The IRS announced a processing moratorium on employee retention credit (ERC) claims on September 14, 2023. As part of that press release, the IRS announced that it was planning to issue two different settlement initiatives in the coming weeks/months.

The first is a settlement program for taxpayers whose ERC claims have already been processed and paid, and the taxpayers deposited the check(s). This program will allow “businesses to avoid penalties and future compliance action,” but no other details were released, and more detail is expected in 2024. The second initiative, which is the focus of this article, is a withdrawal option for taxpayers who have pending ERC claims. The withdrawal option allows taxpayers a “do-over” by permitting them to retract their ERC claims without penalty.

On October 19, 2023, the IRS released more details about the second settlement initiative – the withdrawal option. Taxpayers invoking the withdrawal option are essentially telling the IRS not to process their ERC claims and that they are withdrawing them. Claims that are withdrawn under this program will be treated as if they were never filed, which is good because it means that no interest or penalties will be imposed. The withdrawal of a claim, however, will not exempt a taxpayer from potential criminal liability.

The withdrawal option applies only to complete withdrawals of an ERC claim, not to reductions in the amount of an ERC claim. If a taxpayer needs to reduce or amend a previously filed claim, it can still do so on a corrected Form 941-X.

Who Can Request a Withdrawal

A taxpayer can withdraw an ERC claim only if it meets all of the following requirements:

- The taxpayer filed the ERC claim on an amended employment tax return (Forms 941-X, 943-X, 944-X, or CT-1X);

- The amended employment tax return was filed only to claim the ERC, and no other adjustments were made on the amended return;

- The taxpayer withdraws the entire amount of the ERC claim; and

- The IRS has not yet paid the claim, or if it has paid the claim, the check has not been cashed or deposited.

Three Options to Request a Withdrawal

There are three options to request a withdrawal of an ERC claim:

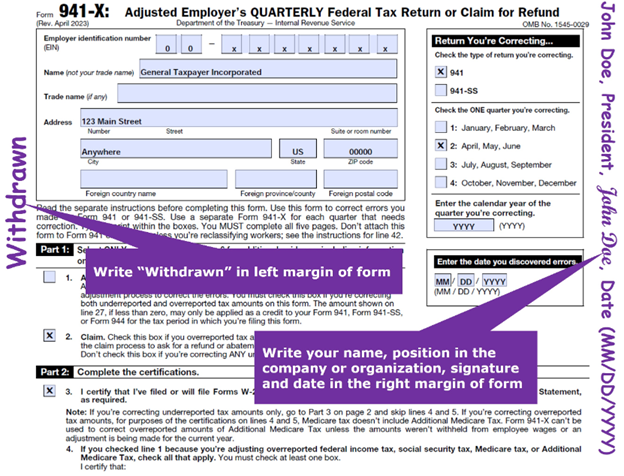

- If a taxpayer has not received a refund and its claim is not under IRS audit, then the taxpayer must make a copy of the amended employment tax return, write the word “Withdrawn” on the left margin of the first page, have an authorized person sign and date it on the right margin of the first page and write their name and title next to their signature, and fax or mail the document to the IRS at the prescribed fax number/address. This process must be followed separately for each calendar quarter in which the ERC was claimed and is now being withdrawn. See the diagram below for an example of what needs to be done.

- If a taxpayer has received a refund check but has not cashed or deposited it, then the taxpayer should prepare the withdrawal request as described below, but instead of faxing or mailing it to the IRS, it should write “Void” in the endorsement section on the back of the refund check, include a note that says “ERC Withdrawal” and briefly explain the reason for returning the refund check. This procedure is similar to the IRS procedure for returning an erroneous refund that existed before the withdrawal option.

- If a taxpayer has not received a refund and its claim is under IRS audit, then the taxpayer should prepare the withdrawal request as described above, but instead of faxing or mailing it to the IRS, it should be sent to the IRS auditor handling the audit.

Below is a sample of how the request for withdrawal should be prepared.

After the steps above are followed, the IRS will send a letter indicating whether the withdrawal request was accepted or denied. The withdrawal request is not effective until the IRS sends an acceptance letter. If the request is accepted, then the taxpayer also should amend its Federal and state income tax returns to reverse the income inclusion relating to the ERC.

This new withdrawal process is helpful for taxpayers who are aware their claim is specious or lacks merit. However, because of the many grey areas inherent in the ERC eligibility rules, our experience has been that many taxpayers may not be aware their claims lack merit.

Contact Us

If you are uncertain about an ERC claim you file or are about to file, or you want a second opinion, reach out to Withum’s ERC Services Team. We have prepared thousands of ERC claims on behalf of clients and have experts that can help determine whether your claim has merit.