When It Comes To Taxes, Regrets Don’t Translate Into Refunds

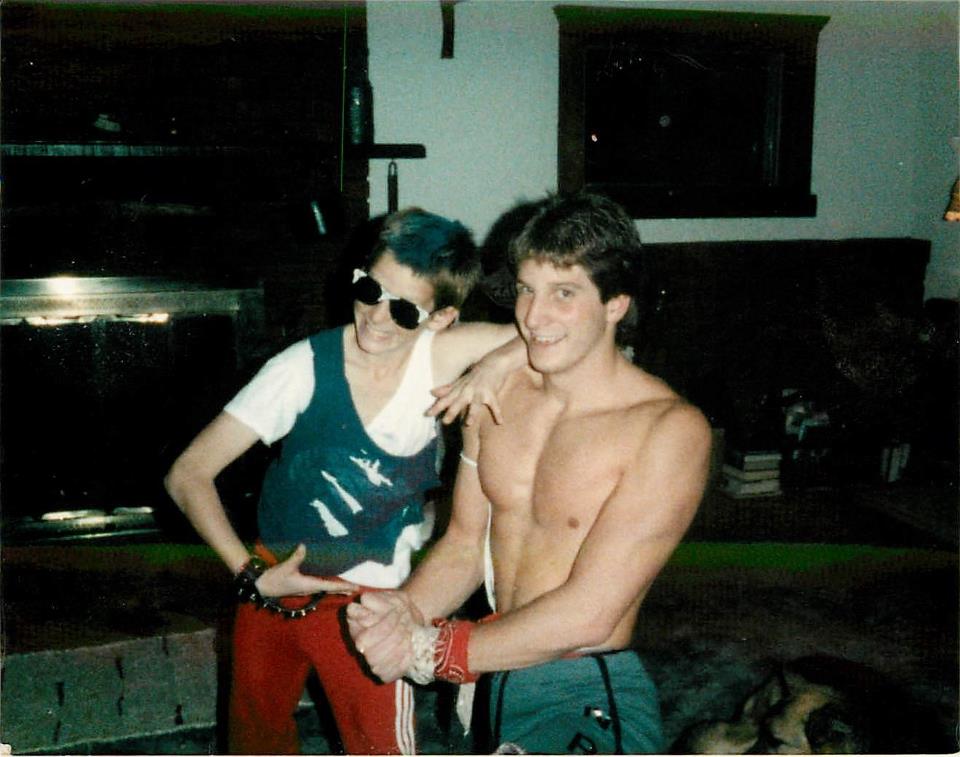

Regret is the worst. Lucky for me, in my 36 years I can’t think of a single thing I’d do differ…oh crap…

/curses the lethal union of his older brother, a scanner, and Facebook

To be fair, it was Halloween, wrestling was HUGE in ’86, and anabolic steroids weren’t as readily available as they are today. Now, where was I…

Oh yeah…regret sucks, and it can push even the most rational of people to irrational behavior in hopes of undoing a bad decision.

Consider the case of Patrick Sheedy, who was granted nonqualified stock options in his employer, a mortgage lender (PCFC). Sheedy exercised the option to purchase 250,000 shares in 2006, at a total exercise price of $5,000. Because PCFC was a private company, the shares were valued by the company’s compensation committee at $3 per share. As a result, Sheedy was required to recognize $745,000 of compensation income upon exercise under I.R.C. § 83 [i], the difference between the FMV of the stock ($750,000) and the exercise price ($5,000). On his 2006 tax return, Sheedy reported the income and paid the tax.

Soon after Sheedy exercised the options, PCFC took a turn for the worse. Sheedy tried to sell his shares, but was unable to do so. By 2007, PCFC had declared bankruptcy, leaving Sheedy holding $750,000 worth of completely valueless stock.

To try to right his wrong, Sheedy filed an amended 2006 return, claiming a theft loss of $643,000 related to the stock (after applying statutory limitations), and requesting a refund of $247,000.

The IRS denied the refund request, and the Tax Court held in favor of the Service. In reaching its conclusion, the court determined the following:

- Comparable 2006 sales of the PCFC stock validated the compensation committee’s determination of a $3 per share value.

- Sheedy was not the victim of theft. He knew well the risks of the mortgage industry, and he bought the stock of his own volition. He can’t invalidate the exercise of the options simply because his decision turned out to be unprofitable.

- The fact that PCFC was worthless six months after Sheedy’s exercise did not impact the value on the exercise date, because the subsequent financial difficulties were not foreseeable when Sheedy acquired the stock.

Thus, Sheedy’s regret be damned, he was not entitled to a refund of the tax he paid upon the exercise of the options. To soften the blow, the court did permit Sheedy to take a $750,000 worthless stock deduction in 2007, though as a capital loss, it was likely of little consolation.

[i] As a reminder, Section 83 taxes as compensation income stock transferred in exchange for services. The income is equal to the excess of the FMV of the stock over any amount paid for the stock, provided the stock is 1) freely transferable, and 2) not subject to a substantial risk of forfeiture. In Sheedy, the stock was taxed immediately upon exercise because it met both requirements.