The term is used so often that it almost seems lazy or cliché to say – disruptors. The industry is full of companies that seem to fit this definition. While they are, by all accounts, referred to as newcomers to the space, they’ve mostly been around for years with minimal impact on our dealer friends and clients. That led us to consider some data points to answer the question – are they really “disruptors?”

Customer Relationships

Online retailers perform almost all of the functions seen in a traditional physical dealer. From selling vehicles, accepting trade-ins, and providing financing for customer purchases. In many cases, these functions can be completed in less than 5 minutes with this new wave of competitors. The difference between these companies and traditional dealerships is the lack of a true fixed operations component. Fixed operations for traditional dealers has been key in maintaining customer relationships and serves as another source of revenue not to be overlooked. That core part of the business may not be relevant to the business model of the disruptors. Looking at the original disruptor, CarMax, it doesn’t appear that the lack of fixed operations has negatively impacted their ability to retain customers or build customer satisfaction. Perversely, it may assist these disruptors in building customer acceptance insofar as it seems everyone has at least one story of a dealer or independent repair shop swindling them in the course of repairing their vehicle. Regardless of whether the customer truly needed that solenoid or brake pad, the perception is that they didn’t.

Prices typically are not negotiable with online retailers, whereas traditional dealers can and will negotiate; a practice that has helped grow the relationship with customers of some backgrounds, while distancing themselves from many more. In the case of the disruptors, new and old, the key theme among their business approaches is similar: no-haggle pricing. Like when purchasing almost any other consumer good, the pricing of vehicles at companies like Carvana is fixed. The very idea of negotiating for many people means that they’re not getting a fair price, even if that logic is disproven by the readily available facts that are proudly highlighted in Carvana’s annual reports. In fact, Carvana’s no-haggle pricing means their gross profit per unit has increased nearly 2,000% in the past five years and now sits at nearly 50% higher than the PVR of the average dealer ($4,056 vs. $2,700). It comes as no surprise to anyone in the business that the best deals are achieved by shopping your local franchised car dealer.

The last position we have heard debated is that the lack of personal interaction at a Carvana or Vroom may not build long-term relationships the same way that a friendly sales associate would at a local dealership. No doubt the top sales professional at any dealership has an outgoing personality, a knack for remembering facts about their customers, and a methodical approach to customer follow-up and CRM management. That all being said, I’ve purchased nearly 10 iPhones and never once patronized the same sales professional, nor has that individual followed up to make sure I was happy with the purchase. Regardless of the impersonal experience, my next phone will certainly be another iPhone. It comes down to customer expectations, and many customers simply want a faster, more streamlined approach to retailing. If anything, this is an area where dealers can excel by offering both a digital retailing option as well as a traditional sales model – something the exclusively-online retailers cannot offer.

Business Model

Up to this point, the evidence we have discussed has been anecdotal and no more scientific than suggesting that the earth is flat. We will take this time to dig into quantitative aspects of these competitors to see if they’re having the impact that the media coverage suggests.

It is no secret that the pandemic’s impact on brick and mortar businesses greatly benefitted online business, with Carvana and Vroom being no exception, experiencing 2020 unit volume increases of 33% and 65%, respectively. This represents an acceleration of adoption for these two brands, which just a couple of years ago were chalked up to failed experiments in the auto retail space. As with all companies, eventually, growth rates will start to wane as they reach their normalized level of market adoption.

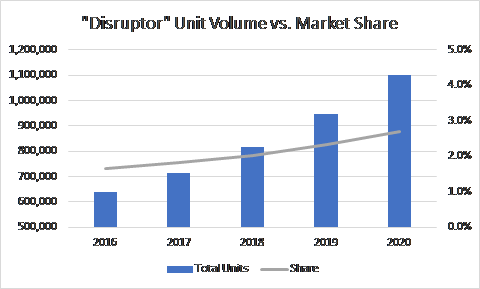

“Disruptor” Unit Volume vs. Market Share

The graph illustrates that while unit volume continues to increase, the market share of the total addressable market is still relatively small. Eventually, the companies (CarMax, Vroom, and Carvana) will reach an inflection point where market share remains constant. For example, even if Carvana is in every US market, only a particular percentage of people will patronize them. There is a Starbucks on every street corner in America, but they still only maintain a certain market share regardless of how many additional locations they open. There are only so many people who prefer Starbucks over other alternatives, just as there are only so many people who wish to buy a used car from a national chain.

What is the normalized market share percentage of the national used vehicle retailers? Nobody has a sense of that. If we look at other transportation companies as a proxy, Uber and Lyft pre-pandemic plateaued at around 10% of the personal transportation market. Uber may have secured 74% of the rideshare market, but as a percentage of total personal travel, their market share remained fairly small. As another point of reference, AutoNation last year retailed less than 3% of the new car volume in the US. They’ve maintained a similar market share for a number of years. At a 3% market share, does the average new car dealer feel pressure from AutoNation? At a 10% market share, does the average new car dealer feel pressure from Uber as a transportation alternative? If dealers aren’t feeling pressured, then it is hard to argue that there is “disruption” of the industry – especially to the extent being publicized in the media.

Keep Your Friends Close…

Much of the disruption talk has been dominated by Carvana and Vroom, while our quick analysis of the data doesn’t appear to bear out those assertions. From our conversations with industry executives, the most serious source of disruption isn’t coming from the outside – it’s coming from the inside. The increasing OEM emphasis on producing EV’s and their insistence on a direct-to-consumer sales model is the greater threat to disrupting our business. For right now, many of the EV sales channels still require the involvement (to some extent) of a local dealer, such as the Ford Mach E or GM Hummer. With the constant evolution of what vehicles mean and are, the very way consumers pay for vehicles may change over time in a way that makes the current franchise dealership model obsolete. EVs receive constant updates and upgrades from the OEM, which present future revenue opportunities that haven’t existed in the past.

We may reach a point in the future where the core revenue source for any vehicle doesn’t come from the sale of the initial product (an iPhone, for example), but the apps and functionalities that are subsequently bought and subscribed. It is not impossible to think of an auto market where vehicles are relatively low priced as a way for OEM’s to secure $400 per month in specialized subscription options such as interior lighting, improved vehicle performance, or even entertainment options like a Netflix partnership. In fact, Tesla recently announced that autonomous features of their models would either be available to purchase for $10,000 or via monthly subscription. This is a prime example of how the $10,000 would allow for potential gross at the dealership, whereas the monthly subscription cash flows would go directly to the OEM. It would be increasingly difficult for dealers to remain relevant (and profitable) in a subscription ecosystem.

There is disruption in our industry that is very quickly accelerating. Its not coming from start-ups. The real disruption is coming from Detroit.

For questions or additional insight, contact Withum’s Dealership Services team to help address your dealership challenges.

Author: Sebastian Banchitta, CPA, CGMA | [email protected] and Stuart McCallum, ASA, Practice Leader, Retail Automotive Services | [email protected]

Dealership Services