Navigating the complexities of international taxation requires a comprehensive understanding of evolving regulations and strategic planning. This overview encompasses key aspects of current tax landscapes that are essential for companies operating internationally.

One Big Beautiful Bill Act (OBBBA) International Provisions

Major International Tax Changes Made by OBBBA – Effective January 1, 2026:

- Permanent extension of the look-through rule for CFCs (section 954(c)(6)).

- Repeal of election for one-month deferral in determination of tax year of specified foreign corporations (section 898).

- Modifications to the pro rata share rules (changes to section 951(a)(1)) (elimination of “last day” rule).

- Modifications to FDII, the BEAT and GILTI.

- Restoration of limitation on downward attribution and enactment of CFC inclusion rules to foreign controlled U.S. shareholders (section 958(b)(4)/section 951B).

- Rules for allocation of certain deductions for purposes of FTC – 951A category income – section 904(b)(5).

- Sourcing certain income from the sale of inventory produced in the U.S. by foreign branches (section 904(b)(6)).

- Other relevant changes affecting other code sections that impact international taxation.

Examination of Select Provisions

Permanent Extension of Look-Through Rule for CFCs (section 954(c)(6))

Section 954(c)(6) provides a look-through rule for CFCs where dividends, interest, rents and royalties received by a CFC from a related CFC are excluded from Subpart F income (Foreign Personal Holding Company Income) if they are attributable to income of the payor that is not Subpart F or U.S. effectively connected income.

Repeal of Election for One-Month Deferral in Determination of Tax Year of Specified Foreign Corporations (section 898)

Section 898 generally requires CFCs to be reported on the same tax year of the majority U.S. Shareholder. An election allowed CFCs to be reported with a tax year that begins one month before the majority U.S. shareholder’s tax year.

Example: A CFC with a calendar year majority U.S. shareholder will generally have the same December 31 year end. With the one-month deferral election the CFC’s tax year will be November 30th.

Modifications to the Pro Rata Share Rules in Section 951(a)(1)

- Currently, U.S. shareholders include their pro rata share of Subpart F and GILTI inclusions from a CFC based on their ownership in the foreign corporation on the last day of the year in which the corporation is a CFC.

- The OB3 modifies these rules to require U.S. shareholders that own stock in a CFC on any day during the tax year to include into income their pro rata share of the CFC’s Subpart F and GILTI tested income.

- The new rules require the deemed dividend inclusion based on the U.S. shareholder’s ownership in a foreign corporation for the period that the foreign corporation is a CFC, rather than a U.S. shareholder’s ownership on the last day the foreign corporation was a CFC.

- Practical Ramifications: Those who purchase CFCs are likely to engage in more protracted purchase price negotiations based on the closing date and amount of Subpart F income and GILTI (net CFC tested income) that they may have to pick up for partial year ownership.

Changes to GILTI

- GILTI is renamed to “Net CFC Tested Income” (“NCTI”).

- The GILTI §250 Deduction is reduced from 50% to 40%, which would lead to an increased GILTI inclusion.

- Allowable GILTI foreign tax credit limitation is increased from 80% to 90%.

- Deemed tangible income return (“DTIR”) is removed from the GILTI computation. which would result in an increased GILTI inclusion.

- Exclusions to GILTI now will result from:

- High-tax exception

- Reduction due to tested loss CFCs

Foreign Derived Intangible Income (FDII)

- FDII is renamed to “Foreign Derived Deduction Eligible Income” (“FDDEI”).

- The FDII § 250 Deduction is reduced from 37.5% to 33.34%, resulting in a 14% ETR on FDII income.

- DTIR is removed from the FDII computation, which would result in an increased FDII deduction.

Amendments to Section 250(b)(3)(A)(ii)

- Current Law: In determining DEI, gross income is reduced by all deductions properly allocable.

- Amended Law: Gross DEI is reduced by all expenses and deductions (including taxes), other than interest expense and R&D expenditures, properly allocable to such gross income.

- Amended law will result in increasing the base on which the FDDEI deduction can be taken.

- Any foreign taxes associated with foreign-source FDDEI are usually allocated to the general basket.

- Effective for tax years beginning after December 31, 2025.

Foreign Sales of U.S.-Produced Inventory (section 904(b)(6))

- Potential US tax consequences before OB3:

- U.S. parent sales income is 100% U.S.-sourced after TCJA due to changes to section 863(b).

- Potential U.S. tax consequences after OB3:

- Solely for purposes of section 904 – if the U.S. parent has a foreign office or fixed place of business, then taxable income from product sales from the foreign branch office is treated as up to 50% foreign-source income.

- Effective for tax years beginning after December 31, 2025.

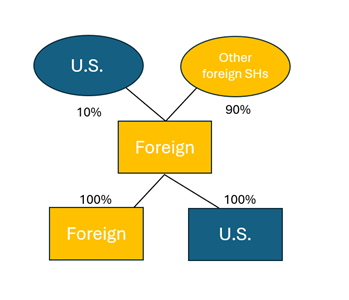

Reinstatement of Section 958(b)(4) and Enactment of New Section 951B

- Reinstates section 958(b)(4) to prevent downward attribution of stock from a foreign person to a U.S. person when determining whether a foreign corporation is a CFC.

- New section 951B applies to foreign-controlled U.S. shareholders (FCUSS) of a foreign controlled foreign corporation (FCFC) to attribute stock owned by a foreign parent to the FCUSS to determine if the FCUSS is required to include amounts (Subpart F and GILTI) from a FCFC.

- A FCUSS is defined as a U.S. person who owns more than 50% of the stock of a foreign corporation, determined by taking downward attribution of stock owned by a foreign parent.

- A FCFC is a foreign corporation, other than a CFC, which is owned more than 50% by a FCUSS.

- Note that a FCUSS will only be subject to these income inclusions if it owns stock in a FCFC directly or indirectly as determined under section 958(a).

Potential Downstream PFIC Consequences from Reinstatement of Section 958(b)(4)

The repeal of section 958(b)(4) led to treating many foreign corporations as CFCs, which would not otherwise have been but for the repeal.

This unintended consequence was the primary driver of the reinstatement of section 958(b)(4) and the enactment of section 951B to target true “de-controlling” multinational structures.

Common Fact Pattern

Assume Foreign Sub operates a passive real estate business that generates rental income and capital gains from the disposition of foreign real property interests.

Prior to the reinstatement of section 958(b)(4), Foreign Parent’s ownership of Foreign Sub would be attributed to U.S. Sub, causing Foreign Sub to become a CFC, U.S. SH to become a section 958(a) indirect shareholder and U.S. Sub to become a constructive shareholder. U.S. Sub would have a 5471 filing requirement but no income inclusion; U.S. SH would have both a 5471 filing obligation and a Subpart F income inclusion

The fact that Foreign Sub would otherwise be classified as a PFIC under both the asset and income tests is ignored because of section 1297(d)(1),known as the “CFC-PFIC overlap rule.” This rule provides that a corporation shall not be a PFIC during the qualified portion of a shareholder’s holding period if during such time the corporation was a CFC.

With the reinstatement of section 958(b)(4), Foreign Sub will cease to be a CFC as of January 1, 2026, thereby making the CFC-PFIC overlap rule inapplicable to U.S. Shareholder, who is a constructive PFIC owner.

What options are available if U.S. Shareholder does not want to own a PFIC and otherwise cannot make a QEF election?

- Foreign shareholders of Foreign Parent could agree to hold their interests through a U.S. partnership, thereby making Foreign Parent and Foreign Sub CFCs. Note that this could result in additional withholding and potential U.S. tax filing obligations for Foreign shareholders.

- If possible, U.S. Shareholder could purchase additional shares directly from Foreign Shareholders or options to acquire more stock from Foreign Parent (more than 50% vote or value), thereby making Foreign Parent and Foreign Sub CFCs. Note that both results are worse than the result under the repeal of section 958(b)(4) because both Foreign Parent and Foreign Sub will be CFCs.

- However, Regulation section 1.954-1(f)(3) provides that if an option is used with a principal purpose of causing a person to be a “related person” with respect to a CFC under section 954(d)(3), then section 318(a)(4) (option attribution) will not apply. The IRS may also argue sham transaction if the issuance of options is only to create CFC status and to avoid PFIC status.

Review of Section 962 Planning

- Basics:

- Individual U.S. shareholders of CFCs may elect to be taxed as a corporation with respect to Subpart F and GILTI (net tested CFC income) inclusions.

- Benefits:

- Reduces tax rate on income inclusions from 37% to 21%.

- Allows FTCs to be claimed with respect to taxes on income inclusions.

- May qualify for section 250 deduction, thereby lowering effective tax rate on net tested CFC income to 12.6%.

- Burdens:

- Income inclusions do not get full benefit of being treated as PTEP, resulting in potential double taxation.

- However, actual distributions may be eligible for qualified dividend rates if CFC is organized in treaty jurisdiction and satisfies LOB article).

- Income inclusions do not get full benefit of being treated as PTEP, resulting in potential double taxation.

- Election must be made annually and will applies to all CFCs owned by taxpayer.

- Increased compliance and E&P tracking costs.

- Requires careful modeling before electing.

Section 962 Election Considerations

- Is the rate of foreign corporate tax as computed under U.S. principles at least 18.9%?

- If so, no need to use section 962 election as income will be not be taxed under high tax exclusion.

- Which of the anti-deferral regimes may apply?

- Section 962 elections on net CFC tested income tend to have more utility because of the section 250 deduction. However, Subpart F inclusions are still eligible.

- Was the CFC subject to foreign corporate taxes?

- If so, indirect foreign tax credits may be very beneficial for the taxpayer.

- If the CFC is organized in a low or no-tax jurisdiction, the FTC may be minimal, thereby reducing the benefit of the election.

- Will distributions be made in the future?

- Because PTEP only encompasses tax paid by individual U.S. shareholder under a section 962 election, the tax consequences of future distributions should be considered carefully.

- If no distributions are likely to be made, the utility of the section 962 election is increased, as it minimizes the tax under the anti-deferral regimes.

- Is the CFC organized in a treaty jurisdiction and is it eligible for treaty benefits under the applicable LOB article?

- Future distributions above PTEP may be eligible for qualified dividend rates if made from a qualified foreign corporation.

- Distributions from non-treaty country CFCs will generally be taxed as ordinary income to the extent they exceed PTEP.

- Is the taxpayer a U.S. shareholder in several CFCs?

- The election applies to all CFCs, so careful consideration of the effect with respect to each is paramount.

Base Erosion Anti-Abuse Tax (BEAT)

- Increases the BEAT tax rate from 10% to 10.5% of modified taxable income.

- Section 899, which targeted “unfair foreign taxes,” was not included in the final bill.

Interaction Between International and Other OB3 Provisions

- New section 174A – Doubling Up on R&D Expense Deductions:

- BEAT – section 59A: Doubling up on R&D could cause additional BEAT tax due to lower regular tax liability.

- Lost Section 250 Deductions: Doubling up on R&D deductions affects net income limitation.

- Foreign Tax Credit Limitation Issues: Doubling up on R&D could cause overall domestic losses.

- Changes to section 163(j) - Effective beginning after December 31, 2025:

- Excludes subpart F and NCTI (including any section 78 gross up) in computing the 30% limitation.

- Section 245A deduction and section 250 deduction are excluded in computing the 30% limitation.

The HIRE ACT

- The Halting International Relocation of Employment Act (HIRE Act) is legislation introduced by Senator Bernie Moreno (R-OH) in September 2025. If enacted, the HIRE Act may significantly impact the way U.S. companies engage in cross-border service arrangements with subsidiaries and unrelated parties through service centers, IT contracts, customer support functions or any offshored operations the benefit of which could be construed as being directed towards U.S. consumers.

- The HIRE Act would impose a 25% excise tax on “outsourcing payments,” such as fees, premiums, royalties and service charges paid to a foreign person in the course of conducting a U.S. business. The benefit of such payments must be directed, indirectly or directly, to consumers located in the U.S. While there are no exceptions for payments to foreign affiliates or subsidiaries, payments for goods or services which benefit both U.S. and non-U.S. persons (so called “mixed payments”) may allow for proration of the excise tax.

- Neither the excise tax nor outsourcing payments themselves would be deductible for U.S. payors.

- The international tax and transfer pricing implications of the HIRE Act, if enacted, are vast. The overall cost of outsourcing the production of goods or provision of services would increase, which may impact existing transfer pricing arrangements, supply chains and pricing arrangements. There are many questions left open by the text of the HIRE Act, including how the proration of the excise tax will work with respect to “mixed payments,” whether there will be carve-outs for specific industries and which anti-avoidance rules may be enacted to bolster the HIRE Act’s purpose.

Your Tax Strategy Simplified

With continued shifts in tax policy, staying proactive with your tax planning can help you take advantage of new opportunities and avoid unexpected liabilities. Withum’s Tax Planning Resource Center provides timely insights, planning tips and compliance reminders tailored to your needs.

Did You Sell Goods or Services Abroad? (Non-U.S. end users)

- FDII Deduction: This deduction lowers the U.S. tax rate to 13.125%.

- Indirect Tax Compliance: Non-U.S. registration or VAT or GST collection obligations may be required.

- Withholding Taxes: W8 Forms and certificates may be required from non-U.S. persons receiving payments from you.

- Transfer Pricing Documentation: If applicable, be sure to have a robust and updated set of documents.

- Trade Agreements: Certain trade agreements might impact the tariffs applied to exported goods.

Cash Repatriation

- U.S. corporations may be eligible for the Dividends Received Deduction. Please check legal requirements ($245,246).

- Foreign Tax Credit (FTC) may also be available.

- This chart refers to the U.S. corporations owning foreign corporations*:

| % Ownership | DRD |

| >10% | 100% |

- The IRS issued guidance on FTC (Notice 2023-55).

*IRS Denies CFC’s DRD. A CFC that receives a dividend from its owned lower-tier foreign corporation doesn’t get the DRD because the recipient is neither a domestic corporation nor a U.S. shareholder for the foreign corporation (IRS Memorandum 202426010, July 31, 2024)

Did Your Organization Adopt Remote Work Policy?

Employers

- Permanent Establishment Risk: While working remotely, your non-U.S. employees may create a taxable presence for your organization in his or her jurisdiction.

- Visas/Social Insurance/Payroll Withholding: U.S. employees working outside of the U.S. may require VISAs (although some countries offer “Digital Nomad” Visas). U.S. employers to be subject to local Social Insurance Taxes (unless a Totalization Agreement applies). Local income tax withholding and remission may also be required.

Employees

- Work Permits/Digital Nomad Visas: While working remotely, if the host country does not provide a “Digital Nomad Visa” program, which allows you to remain a U.S. employee subject ONLY to U.S. tax, you will be required to obtain necessary working permits and be subject to local Social Insurance tax (unless a Totalization Agreement applies) and local income taxes.

- Foreign-earned income exclusion (FEIE): U.S. employees may be eligible for FEIE up to $120,000 (2023). To qualify, you must meet the physical presence test or the bona fide residence test.

Contact Us

Reach out to Withum’s International Tax Services Team for guidance as year-end approaches.

Disclaimer: No action should be taken without advice from a member of Withum’s Tax Services Team because tax law changes frequently, which can have a significant impact on this guide and your specific planning possibilities.