Governor Christie to Withdraw from PA/NJ Reciprocal Income Tax Agreement

The Reciprocal Agreement provided that Pennsylvania residents who received compensation (e.g., wages and salaries) from New Jersey sources were not subject to New Jersey income tax on those earnings, and vice versa for New Jersey residents working in Pennsylvania. Pennsylvania and New Jersey entered into the Reciprocal Agreement with the goal of simplifying tax compliance for their respective residents and only requiring taxpayers to file one income tax return in their state of residence. On September 2, 2016, Governor Chris Christie made the decision to end the state of New Jersey’s participation in the Reciprocal Agreement, effective January 1, 2017.

The income tax rates and structures between Pennsylvania and New Jersey were initially comparable when the Reciprocal Agreement was entered into on October 19, 1977. However, as time went on the tax structures between Pennsylvania and New Jersey began to diverge significantly from one another, causing New Jersey legislators to reevaluate and consider withdrawal from the Reciprocal Agreement over the years. Prior to Governor Christie’s recent decision, former Governor Jim McGreevy proposed withdrawing from the Reciprocal Agreement as part of his 2002 Budget.

Pennsylvania currently has a flat tax rate of 3.07%. Conversely, New Jersey has a progressive income tax structure with rates ranging from 1.4% to 8.97%. Withdrawal from the Reciprocal Agreement will now result in wages being taxed where they are earned. Due to the difference in tax rates between the two states, lower income earners who live in New Jersey and work in Pennsylvania would pay the Pennsylvania 3.07% flat rate rather than a lower graduated rate in New Jersey. However, high income earners who live in Pennsylvania and work in New Jersey would pay tax at New Jersey’s maximum rate of 8.97% rather than Pennsylvania’s 3.07% flat rate.

Withdrawing from the Reciprocal Agreement would result in all employees to pay an equal tax rate based on the state where they physically worked, rather than their state of residence. Prior to the withdrawal from the Reciprocal Agreement, a highly compensated New Jersey resident (wages over $500,000) working alongside a Pennsylvania resident at a location, such as Princeton, NJ would pay a state income tax almost three times as high (8.97% versus 3.07%) than their Pennsylvania resident coworker. Additionally, the State of New Jersey would not collect revenue from the Pennsylvania resident employees’ wages.

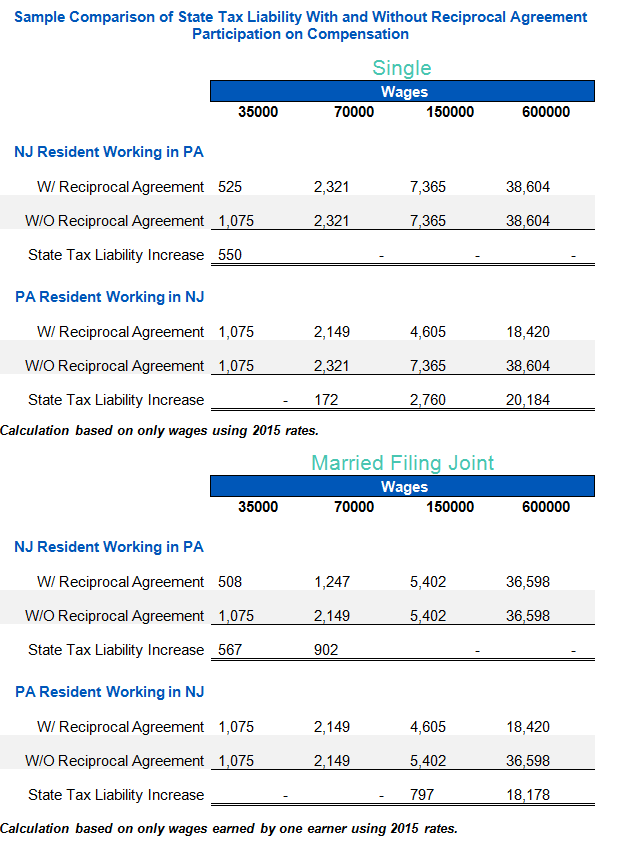

Ending participation in the Reciprocal Agreement results in winners and losers on both sides of the Delaware River. Please find below a sample comparison of state tax liability differences with and without the Reciprocal Agreement based only on compensation.

|

Jodi Kleuskens, CPA, MAcc T (970) 925 7382 [email protected] |

Ask Our Experts

To ensure compliance with U.S. Treasury rules, unless expressly stated otherwise, any U.S. tax advice contained in this communication is not intended or written to be used, and cannot be used, by the recipient for the purpose of avoiding penalties that may be imposed under the Internal Revenue Code.