The Philanthropic Business Plan

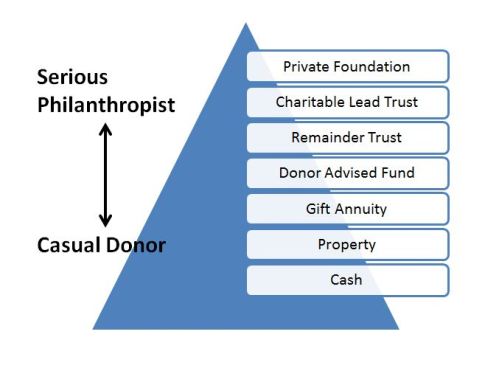

Since the start of this blog, we have focused on the Philanthropic Continuum, that progression from “casual donor,” the person who gives when asked but without much thought, to the “serious or serial philanthropist,” where truly significant gifts and amounts are involved. The more serious your philanthropy, the more important it is for you to treat it in the same manner that you would treat a business or investment portfolio. Certainly, there are few Bill Gates out there whose annual giving might exceed the gross national product of a small country, but there are certainly enough philanthropists and protophilanthropists who have either adopted or should adopt a businesslike approach to their giving. This is important whether you have a private foundation or donor advised fund or just your personal checkbook and it’s not an unreasonable approach; in fact such an approach is already in most responsible people’s DNA. Heck, I recently spent a half hour researching the purchase of a meat thermometer and stainless steel meat skewers (its barbeque season…), the grand total of which did not top $20, including shipping, so why wouldn’t I approach my charitable giving in the same way – systematically, methodically, and rationally?

Fact: Giving to charity is really not “giving” at all, it is “investing.” If you don’t view it this way, then as a donor you are throwing your money away. One’s charitable giving should be deeply connected to one’s val  ues and world view. The donor should be engaged with the cause and feel a sense of ongoing connection to it. If s/he achieves that, then the very act of giving to, no, investing in the cause brings the connection to the next level. Tossing money down a black hole never yields results, but investing in well-conceived and competently executed solutions can be quite rewarding.

ues and world view. The donor should be engaged with the cause and feel a sense of ongoing connection to it. If s/he achieves that, then the very act of giving to, no, investing in the cause brings the connection to the next level. Tossing money down a black hole never yields results, but investing in well-conceived and competently executed solutions can be quite rewarding.

Fact: Investing without a plan is, at best, inefficient. Without systematic measurement toward a goal, you will never know if you have achieved anything at all. The most effective financial investors are those who are strategic in their approach to investments. They first define their goals and then fashion a plan to meet them. Continual measurement of progress toward the goal is implicit in the plan. Some investors do this on their own while others hire advisors to help them. Nonstrategic investors, on the other hand, buy a little of this stock and a little of that annuity and maybe chase some yield at their local savings bank, but in the end, the bulk of their growth can be measured more in terms of their additions to principal rather than by any real market rate of return. The same can be said for charitable giving. Nonstrategic giving will most likely result in giving smaller amounts to a greater number of charities, many of which may not even make it to your values/world view radar screen. Developing a philanthropic investment or business plan can help prevent that from happening.

Fact: The business owner without a plan in place to grow his/her business is taken seriously by no one, least of all investors. Investors will run screaming from an entrepreneur who says “invest in my idea and we will see what happens.” Again, why would you treat your philanthropy any differently? Don’t you want to see results? Don’t you want to be engaged? Wouldn’t you rather strategically connect with your cause as a player than participate passively as a bystander?

So the message is clear – make a plan! Begin with your personal passion and identify charities that are worthy of it. Determine how much you want to give, no, invest and over what period of time. Consider the tax ramifications pertinent to your situation (and discussed throughout in www.charitable-nation.com) and adjust accordingly. Develop personal relationships with the charities you support. Learn more about the cause and become an unpaid ambassador or advocate, helping to raise awareness and ultimately more money. Volunteer. Find ways to use your professional skills and personal connections to help make a difference. (Time, treasure and talent) Stay on top of the charities you support, and don’t be afraid to offer advice or criticism if and when needed but, of course, be realistic in your expectations –the size and reach of the organization and the relative size of your contributions will likely play a role in how effective you can be in an informal advisory role. To formalize that role and perhaps increase your influence, consider taking a position on the organization’s advisory board or board of directors.

Unlike financial investing or for-profit business ownership, philanthropic investing will not result in a personal, positive rate of return. It will, however, produce a discernible social return on investment that will be meaningful to you, but only if you take the time to define and measure it.