In another unforeseen twist, Treasury promulgated Final and Proposed Regulations that are extremely tax-payer friendly. The first unexpected gift deals with the high-tax exception which has been surprisingly included in the newly issued Proposed Regulations despite being omitted from previous proposed Regulations. That topic is discussed here. The second issue, addressed in the Final Regulations and the newly issued Proposed Regulations, indicates that US partnerships can be treated as foreign partnerships for purposes of determining the individual partner’s GILTI and Subpart F inclusion amount.

Historically, domestic partnerships have been regarded as taxpayers for purposes of Section 958(a) ownership so that if a US partnership owned 10% of a CFC, the partnership was considered a US shareholder of a CFC and the partners were allocated their pro-rata share of the partnership’s subpart F income of the CFC, even if the individual partner indirectly owned less than 10% of the CFC. Foreign partnerships, on the other hand, were not regarded for purposes of determining CFC ownership. Rather, ownership was determined at the partner level so that if the individual partner did not own 10% of the shares of the foreign corporation, she was not a US shareholder of a CFC.

The Final Regulations confirm this treatment for all GILTI inclusions while the newly issued Proposed Regulations extend this treatment of domestic partnerships for determining which US taxpayers have inclusions under the Subpart F provisions as well. This change in treatment will potentially save many US taxpayers from having to include foreign corporation earnings in their taxable income.

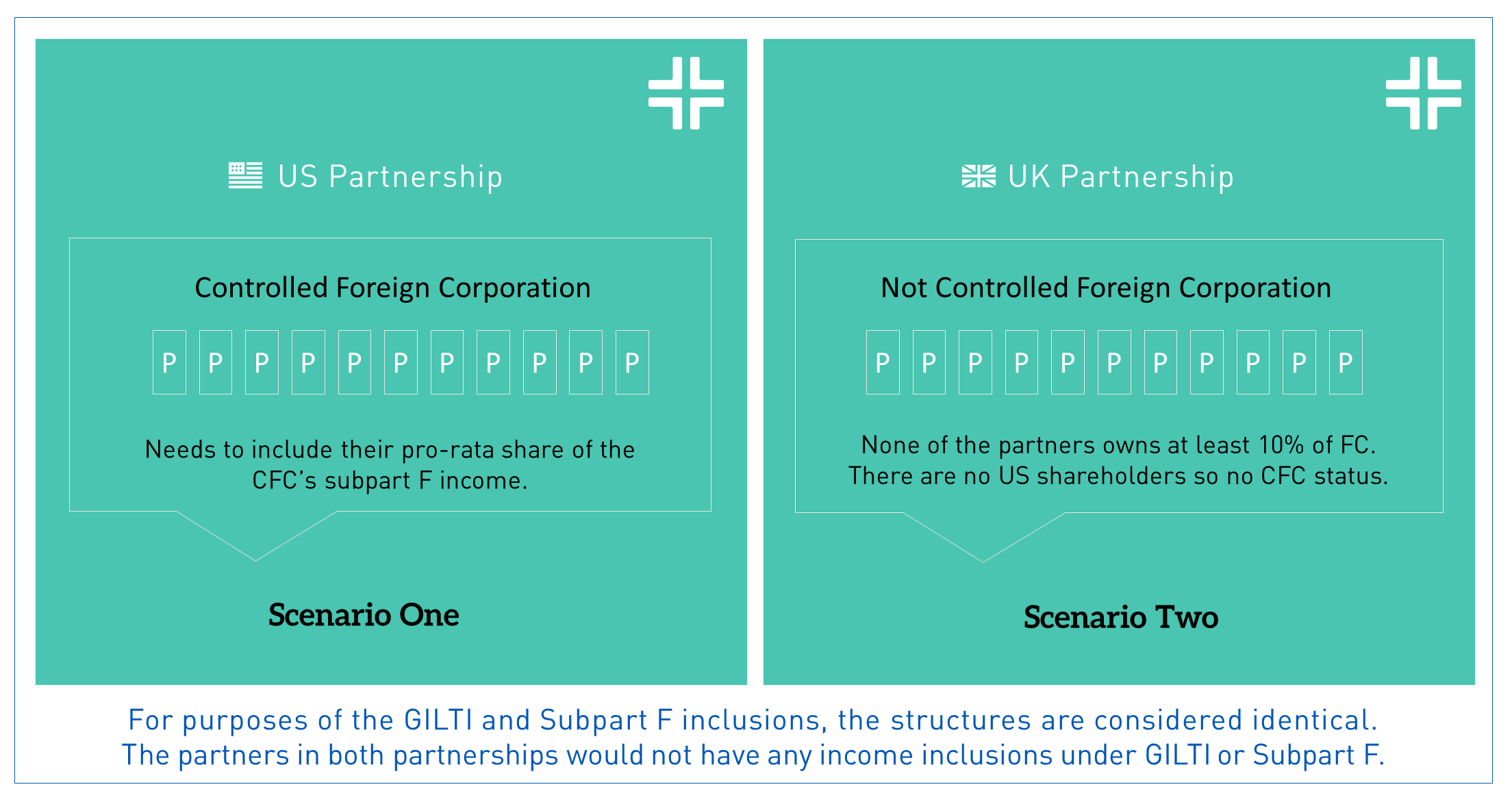

Consider the following two scenarios, a US partnership and a UK partnership with 11 equal US partners:

In Scenario 1, FC is a controlled foreign corporation. Prior to the Final and Proposed Regulations, all 11 partners would have needed to include their pro-rata share of the CFC’s subpart F income. In Scenario 2, FC is not a controlled foreign corporation because we look through the partnership and since none of the partners owns at least 10% of FC, there are no US shareholders so no CFC status. Based upon guidance in the Final and Proposed Regulations the foreign corporation in Scenario 1 remains a CFC, however, for purposes of the GILTI and Subpart F inclusions, the structures are identical; the partners in both partnerships would not have any income inclusions under GILTI or Subpart F.

Author: Josh Gelernter, CPA | [email protected]

Does GILTI Have a High Tax Exclusion?