tax returns. Globally, information reporting and withholding requirements are expected to become more numerous and complex, particularly in light of the many provisions of FATCA that became effective July 1, 2014. Facing potentially steep penalties for noncompliance, companies and individuals should continue to evaluate the processes they have in place to ensure compliance, as well as prepare for additional information reporting and withholding requirements likely arising in the future.

U.S. persons with foreign operations or investments are subject to special compliance rules. The unifying theme is that foreign operations and investments may affect a U.S. person’s U.S. tax liability, but it is difficult for the IRS to obtain information directly about assets and activities abroad, especially if the records are kept overseas. The outbound reporting rules exist in large part to require the U.S. owners of such operations and investments to obtain this information, compile it and provide it to the IRS.

Some of the compliance rules directly associated with ownership of an investment outside the United States that require information to be gathered and reported include:

- U.S. persons must file information returns on Form 5471 with respect to foreign corporations in which they own a significant interest.

- U.S. persons engaging in transactions governed by Subchapter C with foreign corporations must report them on Form 926.

- U.S. persons with investments in “passive foreign investment companies” must report them on Form 8621.

- U.S. partners with significant interests in foreign partnerships must report them on Form 8865, and foreign partnerships with U.S. income may have to file partnership returns on Form 1065.

- Foreign-owned U.S. persons may have to report transactions with certain related parties on Form 5472.

- U.S. persons subject to tax in both the U.S. and a foreign country and claiming losses that are potentially deductible in both places, may need to make certain elections and certifications under the dual consolidated loss rules.

- U.S. persons with direct or certain indirect investments in entities that are disregarded for U.S. tax purposes must report these investments on Form 8858.

- U.S. persons relying upon a tax treaty to modify their U.S. tax obligations may have to report this on Form 8833.

- U.S. persons with an ownership interest in, or signatory authority over, a foreign bank or other financial account (FBAR) may have to report this on FinCEN Form 114.

- Similarly, U.S. persons with an ownership interest in specified foreign financial assets may have to report this on Form 8938.

Foreign persons who are doing business in the United States or deriving income from the United States may well be subject to U.S. tax. The U.S. distinguishes between foreign persons who are and who are not engaged in a U.S. trade or business.

If a foreign person is not engaged in a U.S. trade or business, she may well be subject to tax on certain categories of U.S.-source income. However, due to the problems of trying to collect taxes from a foreigner with no U.S. presence, Congress has required persons paying such income to foreign persons to collect and withhold any tax. Although the substantive rules imposing tax on the foreign payee in this situation and the rules requiring tax to be withheld by the U.S. payor are not completely symmetrical, in most cases, the foreign investor has no compliance obligations provided that all required withholding is in fact properly done.

The situation of a foreign person engaged in a trade or business in the United States is different—such a person is required to file a return, just as U.S. persons are. The special issues relating to the U.S. tax return of a foreign corporation are fairly complex, and a significant amount of planning is required prior to preparing the compliance for this return.

Persons with U.S.-related activity situated abroad, U.S. branches of foreign corporations and foreign-owned U.S. corporations are subject to special reporting rules on Form 5472 in order to collect the information the U.S. desires to ensure that transactions between such persons and related parties are at arm’s length. Foreign persons, regardless of whether they are engaged in a U.S. trade or business, who are relying upon an income tax treaty to reduce or modify their U.S. tax obligations may have to report this on Form 8833.

In addition to numerous penalties that exist for not filing the forms listed above, the statute of limitations for the assessment of tax if a taxpayer fails to file or files substantially incomplete IRS international-related information returns has changed. This change is significant because any failure to comply with any of these filing requirements keeps the statute of limitations open indefinitely for assessments on the entire tax return, not just with respect to those items required to have been reported on the information return.

Not only have the number of forms increased, but these forms have grown in complexity and penalty risk, and the new statute of limitations has dramatically expanded the risk profile in this area of tax compliance.

|

Mark Farber, CPA, Partner 212-751-9100 [email protected] View Experiences |

Maintaining Not-For-Profit Board Integrity

Maintaining Not-For-Profit Board Integrity

[author-style]Brad Caruso, CPA[/author-style]

To safeguard the NFP organization, the board members and/or subcommittees of the governing body, should consider the following:

| 01 | A strong system of written internal controls is required. Review and approval annually by the oversight group is also encouraged. |

| 02 | A subcommittee structure where individuals in varying fields of expertise oversee different areas can strengthen oversight. |

| 03 | Significant transactions and contracts carry additional risk and should have an ancillary layer of review outside of the executive director. Contractual obligations may require full board approval. |

| 04 | The 501(c)(3) exemption is conditioned on the organization being one “of which no part of the net income inures to the benefit of any private shareholder or individual.” A strong conflict of interest policy should be in place and enforced to identify related-party transactions and instances where private inurement arises. |

| 05 | NFP accounting nuisances exist due to additional layers of disclosure and differences in the treatment of revenue as compared to for-profit accounting. Be careful when reviewing NFP financial statements to consider the unique operating metrics of NFPs. |

| 06 | Revenue generated from activities which are outside of the organization’s charitable mission may be subject to income tax. Performing too many unrelated tasks could lead to loss of tax exemption. The governing body should ensure the evaluation of each revenue stream for potential unrelated business income issues. |

| 07 | Non-filing of the 990 tax return for three consecutive years will lead to loss of tax-exempt status. The governing body is required to be a part of the review and filing process as well as for overall compliance with the filing requirement. |

| 08 | Annual discussion of agency-wide risk and threats to the organization is strongly suggested. The governing body should maintain written notation of any internal control evaluation or risk assessments performed. |

| 09 | Compliance with all federal, state and local laws is required, and governing body members can be held personally liable for lack of compliance. The governing body should verify management is handling these matters. |

| 10 | Grant contracts and donor contributions are complex, and the organization needs to monitor these agreements closely and carefully to ensure compliance. In today’s environment, states and local governments are trying to cut, not increase, their budgets, and the first place they look are organizations with habitual noncompliance. |

| 11 | Executive compensation must meet the IRS criteria of “rebuttable presumption of reasonableness,” which means a formal process to determine and evaluate officer compensation must exist, and the process must be written and based on an analysis of comparable data. This documentation generally occurs at the governing-body level and should be done annually. |

| 12 | Meeting minutes must be written and contain information concerning significant actions of the board as well as the subcommittees of the board. The minutes should be approved by the board members by vote. |

| 13 | If the organization has an endowment fund, each state generally has laws over the prudent management over the endowment and the investments. An investment committee of the governing body generally oversees the management of endowment funds and establishes an investment policy. |

Although one is generally in a volunteer capacity, it is important to remember that being a member of the governing body of an NFP requires due care, strong oversight and exercising of fiduciary responsibility in that role.

|

Brad Caruso, CPA 732-828-1614 [email protected] |

Areas of Dispute in Business Valuation: How to “Work” the Value

Areas of Dispute in Business Valuation: How to “Work” the Value

[author-style]Nicole D. Lyons, CPA/CFF, CVA and Myroslava Hreb[/author-style]

This article will focus on three areas that impact value: (1) reasonable compensation, (2) weighting and (3) capitalization rate. A modification to any of these items can materially change the calculated value of a company. The valuation appraiser, in determining these components, relies on not only financial documentation, research and information obtained from management, but also his or her professional judgment. The selection of these components is, in part, a subjective process; therefore, the components are often areas of dispute in business valuation.

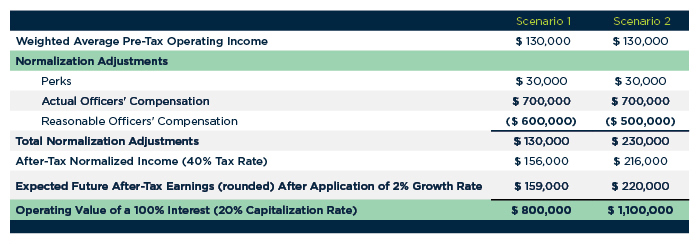

In determining reasonable compensation, an appraiser must put himself or herself in the shoes of a hypothetical investor and ask: What would I have to pay to fully replicate the contributions of the owner/operators? The valuation appraiser interviews the business owner and other management to determine duties, responsibilities and time spent of and by the owner. The valuation appraiser also researches various third-party sources, salary surveys, compensation databases and governmental sources. The adjustment of reasonable compensation is performed in valuations to normalize earnings and present replacement compensation for owners. The following table illustrates the difference in value using two different amounts of officers’ reasonable compensation. Scenario #1 uses $600,000 as reasonable officers’ compensation and Scenario #2 uses $500,000 as reasonable officers’ compensation. As shown in the chart below, all else being equal, the value of the company is calculated as $800,000 for the former and $1,100,000 for the latter—a difference of $300,000 in value.

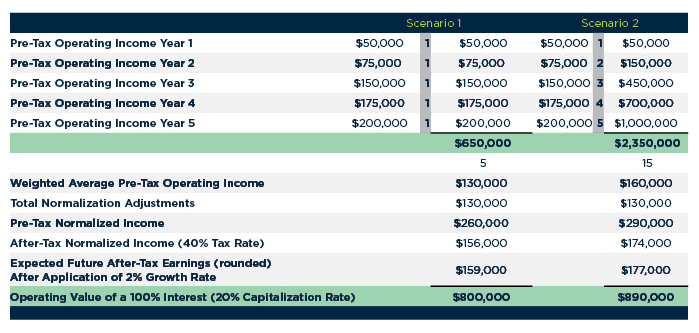

Changing the weighting of historical economic earnings also impacts the value of a company.

There are two types of weighting that are used to estimate the future earnings an investor can reasonably expect to receive—a straight average and a weighted average. A straight average is typically used when the average of the historical economic income serves as a good proxy of the future expected benefits, or earnings represent a business cycle of peaks and valleys that are expected to continue. By using a straight average, the valuation appraiser considers the value of operating income in each year analyzed as being equal. A weighted average, however, is typically used when one or more of the historical years analyzed are more representative of the future estimated benefit or when a trend or pattern exists and is expected to continue. The following table illustrates the difference in value by using a straight average versus a weighted average in determining the future expected earnings. As shown in the chart below, all else being equal, the straight average results in a value of $800,000 for the company, while the weighted average results in a value of $890,000 for the company—a difference of $90,000 in value.

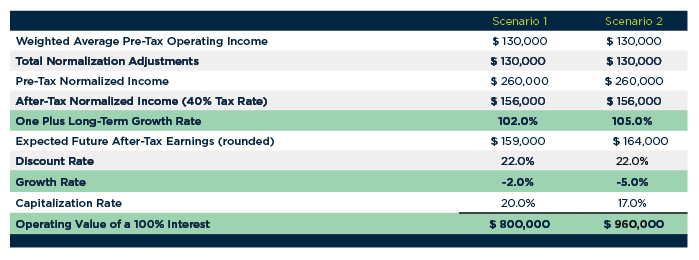

In addition to reasonable compensation and weighting, the selection of the capitalization rate can also materially impact the value, especially considering the impact of growth, which directly affects the capitalization rate. The capitalization rate has an inverse relationship to value; the higher the capitalization rate, the lower the value, and vice versa. The capitalization rate is a function of risk; therefore, the valuation appraiser considers the industry in which the company operates, its competition and the diversification of the company’s customers, just to name a few. It should be noted that the growth rate impacts the value in two ways: (1) growth is applied against the after-tax cash flow to obtain the future expected cash flow (increase to after-tax future earnings stream); and (2) growth is removed from the capitalization rate (decrease to the capitalization rate is an increase to the value as applied against the earnings stream). The following table illustrates the difference in value when utilizing different growth rates. As shown in the chart below, all else being equal, the use of a two percent growth rate versus a five percent growth rate calculates to a value of $800,000 and $960,000, respectively—a difference of $160,000 in value.

|

Nicole Lyons/CPA, CFF, CVA 609-520-1188 [email protected] |

|

Myroslava Hreb 201-265-2800 [email protected] |

Beware of the “Double Dip”

Beware of the “Double Dip”

[author-style]Noël J. Capuano, CPA/CFF, CVA[/author-style]

Early in 2005, with the issuance by the New Jersey Supreme Court of the Steneken decision, the areas of valuation, equitable distribution and support became considerably more interdependent. They also became decidedly more complex. As a result, the Steneken decision, and the concept of “double-dipping” which it addresses, has become one of the hottest issues facing valuation professionals today.

The concept of “double-dipping” refers to the consideration of a marital asset in both the determination of support and the division of marital assets (equitable distribution).

In the Steneken case, Mr. Steneken owned a business and drew a salary in excess of $200,000 per year. During the course of valuing Mr. Steneken’s business, his valuation expert determined that Mr. Steneken’s “reasonable compensation” was in the range of $150,000. The $50,000 “excess” compensation was added back to earnings and capitalized at a rate of 24%, thus increasing the value of the business by approximately $240,000. Mrs. Steneken was awarded 35% of the business in equitable distribution and alimony based on the reasonable compensation of $150,000.

Mrs. Steneken appealed, arguing that the family’s lifestyle during the marriage had been supported by Mr. Steneken’s actual salary of more than $200,000. On remand, the trial court agreed and increased her alimony award based on Mr. Steneken’s actual salary. Although the decision was appealed based on the argument that Mrs. Steneken had already received her share of Mr. Steneken’s “excess” compensation by virtue of the fact that it had already been capitalized and distributed in equitable distribution, the appeal failed, and the Supreme Court affirmed the trial court’s decision.

The implications of this decision for the business owner are far-reaching. Business owners typically pay themselves a salary that is, at best, discretionary. For those business owners getting divorced, be aware that the court appears not to be concerned with whether or not salary is “reasonable” for purposes of determining alimony awards.

For more information about “double-dipping” or other valuation/marital dissolution issues, please contact a member of WS+B’s Litigation, Valuation and Insolvency Services Group.

|

Noël J. Capuano, CPA/CFF, CVA 609-520-1188 [email protected] |

WS+B Promotes Three to Partner

WS+B Promotes Three to Partner

Mike is a member of the firm’s Manufacturing, Distribution & Logistics and Employee Benefits Services groups. He has over a decade of public accounting experience including auditing, financial statement preparation and analysis as well as business consulting with a focus on private and publicly-held entities. Mike provides accounting and auditing services to clients in the manufacturing, distribution, ERISA, technology and retail industry sectors. Mike graduated from Providence College with a BS degree in accounting and also received his MBA degree in finance from the Stillman School of Business at Seton Hall University. He is a member of the American Institute of Certified Public Accountants (AICPA) and the New Jersey Society of Certified Public Accountants (NJCPA).

Nicole serves as a member of WS+B’s Litigation Department and has an expertise in business valuation and forensic accounting. She also specializes in shareholder/partner disputes, matrimonial litigation and damage assessment engagements. Court-appointed on numerous cases, Nicole has testified in Superior Court and in arbitration. She graduated from Villanova University with a BS degree in accounting and a minor in Spanish. Nicole is a member of the AICPA, the NJCPA, the National Association of Certified Valuation Analysts (NACVA) and the Association of Certified Fraud Examiners (ACFE).

Dave is a member of WS+B’s Tax Services Group. He has extensive experience in tax planning and compliance and concentrates his efforts on special projects such as tax law research, tax audit representation and working with multistate clients. His industry expertise includes manufacturing, restaurant services, mortgage banking and aviation. Dave graduated from Roger Williams University with a BS degree in accounting and also received his masters of science in taxation from Seton Hall University. He is a member of the AICPA and the NJCPA.