Individual Tax Planning

Standard Deduction

Single and Married Filing Separately

2025 DEDUCTION: $15,750

2026 DEDUCTION: $16,100Married Filing Jointly and Surviving Spouses

2025 DEDUCTION: $31,500

2026 DEDUCTION: $32,200Head of Household

2025 DEDUCTION: $23,625

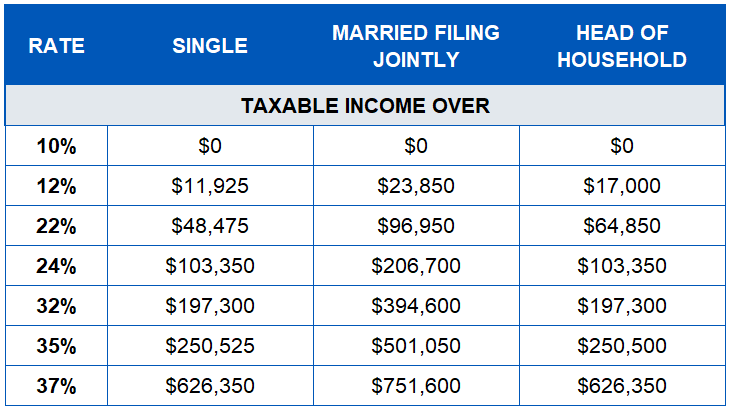

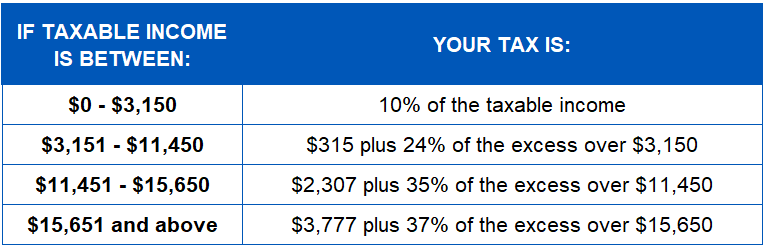

2026 DEDUCTION: $24,1502025 Individual Tax Brackets and Rates

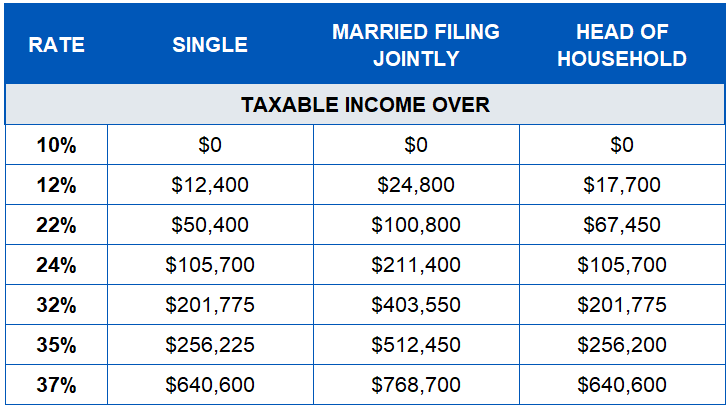

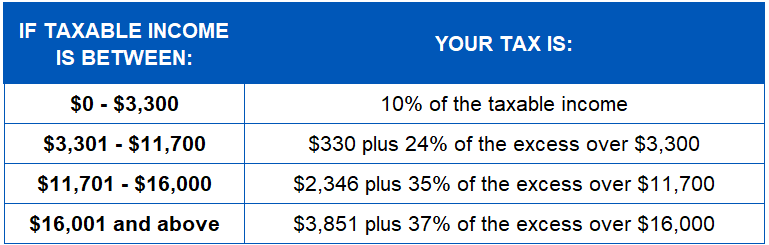

2026 Individual Tax Brackets and Rates

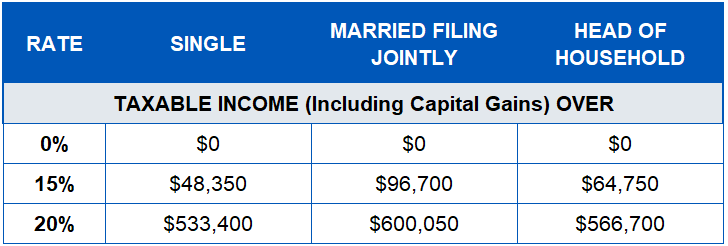

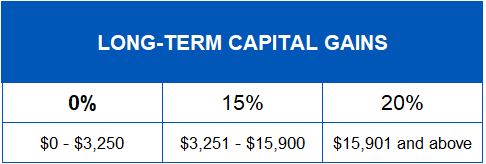

2025 Individual Long-Term Capital Gains Tax Brackets

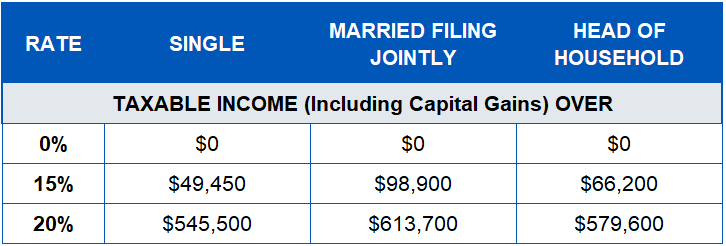

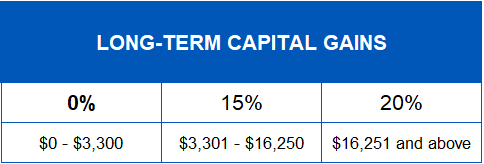

2026 Individual Long-Term Capital Gains Tax Brackets

One Big Beautiful Bill Act (OBBBA)

- The uncertainty about the expiring tax provisions has been removed, and the following provisions were made permanent:

- TCJA brackets & the enhanced standard deduction.

- Pass-through deduction (Section 199A).

- Opportunity Zones.

- Limitation on excess business losses (Section 461(L)).

- Itemized deduction for home mortgages continues to be based on $750,000.

- Elimination of 2% miscellaneous itemized deductions.

- Some aspects of the legislation will impact 2025 tax returns:

- Itemized deductions (2025–2029)

- Taxes – SALT deduction increased to $40,000.

- The cap increases to $40,000 per household, with a phase-out beginning at $500,000 of modified AGI.

- Consider paying Q4 estimates in December to reach $40,000 limit.

- Need to source property taxes for the tax return.

- Taxes – SALT deduction increased to $40,000.

- Interest on up to $10,000 in car loans for certain vehicles (2025–2028) .

- Available whether you itemize or not, but the deduction begins to phase out at $100,000 of modified AGI for individual taxpayers and $200,000 for joint filers.

- Requirements:

- New vehicle purchased with a loan after December 31, 2024.

- Car, minivan, SUV, pickup truck or motorcycle (all weighing less than 14,000 pounds).

- Assembled in the U.S.

- Personal vehicle only (no business vehicles).

- Itemized deductions (2025–2029)

- Other provisions will be affective for January 1, 2026.

- Charitable Giving

- Above-the-line charitable deduction returns in 2026: $1,000 for single filers and $2,000 for joint filers, even for those who do not itemize.

- Reduction of the itemized charitable deduction.

- 0.50% AGI floor for itemizers to deduct charitable contributions. Starting in 2026, those who are charitably inclined and itemize will no longer be allowed to deduct charitable contributions to the extent of the first 0.50% of AGI.

- For example, a married couple with an AGI of $250,000 will not be able to deduct charitable contributions until they exceed $1,250.

- 0.50% AGI floor for itemizers to deduct charitable contributions. Starting in 2026, those who are charitably inclined and itemize will no longer be allowed to deduct charitable contributions to the extent of the first 0.50% of AGI.

- Limit on Itemized Deductions

- The benefit of itemized deductions will be capped at 35%. Taxpayers in the top tax bracket will see their total itemized deductions reduced by 2% tax – this includes deductible medical expenses and charitable contributions, as well as investment interest expense.

- Charitable Giving

General Income Tax Planning

- Postpone income until 2026 and accelerate deductions into 2025.

- Doing so may enable you to claim larger deductions, credits and other tax breaks for 2025 that are phased out over varying levels of adjusted gross income (AGI).

- Postponing income is also desirable for taxpayers who anticipate being in a lower tax bracket next year due to a change in financial circumstances.

- Long-term capital gain from sales of assets held for more than one year is taxed at 0%, 15% or 20%, depending on your taxable income. If you hold long-term, appreciated capital assets, and are in the 0% rate bracket, consider selling enough long-term assets to maximize the 0% rate in 2025.

- The 3.8% net investment income (NII) tax will apply depending on your modified adjusted gross income (MAGI) and NII for the year. You should consider ways to minimize or eliminate (e.g., through deferral) additional NII for the year, while trying to reduce MAGI other than NII.

- The 0.9% additional Medicare tax applies to individuals for whom the sum of their wages received with respect to employment and/or self-employment income exceeds a threshold amount ($250,000 for joint filers, $125,000 for married filing separately and $200,000 in other cases).

- Employers must withhold the additional Medicare tax from wages in excess of $200,000, regardless of filing status or other income. Thus, you can minimize the additional Medicare tax by deferring income to 2026.

- Consider asking your employer to increase withholding of state and local taxes (or you can pay estimated state and local tax payments) before year-end to pull the deduction of those taxes into 2025. Remember that state and local tax deductions are limited to $40,000 per year through 2029 (and subject to phaseouts above certain income levels), so this strategy is not a good one to the extent it causes your 2025 state and local tax payments to exceed $40,000.

- Consider relocating your tax domicile for the purpose of reducing or eliminating your state income tax. For example, common states where people move to reduce state income taxes are Florida, Texas, Wyoming and Nevada.

- Consider increasing the amount you set aside for next year in your employer’s health flexible spending account (FSA).

- Consider contributing to a health savings account (HSA).

- For 2025, individuals with a high-deductible health plan can contribute $4,300 for self-only coverage and $8,550 for family coverage. Those 55 and older who are not enrolled in Medicare can contribute an additional $1,000.

- If you’ve made any energy home efficient improvements, you may be eligible for a tax credit that expires at the end of 2025. Consider finishing any relevant projects if you can. The credit applies to a wide range of home upgrades including insulation, windows, doors and energy efficient appliances. Also, the solar tax credit expires at the end of 2025 and needs to be fully installed (though not necessarily connected to a utility) in order for the credit to apply. Note that any roof repairs or construction cannot be included as part of the solar tax credit.

- If you were in a federally declared disaster area, you may be eligible to claim a loss if you had a loss in excess of insurance proceeds. Additionally, you can elect to claim your loss in the tax year prior to year in which the loss occurred. Confirmation regarding whether the damaged area is categorized by the IRS as a federal casualty loss or qualified disaster loss is important to avoid the 10% AGI limitation.

- A calendar-year taxpayer who suffers a disaster loss in 2025 has until October 15, 2026, to make the prior-year election to deduct the loss for 2024.

- If eligible, consider making a qualified charitable distribution (QCD) to support your favorite charities. A taxpayer can transfer up to $108,000 in 2025, which can help you reduce taxable income without itemizing. QCDs can also count towards your required minimum distributions (RMDs). See the RMD section for more information.

- Donating to a donor-advised fund can be a strategic way to manage your charitable giving and accelerate your deductions.

- A 529 plan, also known as a qualified tuition plan, is a tax-advantaged savings plan aimed at encouraging savings for education expenses. These plans are sponsored by states, state agencies or educational institutions, and contributions are treated as completed gifts for federal gift tax purposes. Although contributions are not federally deductible or limited, each state may have their own aggregate limits per beneficiary and state tax benefits. You can superfund your 529 plan in 2025 with up to $95,000 (or $190,000 per married couple) without reducing your lifetime gift and estate tax exemption, assuming no other gifts were made to the beneficiary during 2025. See more about 529 plans in the Charitable Gifting & Contributions section.

- You may contribute up to $2,000 per beneficiary annually to a tax-exempt Coverdell Education Savings Account (Coverdell ESA) for individuals under 18 (or special needs beneficiaries of any age). The maximum contribution is gradually reduced for those with a modified AGI between $190,000 and $220,000 for joint filers and between $95,000 and $110,000 for others.

Capital Gain Planning

- Capital gain rates are always top of mind for those considering whether to sell stocks/bonds now or wait for the new year. This is especially true for those with substantial unrealized gains or business owners looking to sell their businesses. An increase in capital gain rates, even by a few percentage points, could make the difference between selling now or later .If there is a decision to sell loss stock in 2025, individuals should remember that capital losses can be used only to offset realized capital gain and an additional $3,000 of ordinary income each year.

- While individuals might be motivated to sell stock during 2025 to capture the capital loss and purchase the same stock at a lower cost, the wash-sale rule could apply. The wash-sale rule prohibits selling an investment for a loss and replacing it with the same or a “substantially identical” investment within 30 days before or after the sale. If you have a wash-sale, then the loss will be deferred until the replacement investment is sold.

- The wash-sale rule stops taxpayers from claiming a loss on the sale of stock or securities if they buy and sell substantially identical stock or securities within a 61-day window (30 days before or after the sale date).

- This means you can’t sell stock to create a tax loss and then repurchase it the next day. However, there are strategies to partially maintain an investment position while still realizing a tax loss, such as waiting to buy the same securities at least 31 days after sale or shifting investments to similar securities in different companies in the same line of business.

- Donating appreciated stock to charity can be a smart tax strategy. When you donate stock that has increased in value, you avoid paying capital gains tax on the appreciation.

- Additionally, if you held the stock for more than one year at the time of the donation, then you could claim a charitable deduction for the full market value of the stock at the time of the donation, which may reduce your taxable income. This way, both you and the charity benefit more than if you sold the stock and donated the cash proceeds.

Tax-Advantaged Accounts

- It may make sense to convert all or part of your eligible retirement accounts (e.g., traditional IRAs) to a Roth IRA before year-end. However, such a conversion may increase your AGI for 2025, and possibly reduce tax breaks that are tied to AGI (or MAGI). Keep in mind that your RMD for the year (if any) must be completed before you are allowed to convert to a Roth IRA.

- Consider taking versus delaying RMDs from your IRA or 401(k) (or other employer-sponsored retirement plan).

Required Minimum Distributions

- There are a few things to keep in mind for retirement planning at year-end. RMDs, which begin at age 73 (except for Roth IRAs), are one consideration. There is a complex set of rules regarding the timing of distributions from inherited IRAs, so beneficiaries should work with their Withum Wealth planners for accurate planning strategies.

- RMDs are classified as ordinary income and can push individuals into a higher tax bracket for a particular calendar year. Those who do not need the income may consider making a qualified charitable distribution from their IRA. This allows charitably inclined individuals to direct up to $108,000 from their IRA each year (at age 70½ and older) to a public charity, reducing the RMD – and thus, taxable income by that amount.

Contribution Limits

- In 2025, the maximum amount that can be contributed to an employer-sponsored plan is $23,500, with a $7,500 catch-up contribution for those 50 and older. New in 2025, there is a special catch-up for those aged 60 to 63 in the amount of $11,250 (instead of $7,500).

- For IRAs, the contribution limit in 2025 is $7,000, with a $1,000 catch-up contribution for those 50 and older. The deadline for 2025 IRA contributions is April 15, 2026. The contribution limit for 2026 is $7,500 per person with a $1,100 catch- up contribution for those 50 and older.

Trust and Estate Tax Planning

2025 Trust and Estate Income Tax Brackets and Rates

2026 Trust and Estate Income Tax Brackets and Rates

2025 Trust and Estate Long-Term Capital Gains Tax Brackets

2026 Trust and Estate Long-Term Capital Gains Tax Brackets

Trust and Estate Income Tax Planning

The OBBBA temporarily increases the state and local tax (SALT) deduction cap to $40,000 for non-grantor trusts beginning with tax year 2025, which offers a significant planning opportunity. Trustees should consider accelerating the payment of state income taxes and real estate taxes before year-end to fully utilize this expanded deduction. This is particularly beneficial for trusts located in high-tax jurisdictions or those with substantial real estate holdings. Since the increased cap is scheduled to sunset after 2029, taking advantage of it now can yield meaningful tax savings while the provision is in effect.

Trusts and estates can also benefit from accelerating other deductible expenses into the current tax year to reduce taxable income. Common deductible expenses include trustee fees, legal expenses and accounting costs. Timing these payments before December 31 ensures they are captured in the current year’s tax return.

Capital loss harvesting is a valuable year-end strategy for trusts and estates. By realizing losses on underperforming investments, trustees can offset capital gains realized during the year and reduce net taxable income. If capital losses exceed gains, up to $3,000 of the excess losses can be used to offset ordinary income in the current year and the remainder will be carried forward to future years. Trustees should carefully review investment portfolios before year-end to identify loss positions but be mindful of the IRS wash-sale rules, which disallow losses if the same or substantially identical security is repurchased within 30 days before or after the sale.

One of the most effective strategies for minimizing trust-level income tax is to distribute income to beneficiaries who are in lower tax brackets. In 2025, trusts reach the highest federal income tax rate of 37% at just $15,650 of taxable income. By contrast, individual beneficiaries may have significantly more room in lower brackets. Trustees can use discretionary distributions to shift taxable income from the trust to beneficiaries and reduce the overall tax burden borne across the trust and beneficiaries. This approach not only preserves more wealth within the family but also aligns with fiduciary duties when done in accordance with the trust’s terms and the beneficiaries’ needs.

The Internal Revenue Code allows trustees to make a “65-day election,” which permits distributions made within the first 65 days of the following tax year to be treated as if they were made in the prior year. This election, available under section 663(b), provides valuable flexibility for trustees who may not have finalized distribution decisions by year-end. Distributions made by March 5, 2026, can be applied to the 2025 tax year, which allows trustees to retroactively reduce the trust’s taxable income and shift it to beneficiaries. This strategy is especially useful when year-end income and expense figures are not yet finalized and offers a second chance to optimize tax outcomes.

It’s important to recognize that the distribution strategies discussed above primarily apply to trusts taxed as complex trusts and not all irrevocable trusts fall into this category. Many estate plans utilize grantor trusts, which are structured so that the grantor is treated as the owner of the trust’s assets for income tax purposes, but not for estate tax purposes. In these cases, distributions to beneficiaries do not carry out taxable income because the income is reported on the grantor’s personal return. Given this distinction, trustees and advisors may wish to evaluate whether a trust currently taxed as a grantor trust could or should be converted to a complex trust in future years to take advantage of income-shifting opportunities. This decision should be carefully balanced against the estate planning benefits of the grantor paying the trust’s income taxes – namely, reducing the grantor’s taxable estate while allowing trust assets to grow income tax-free for beneficiaries.

Federal Lifetime Gift and Estate Tax Exemption

The passage of the OBBBA in July 2025 permanently reshaped the federal estate, gift and generation-skipping transfer (GST) tax landscape. Effective January 1, 2026, the lifetime exemption increases to $15 million per individual ($30 million for married couples). These amounts are indexed for inflation and do not sunset, unlike the temporary increases under the Tax Cuts and Jobs Act (TCJA).

The urgency for many to use lifetime exemptions before the end of 2025 has eased with the passage of the OBBBA. However, those with significant wealth who are interested in making gifts and have sufficient assets to do so should still consider gifting in 2025. Even though the exemption is increasing, using the current $13.99 million ($27.98 million for married couples) exemption now can help shift more assets out of your estate sooner. Transferring appreciating assets locks in lower valuations and removes future growth from your taxable estate.

We recommend reviewing your existing trusts and estate plans to ensure alignment with the new exemption levels and strategic goals.

Annual Exclusion Gifting

The 2025 gift tax annual exclusion is $19,000 per donor per donee. This is the amount that can be gifted to an individual from your estate without triggering gift tax or using any portion of your lifetime exemption. Married couples can effectively double this exclusion to $38,000 per recipient by electing to split gifts on their gift tax returns or by making gifts from community property assets.

Annual exclusion gifting strategies to consider are:

- Make annual exclusion gifts to multiple recipients: You may gift $19,000 to each recipient, or $38,000 each between you and your spouse. These gifts are non-taxable and help reduce the size of your gross estate.

- Front-load 529 plans: You can contribute up to five years’ worth of annual exclusion gifts to a 529 plan in a single year. For example, between you and your spouse, you can make a one-time gift of $190,000 to a 529 plan in 2025. However, this strategy uses up the annual exclusion for that beneficiary for the current year and the next four years.

- Forgive intra-family loans: You may forgive loans (such as promissory notes or informal family loans) annually up to the $19,000 exclusion amount and avoid gift tax implications.

Certain transfers do not count against your lifetime exemption and are not subject to gift tax. These include:

- Direct payments of tuition and medical expenses: These payments must be made directly to the educational or healthcare institution. They can be made on behalf of anyone – not just immediate family members – and do not use any of your lifetime exemption.

- Gifts to a spouse: Assuming both spouses are U.S. citizens, gifts between spouses qualify for the unlimited marital deduction and are not subject to gift tax.

Advanced Estate Planning Tools

Spousal Lifetime Access Trust (SLAT)

For individuals concerned about relinquishing too much control or access when making large gifts, SLATs offer a flexible and strategic solution. A SLAT allows one spouse (the donor-spouse) to transfer assets to an irrevocable trust for the benefit of the other spouse (the beneficiary-spouse), effectively removing those assets from the donor’s taxable estate. Importantly, this structure provides indirect access to the gifted assets through the beneficiary-spouse, offering a measure of financial security while still achieving estate tax efficiency.

Intentionally Defective Grantor Trust (IDGT)

Grantor trusts remain a cornerstone of advanced estate and income tax planning. These structures allow the grantor to retain certain powers – such as the ability to substitute assets or borrow without adequate security– that cause the trust’s income to be taxed to them personally. This arrangement enables the trust to grow without the drag of income taxes, effectively creating a tax-free transfer of wealth to future generations. Importantly, the grantor’s payment of the trust’s income taxes is not considered an additional gift, preserving the grantor’s lifetime gift and estate tax exemption.

Irrevocable Life Insurance Trust (ILIT)

For individuals seeking to remove life insurance proceeds from their taxable estate while providing liquidity for heirs, ILITs are a time-tested and effective planning tool. An ILIT is a trust specifically designed to own and manage life insurance policies outside of the insured’s estate. By purchasing a policy through the trust, the death benefit is excluded from the insured’s gross estate, potentially saving millions in estate taxes. ILITs are often funded using annual exclusion gifts which are used to pay premiums. When structured properly, these gifts avoid gift tax and preserve the grantor’s lifetime exemption.

Qualified Personal Residence Trust (QPRT)

For individuals looking to transfer a personal residence to heirs at a reduced gift tax cost while continuing to live in the home, QPRTs offer a strategic solution. A QPRT allows the owner to transfer a primary residence or vacation home into an irrevocable trust while retaining the right to live in the property for a specified number of years. Because the transfer is structured as a future interest gift, the value of the taxable gift is discounted, often significantly, based on the retained interest. If the grantor survives the trust term, the residence passes to the beneficiaries outside of the taxable estate, potentially saving substantial estate taxes.

QPRTs are especially effective in high-interest-rate environments, where the IRS valuation assumptions further reduce the taxable value of the gift. However, if the grantor does not outlive the trust term, the full value of the residence is included in the estate, so careful planning is essential.

Charitable Remainder Trust (CRT)

CRTs establish an income stream for the beneficiary over a defined period – either for life or a set number of years after which the remaining assets pass to a qualified charity. The donor receives a charitable income tax deduction equal to the present value of the remainder interest that will eventually go to charity. High-interest-rate environments result in a larger deduction – a favorable outcome for income tax planning.

CRTs are particularly effective when funded with low-basis, highly appreciated assets. By contributing these assets to the trust, the donor avoids immediate capital gains tax, yet the full fair market value is used to calculate both the income interest and the charitable deduction.

To preserve family wealth, CRTs are often paired with wealth replacement strategies, such as ILITs. This ensures that heirs receive assets equivalent in value to those ultimately donated to charity.

Intra-Family Loans

Intra-family loans are a tax-efficient way to transfer wealth by lending money to family members at low, IRS-approved interest rates known as Applicable Federal Rates (AFR). As long as the loan is properly documented and interest is charged at or above the AFR, it is not considered a gift and does not use any of the lender’s lifetime exemption. These loans can help fund home purchases, business ventures or investments, and if the borrower earns a return greater than the interest rate, the excess growth stays outside the lender’s estate, making it a simple but powerful estate planning tool.

Grantor Retained Annuity Trust (GRAT)

GRATs are used to transfer the future appreciation of assets to beneficiaries with little or no gift tax. They are especially useful for individuals who have already used their lifetime exemption and want to shift additional wealth out of their estate. The grantor contributes assets to a trust while retaining an annuity interest for a set term. If the assets grow faster than the IRS’s section 7520 hurdle rate during that period, the excess appreciation passes to beneficiaries’ gift tax-free. A common strategy involves using short-term, rolling GRATs to reduce mortality risk and smooth out fluctuations in asset performance.

Sale to an Intentionally Defective Grantor Trust

For individuals who have already used most or all of their lifetime exemption, a sale to an Intentionally Defective Grantor Trust (IDGT) offers a powerful way to transfer appreciating assets out of the estate with minimal gift tax exposure. This strategy involves selling assets at fair market value to an irrevocable trust in exchange for a promissory note. Because the trust is a grantor trust, the transaction is disregarded for income tax purposes. Typically, the trust is seeded with a gift of at least 10% of the sale value to support the transaction and ensure it is respected for tax purposes.

Retirement Plans as Part of Your Estate Planning

Recent changes to the rules governing retirement accounts, particularly under the SECURE Act and SECURE 2.0 Act, make it more important than ever to review your estate plan and ensure that beneficiary designations align with your tax and legacy goals. This is especially critical when naming a trust as the beneficiary, as the income tax treatment of inherited retirement accounts can vary significantly depending on the type of account and the classification of the beneficiary.

As of 2025, most non-spouse beneficiaries must fully deplete inherited retirement accounts within 10 years of the original owner’s death. If the account owner had already reached their Required Beginning Date (RBD), the beneficiary must also take annual Required Minimum Distributions (RMDs) during that 10-year period. These rules apply to both individuals and trusts, and failure to comply can result in penalties.

Naming a Charitable Remainder Trust (CRT) as the beneficiary of a retirement account allows the account to provide income to heirs over time with the remainder going to charity. This structure defers income tax, supports philanthropic goals and can be paired with life insurance in an ILIT to replace the value for heirs. Charitably inclined individuals may also consider leaving retirement accounts to a charity directly; this strategy can reduce both estate and income tax exposure for heirs.

Additionally, Roth conversions remain a popular planning tool. By converting traditional IRAs to Roth IRAs during life, individuals can prepay income tax at today’s rates, reduce the size of their taxable estate and allow heirs to inherit tax-free Roth assets. This is particularly appealing under the 10-year rule, as Roth IRAs are not subject to RMDs during the owner’s lifetime and offer tax-free growth and distributions to beneficiaries.

Contact Us

For more information on this topic, reach out to Withum’s Private Client Services Team to discuss your individual situation as year-end approaches.

Disclaimer: No action should be taken without advice from a member of Withum’s Tax Services Team because tax law changes frequently, which can have a significant impact on this guide and your specific planning possibilities.