Tools & Techniques 101 – The Charitable Gift Annuity

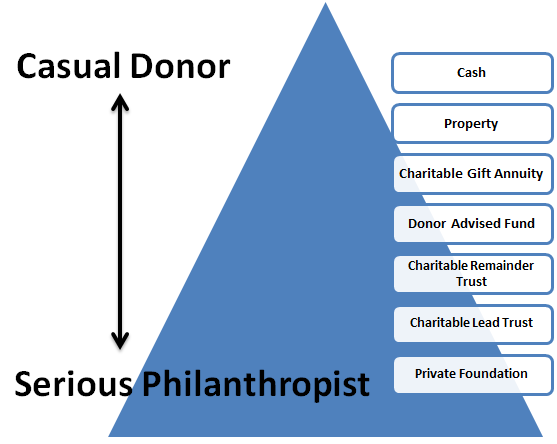

I am going to use the graphic in this and future posts to illustrate the use of tax and legal tools and techniques in charitable planning. The Philanthropic Continuum is what I call the evolutionary path from casual donor, giving when asked but without much thought, to protophilanthropist, having a more formalized view of giving, to serious (or serial) philanthropist, where truly significant gifts and amounts are involved. We all fall somewhere along this continuum; those who are serious about their philanthropy will take steps to move further using some or all of these techniques. That’s not to say that a serious philanthropist cannot achieve all his/her goals using mainly cash, it’s just to say that the “3E test” – effective, efficient, and elegant – may make some of these other tools and techniques more desirable and useful in philanthropic planning.

For example, the Charitable Gift Annuity (CGA) is a terrific way to have your cake and eat it too. It has particular use in the philanthropic portfolio of a family where one spouse is gung-ho about making a significant gift to a particular charity while the other may have reservations because of lifetime cashflow concerns. In many ways it is a lower end or beginner’s tool in that many charities will establish such accounts for as little as $10,000, kind of like a lifetime CD with charitable legs. It is a contract between the donor and the charity whereby a gift is made to the charity in exchange for a guaranteed lifetime income stream. Simpler to establish than a trust, assets are transferred directly to the CGA which is then administered by the charity. The income stream may be immediate or deferred and is determined and set based on the donor’s single or joint life expectancy.

Before you even go there, realize that comparing a CGA to a commercial annuity is an apples and oranges comparison. CGA’s are designed so that on average the charity will end up receiving 50% or more of the initial investment (and must receive at least 10% in order to generate a charitable deduction for the donor). Commercial annuities obviously are not, so financially they may be comparatively better investments. However, that is not the point. The donor retains an income stream AND benefits a charity. This split interest makes it a compromise investment between the donor and charity. As long as the guaranteed payment is sufficient for the needs of the donor, the haircut should be inconsequential.

CGA’s are better investments for older donors as the payout rates tend to increase with age. For example, current rates published by the American Council on Gift Annuities for joint lives of couples aged 50, 60, and 70 are 3.1%, 3.9%, and 4.6% respectively.

The following table details some of the advantages and disadvantages of CGA’s. Additional information can be found in a recent article in Forbes Magazine or at the website of the American Council on Gift Annuities.

Advantages

- Converts an asset into an income stream benefitting the donor during life and the charity at the donor’s or beneficiary’s death.

- Converts an asset into a fixed stream of payments, an “anchor to windward” in the donor’s portfolio.

- Provides an immediate income tax deduction for the establishment of the annuity based on actuarial assumptions.

- Acts as a form of “installment sale” spreading out any capital gain on the sale of the asset over the life expectancy of the donor.

- Removes the asset from the donor’s estate for estate tax purposes.

Disadvantages

- Donor is relying on the financial health, discipline, and longevity of the charity – be careful of shoestring organizations!

- Longer term inflation can erode the purchasing power of the annuity.

- The ultimate charity is determined at the time the annuity is established. There is no flexibility to change the charity down the line.

- Unlike a charitable remainder trust, which can be structured to minimize or eliminate any built-in capital gain, the capital gain associated with a CGA must be recoginized over the life expectancy of the donor.

- Not all states allow charitable gift annuities – check with your tax and legal advisors.