Many people make charitable gifts every year. Cash is typically used because it is easy to write a check and it is the medium that comes to mind first. Charities likewise prefer gifts of cash because property may take time to liquidate and its value can fluctuate.

|

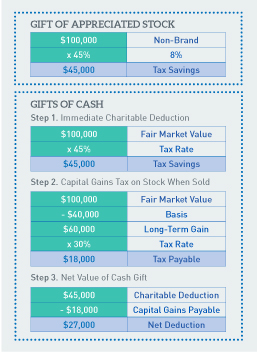

An often overlooked alternative is the gifting of appreciated stock. It serves two purposes. You get the full value of the stock as a deduction. Plus, you do not have to pay tax on the long term capital gain. From the charity’s perspective, gifts of appreciated stock which are publicly traded are equal to cash because the charity can sell them immediately upon receipt.

Let’s consider an example. Mr. Philanthropist is in the 45% income tax bracket and wants to make a gift to a charity of $100,000. He can use cash or appreciated stock he bought 5 years ago for $40,000. His long-term capital gains are taxed at 30%. The Bottom Line. You increase the value of your deduction by 64% ($18,000/$27,000) by gifting appreciated stock. It’s that simple. |

Withum PlatinumTM Team.

Withum PlatinumTM