Interest rates are at an all-time low, even lower than during the 2008/2009 financial meltdown and recession that followed. Right now, no one knows what will happen and when the end will be and how things will turn out. We can only hope for the best and while much of what is being done will have long term consequences, we are going through a devastating period and the government has to perform triage to keep us together so we will be able to rebuild when the virus is tamed and subsides.

For reasons beyond my understanding the stock market has pretty much recovered from its initial torrential losses. Me and my client base are long term investors and I believe the long term outlook still warrants remaining in the stock market in well-diversified portfolios.

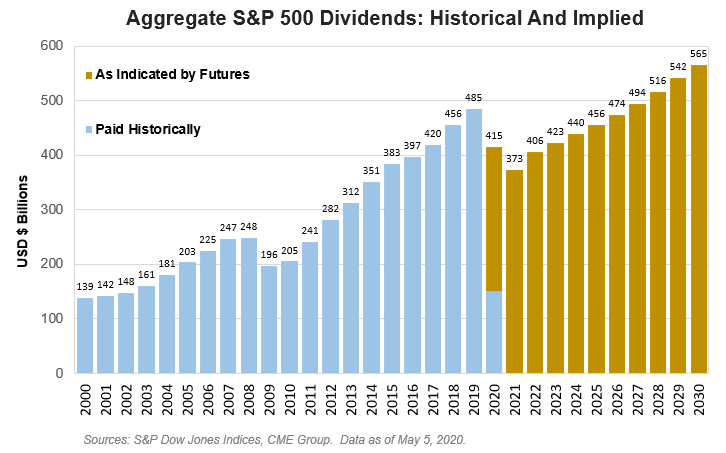

One measure I use to evaluate the market and stocks is the sustainability of dividend payments. In the 2008/2009 period the dollar amount of dividends from the S&P 500 stocks dropped 21% in 2009 from the record high 2008 dollar payouts and came back to reach a new high in 2012. Not too bad, and very good when comparing it to the drop in interest rates.

Now, I’ve seen an analysis by David Wilson, Stocks Editor, Bloomberg Radio titled “Payout Pessimism” that I interpret as an optimistic view of the continuity of dividends, albeit at reduced amounts. Based upon his chart it looks like the dollar amount of dividend payments will drop in 2021 by about 23% from the 2019 all-time high. Considering the recent plummeting of interest rates, this is fantastic! After reading his email I went to his source that shows the actual dividends from 2000 to the present and projected to 2030. That chart is included with this blog. At the end of this blog I include two links from where I got the idea and information for this blog and the caveat on its use.

It’s great when stock prices go up, but we really live off dividends or use the dividends to reinvest in more stock. For those living off the dividends, your cash flow will pretty much be maintained. For those reinvesting into more stocks, why do you want the prices higher? Aren’t you better off buying new shares at reduced prices?

Comment: Do not get caught up in the dividend yield percentages right now. As long as the dollar amounts are maintained, or just drop a little, i.e. less than 25%, your cash flow will be preserved. As stocks go up, the percentage yields will drop and when stocks drop the yields increase, but it’s the dollar payout that matters right now.

Here is a link to request David Wilson’s Chart of the Day.

Here is the link to David’s source, Tim Edwards, Managing director, Index Investment Strategy, S&P Dow Jones Indices, and you could also sign up for his emails.

Here is Tim’s caveat: “Of course, futures prices are not perfect predictions. The dividend futures markets may be overly pessimistic – they have tended to underestimate payouts historically. But there are plenty of reasons to suppose that prices should recover faster than dividends. Declining U.S. Treasury yields offer a justification for valuations to increase faster than fundamentals (as discount rates fall), while dividends themselves may prove less popular with some shareholders and CEOs during a time of economic uncertainty. Time will tell, but if we take futures prices as imperfect guides, it seems fair to conclude that S&P 500 dividend payments could slow considerably in the short term and take quite a few years more to recover.”

This blog is presented for informational purposes and is not intended to be a recommendation of any sort to invest in any manner whatsoever.

If you have any business or financial issues you want to discuss please do not hesitate to contact me at [email protected] or fill out the form below.

Read More of the Partners’ Network Blog