For years, only a handful of states have imposed entity-level taxes on pass-through entities (PTEs). However, in the recent years there’s been a significant development of states enacting PTE income taxes.

The TCJA imposed a $10,000 limitation on the amount of state and local tax (“SALT”) that individuals (or pass-through business owners) may deduct for federal income tax. Some states responded by enacting various workaround bills in an effort to mitigate the impact of the limitation.

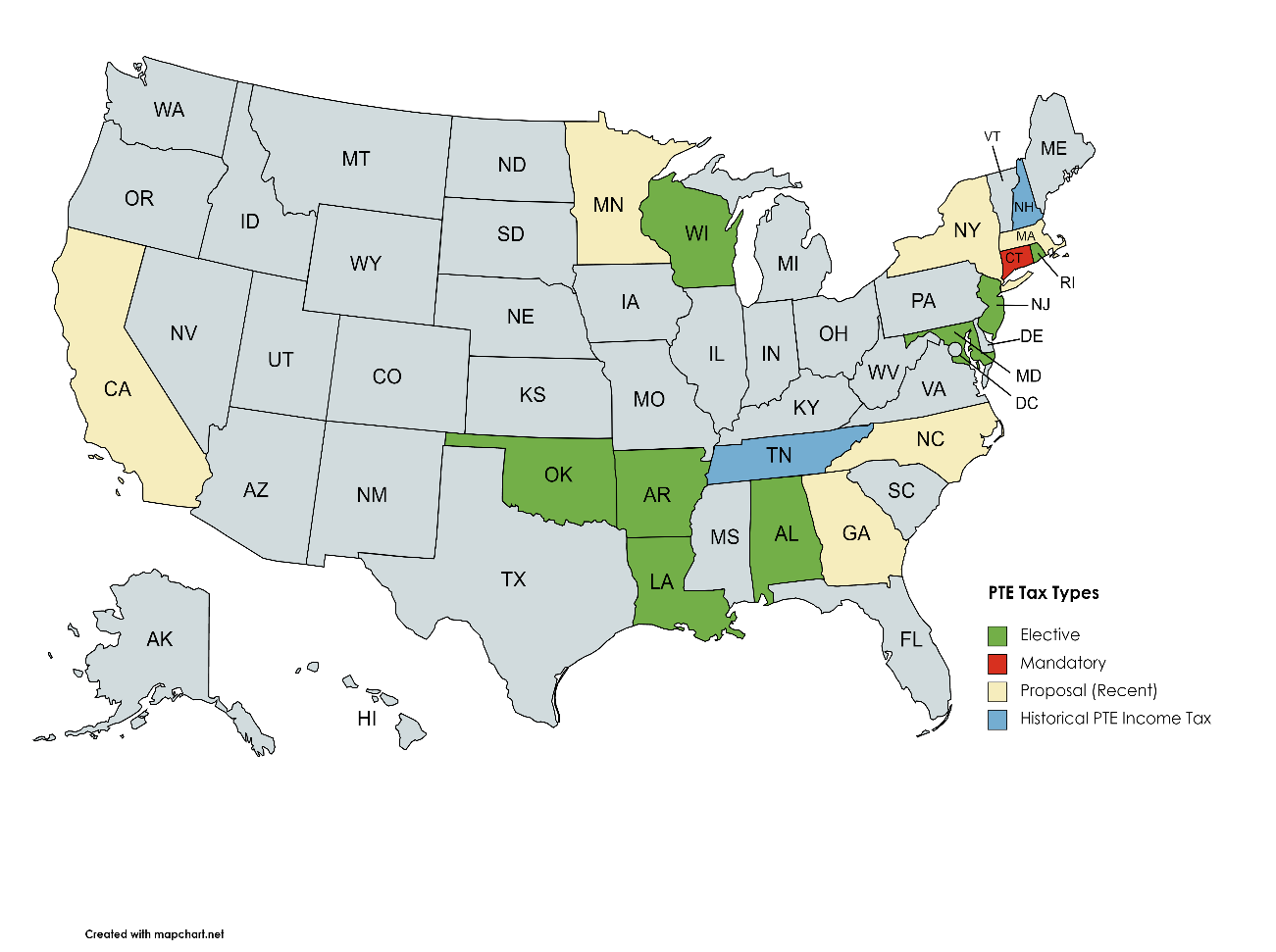

As the momentum of state PTE taxes continue to speed up, it is important for businesses to monitor this evolving trend. Therefore, Withum SALT has put together a “Pass-Through Entity Landscape Map”. Refer to Withum’s PTE Map; identifying states with “mandatory”, “elective”, “proposed”, and “historical” PTE income taxes.

Eight states to date have enacted elective PTE income taxes, including New Jersey, and a number of states have proposed PTE tax legislation which would continue this recent trend. There’s an expectation these trends will continue to gain steam in light of the IRS’s issuance of Notice 2020-75. As we wrote about in our November of 2020 article, “IRS tends to Greenlight Full State Income Tax Deduction For Pass Throughs”, the IRS published guidance in Notice 2020-75, affirming the use of PTE SALT workarounds. As of today, the New York legislature delivered a bill to the Governor which would continue this trend. This legislation is expected to be signed, which would be retroactive to January 1, 2021, and would create an annual election for pass-through entities to be taxed at the entity-level.

Although most of the states with PTE income taxes are elective, Connecticut’s PTE tax is mandatory. Also, in addition to the states identified in Withum’s PTE Map, there are also some states that impose non-income entity-level taxes on pass-through entities, such as gross receipts taxes (e.g. OH, TX, WA).

It’s important that businesses consider modeling out the potential benefits of an elective PTE tax, as each state’s PTE tax may function differently. Similar with New Jersey’s PTE tax or better known as “BAIT”, we explored in our September 2, 2020 article with some of the important factors in making such election. One of the common denominators with modeling out PTE taxes is the composition of owner (e.g. partner) demographics. As such, nonresident owners of an entity subject to entity-level tax may not receive a credit in their home state for the entity tax paid, resulting in possible double state income taxation. Depending on the facts and circumstances, with more resident state income, this may supersede the benefit of a deduction for federal purposes.

Let’s Talk

Although some states have historically imposed entity-level income taxes on pass-through entities, state PTE tax legislation and proposals have been on the rise since the passage of the TCJA, and it’s expected to continue to trend upward with IRS Notice 2020-75. That being said, some states may be waiting to see if the Biden administration tax proposals ultimately reestablish the SALT deduction.

As a number of different factors will play a role in businesses considering making elections into entity-level taxes, it is crucial all of the various considerations are modeled out. A key consideration may be owners state residency, but there may be potential structuring strategies in order to maximize the federal benefit to owners. If you like to discuss how these PTE taxes or these proposals may impact you, then contact Withum’s State and Local Tax Group for a deeper discussion.