The Senate Finance Committee released its markup of the One Big Beautiful Bill last Tuesday, June 17, 2025, with the expectation that the Senate will vote on the bill sometime this week. Three provisions that will have a direct impact on pass-through entity owners, including limitations on the deductibility of state pass-through entity tax payments at the individual level, maintaining the Section 199A deduction at 20% (versus 23% as provided in the House bill), and limiting the deductibility of business losses for pass-through entity owners.

Section 199A

Under current law, certain individuals, trusts and estates may deduct 20% of qualified business income from a partnership, S corporation or sole proprietorship. The deduction can result in pass-through business owners having a maximum effective federal tax rate of approximately 30%, as opposed to 37%. The deduction was provided under the Tax Cuts and Jobs Act in order to provide more equity in the applied tax rates for pass-through businesses and C Corporations, given that the C Corporation tax rate was decreased from 35% to 21% as part of the legislation. However, the C Corporation 21% tax rate was a permanent tax provision, while the 199A deduction is set to expire as of December 31, 2026.

The House had proposed to increase the deduction to 23% of qualified business income, but the Senate bill proposes that the deduction remain at 20%.

The 199A deduction is eventually phased out for specified service trades or businesses (SSTBs) when an owner’s taxable income exceeds a certain threshold amount. Trades or businesses that are subject to this phase-out include businesses involving the performance of services in the fields of health, law, accounting, actuarial science, performing arts, consulting, athletics or financial services. Current law applies this phase-out when taxable income exceeds $100,000 for married filing joint taxpayers ($50,000 for all others). The Senate bill would increase the threshold amount to $150,000 for married filing joint taxpayers ($75,000 for all others).

In addition, the Senate bill provides for a $400 minimum 199A deduction if a taxpayer materially participates in a qualified trade or business and has income of at least $1,000. The Senate bill would enact these changes for taxable year beginning after 12/31/25.

Note: While both the Senate and House bills make permanent the 199A deduction, the Senate bill did not follow the House’s proposal to increase the deduction to 23% but supports continuing with a 20% 199A deduction. The Senate’s decision to maintain the 20% deduction appears to be linked to the desire to make other tax provisions permanent in the bill. Unlike the House bill, the Senate proposal provides that bonus depreciation and the ability to calculate the interest expense limitation utilizing EBITDA (as opposed to EBIT) are permanent tax provisions.

Pass-Through Entity Tax (“PTET”) Deduction

Even though the Tax Cuts and Jobs Act limited individuals to a state and local tax deduction of $10,000, 36states and New York City have developed PTET regimes where the state and local tax associated with the pass-through entity is assessed at the entity level. This results in pass-through business owners avoiding the $10,000 state and local income tax limitation on their pass-through income.

The Senate bill proposes a broad sweeping change that would limit pass-through entity owners’ ability to deduct PTET payments for federal income tax purposes to the greater of $40,000 or 50% of PTET. This limitation would apply to all pass-through businesses, and unlike the House bill’s proposal, would not be subject only to SSTBs. Notably, the Senate bill does not provide any additional state and local tax limitation on C Corporations.

In addition, the Senate bill would also compel several states to revisit their PTET regimes, as certain PTET tax paid by a pass-through owner could be limited to a $10,000 deduction. Based on the Senate bill, if a taxpayer pays a PTET to a state starting in a taxable year which is 18 months after the bill is enacted, and the amount being paid to the state exceeds 102% of what a single individual would have paid on the pass-through income in that state, then the ability to deduct the greater of $40,000 or 50% of the PTET payment is no longer allowed. Instead, the entire PTET payment would be deemed a substitute payment and limited to $10,000.

For example: Assume $500,000 of pass-through income is allocated to a New York state resident, filing a married filing joint return, for the 2028 calendar year. Assume for the same taxable year, a New York resident filing as a single taxpayer would have a tax liability of $30,400 related to the $500,000 of pass-through income. Provided that the PTET payment exceeded $31,008 (102% of 30,400) it would no longer be considered a PTET for federal income tax purposes, and only $10,000 would be deductible.

Get the Latest Tax and Legislative Developments

Withum’s National Tax Policy and Legislative Updates Resource Center is your go-to source for timely updates on tax law and legislative changes. Our team is closely monitoring sweeping tax reform changes, shifting tariffs and tax industry updates, delivering in-depth analysis and actionable insights.

Excess Business Loss Limitation Rules

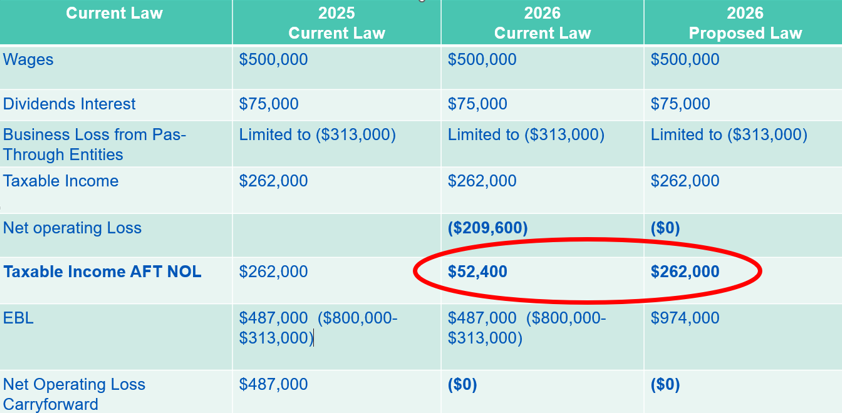

Under current law, an excess business loss is not allowed for pass-through owners provided it exceeds $626,000 for a joint return (or $313,000 for other taxpayers) for the 2025 taxable year. To the extent that any loss is in excess of the threshold amount, the current law provides that it is treated as a net operating loss to be carried forward to a subsequent taxable year. This allows for the loss to offset income other than trade or business income in future years. The excess business loss limitation rule is applicable for effective taxable years beginning after December 31, 2020, and before January 1, 2029.

The Senate and the House bills would make the excess business loss rule permanent. In addition, both chambers of Congress support any excess disallowed loss created for taxable years beginning after December 31, 2024 to be included in the subsequent year’s testing of the excess business loss limitation. In other words, any disallowed loss created due to the excess business loss rule can only offset business income in the future and will not be allowed to offset non-business income in future years.

The change in the excess business loss provisions could cause taxpayers who are operating with business losses to have unexpectedly large federal cash payments.

Note: Unlike the passive activity loss rules, currently neither the Senate bill nor the House bill provides for an immediate deduction of excess business losses when the entire business is disposed of.

While many pass-through owners are excited to see the 199A deduction become permanent, the changes to the deductibility of PTET and excess business losses could increase federal taxable income and tax payments, surprising many pass-through owners. As both chambers continue to make adjustments to the pending legislation, careful attention should be paid to understand the impact on both you and your pass-through entity business.

Contact Us

For more information on this topic, reach out to Withum’s Business Tax Services Team today.