A new and significant deduction limitation for research and experimental (R&E) expenses takes effect in 2022. The ability to expense R&E spending, coupled with the research and development (R&D) tax credit, are two important ways the tax code incentivizes businesses to make this critical investment. However, under the December 2017 Tax Cuts and Jobs Act (TCJA), R&E expenses are no longer deductible in 2022; instead, taxpayers are required to capitalize and amortize their Section 174 R&E expenses over a 5-year period (or 15 year-period if attributable to foreign research).

And while many businesses were holding out for Congress to extend the ability to immediately deduct Section 174 R&E expenses for the 2022 taxable year, no such legislation has been passed as of today. With final estimated tax payments for the 2022 taxable year approaching, coupled with the need to issue audited financial statements, businesses will be forced to develop an approach to address R&E capitalization.

What This Means for Your Company

Companies in many industries, including the technology and life sciences industries that incur significant R&D expenses will be affected by this change in tax law. Since the option to immediately expense these costs is currently not available for the 2022 taxable year, companies will be required to amortize their R&E expenditures beginning with the midpoint of the 2022 taxable year. This decrease in allowable deduction could cause the creation of taxable income, even though the business may have no previous history of federal taxable income.

While some companies may think that they have ample net operating losses (NOLs) to offset any potential taxable income, careful examination is required to determine the year the net operating losses were created by the company. While it is true net operating losses incurred in taxable years before December 31, 2017, will fully offset taxable income, the TCJA made significant changes to the ability to utilize net operating losses incurred after December 31, 2017. Under the TCJA amendment net operating losses that were incurred after December 31, 2017, and applied to taxable years after December 31, 2020, can only be utilized to offset up to 80% of taxable income, leaving 20% of taxable income subject to federal income tax.

For a simple example, assume a C corporation has $10,000,000 of income and $15,000,000 of R&E expenses for the 2022 taxable year. Prior to the 2022 taxable year, the business would record a $5,000,000 net operating loss. However, due to the Section 174 R&E capitalization requirement, the business now will be required to amortize the $15,000,000 of R&E expenditures and only be allowed a deduction of $1,500,000 (15,000,000/5 x ½) for the 2022 taxable year. This results in taxable income of $8,500,000 (10,000,000 – 1,500,000). If the only NOLs for the corporation were created after December 31, 2017, the company utilization of the net operating losses will be limited to 80% of taxable income. At least $1,700,000 of taxable income ($8,500,000 x 20%) would remain after the utilization of net operating losses, resulting in federal tax due of $357,000 (1,700,000 x 21%).

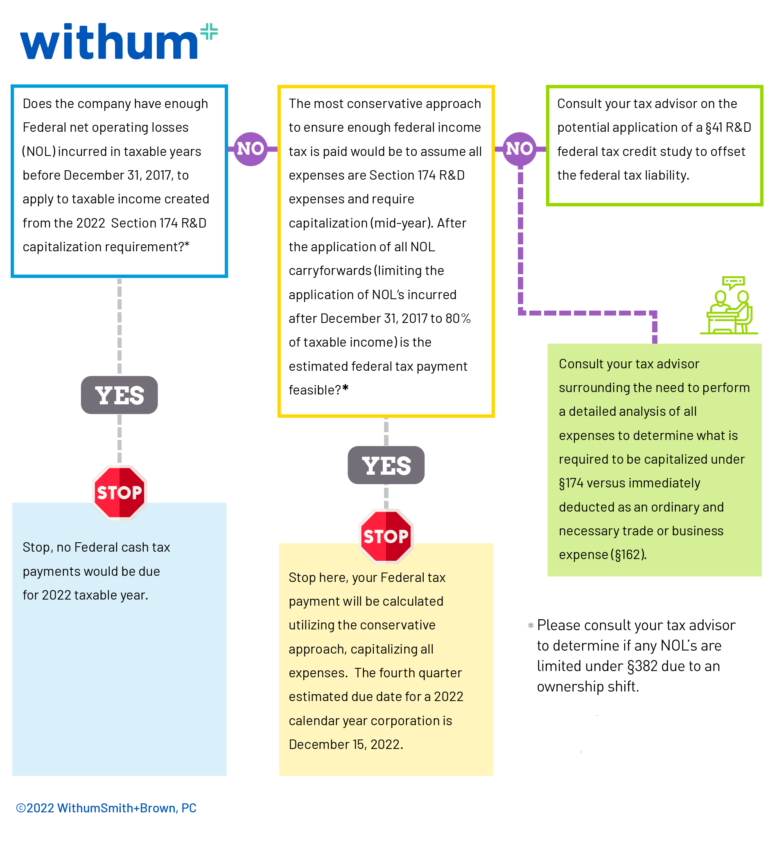

For further assistance in assessing the federal cash impact of the Section 174 R&E required capitalization policy for the 2022 taxable year, please review the steps provided in the following flow chart:

Research or Experimental Expenses

In previous years it was not relevant for taxpayers to separately identify Section 174 R&E expenditures as they were fully deductible.However, the 2022 R&E capitalization requirement will force companies to specifically identify costs related to Section 174 R&E expenditures to ensure proper amortization.

Broader Expense Valuation

The definition of R&E expenses under Section 174 is extremely broad when compared to the expenditures identified for a Section 41 R&D credit. The regulation applies an expansive principle of inclusion of costs incurred in, or incident to, research and experimentation limiting an immediate deduction even further.

Section 174 expenditures generally include all costs incidental to the development or improvement of a product. Examples of these include costs of obtaining a patent, attorney fees, wages, utilities (i.e., heat, light, and power), drawings, models, laboratory materials, and depreciation of a building associated with a project. Any activities related to the discovery of information that would eliminate uncertainties concerning the development or improvement of a product also would need to be capitalized.

It is important to note that Section 174 expenses are not limited to these examples listed. The categorization depends on the nature of the activity to which the expenses relate. The success or failure of the project is irrelevant when determining Section 174 R&E expenditures. Lastly, even if the property to which Section 174 R&E expenditures are incurred is disposed of, retired, or abandoned the law will not allow an accelerated deduction and will still require the costs to be amortized over the remaining 5-year (or 15-year) period.

| Type of Expense | Allowed Under §174 | Allowed Under §41 |

|---|---|---|

| W-2 Wages | Yes | Yes |

| Non-Taxable Employee Benefits | Yes | No |

| Any Amount Paid or Incurred for Supplies | Yes | Yes |

| Contract Research Expense | Yes (100%) | Yes (65%) |

| Land/Improvement to Land | No | No |

| Depreciation Expense | Yes | No |

| Overhead | Yes | No |

| G&A Allocation | Yes | No |

| Ordinary Utilities | Yes | No |

| Indirect Expense | Yes | No |

| Rent Expense | Yes | No |

| Patent Expense | Yes | No |

Software Development Costs

The TCJA also changed the treatment of software development costs. It added Section 174(c)(3) which explicitly states that any amount paid or incurred in connection with the development of any software must be treated as a Section 174 R&E expense. This means it must be capitalized starting in 2022.

Exclusions from Capitalization

Section 174 specifically excludes the following expenditures from capitalization: quality control, efficiency surveys, management studies, consumer surveys, advertising, acquisition of another patent, and research in connection with literary, historical, or like projects.

International Tax Considerations

The TCJA also introduced the Global Intangible Low-tax Income (GILTI) provision which requires taxpayers with controlled foreign corporations (CFCs) to calculate an income inclusion based on US tax principles. Therefore, if the CFC has been expensing R&E costs, these costs would now need to be capitalized over a life of 15 years in the GILTI-tested income calculation.

Treatment for Tax Provisions

For domestic Section 174 R&E expenses, there should not be an impact on a business’s effective tax rate because the amortization of these expenses results in a timing difference. It will affect the current/deferred classification and the balance sheet and footnotes. For a company with international Section 174 capitalization, however, a rate impact may result as it could affect the GILTI addback, resulting in a permanent difference.

Conclusion

With the mid-term elections behind us, there does seem to be motivation by Senate Finance Committee Chairman Ron Wyden to include tax extender discussions in the Congressional agenda for the upcoming lame-duck session. While the Republicans support extending the immediate deduction of Section 174 expenditures, the Democrats in return are looking for an increase in child tax credits. Whether the two parties can come to an agreement will largely depend on the mood of Congressional leaders when they return to Washington. However, the decision regarding a year-end tax bill will likely not extend past December 16th, the House’s last day in session for the year.

For now, businesses should work closely with their tax advisors to model out the tax and book impacts of capitalization.

Authors: Lore Bilbao, CPA, MAcc | [email protected] and Lynn Mucenski-Keck, CPA, MST, Principal, Federal Tax Policy | [email protected]

Contact Us

For more information on this topic, please contact a member of Withum’s Technology and Emerging Growth Services or R&D Tax Credit Services Teams.