In recent years, there have been significant changes to the State and Local Tax nexus requirements. The longstanding physical presence nexus rules have been superseded by economic nexus. Almost all states have adopted economic nexus concepts, under which merely making sales into a state can result in a filing obligation, even if the business has no employees or property in the state.

The U.S. Supreme Court in Wayfair upheld the concept of economic nexus for both sales tax and income tax. In 2023, New Jersey became the first state to officially adopt the economic nexus standard (i.e., $100,000 sales or 200 transactions) for both corporation business taxes and sales taxes.

Economic nexus presents risk and opportunity for taxpayers. States use differing source rules and methodologies to assign sales to a particular state for multistate businesses. Although a business might have economic nexus in a state, with proper planning, income tax burdens can be alleviated or reduced with a sales-sourcing analysis, which ensures sales are correctly apportioned among the states. As states continue to adopt single-factor sales apportionment coupled with market-based sourcing, many businesses are actively reexamining their sales sourcing approaches to reduce state taxes.

Sales and Use Tax Planning Considerations

With economic nexus here to stay, sales and use taxes can be a significant financial burden if proper procedures are not in place and appropriately maintained. The issues of taxability review, the use of marketplace facilitators, and exemption certificate management have garnered more analysis in a post-Wayfair world. Companies should periodically review their sales and use tax process and procedures, including, but not limited to:

Nexus

- Physical presence and economic nexus for sales tax purposes should be reviewed throughout the year to identify jurisdictions where

additional collection (and self-assessment) responsibilities exist. - Missouri was the last state to adopt economic nexus and has set a threshold of $100,000 in revenue into the state in the previous

12-month period, effective January 2023. - Remote retailers, marketplace sellers, and marketplace facilitators should review if they are compliant with state and local sales

and use tax laws and marketplace facilitator rules.

Sales Tax Nexus Determination Tool

As a result of client requests to frequently identify where they have nexus for sales tax purposes, Withum has developed a Sales Tax Nexus Determination Tool. Use our interactive tool to determine where your business has established nexus.

Withum’s Nexus Determination Tool will allow you to identify states where your business may have nexus for sales and use tax by answering a few simple business questions. Determining sales tax nexus is crucial for a business for several reasons:

- Compliance with Tax Laws: Understanding where your business has sales tax nexus is essential for complying with state and local tax laws. Failing to collect and remit the appropriate sales tax can result in penalties and legal issues.

- Minimize Tax Liabilities: Without knowing your nexus, you may inadvertently accrue tax liabilities in multiple jurisdictions. Identifying your nexus allows you to calculate, collect tax from customers when applicable, and pay the correct amount of sales tax to avoid penalties and interest.

- Operational Efficiency: Identifying sales tax nexus helps streamline your business operations. You can set up accurate tax collection procedures, reducing the administrative burden and potential errors in tax calculations.

- Audit Preparedness: Tax authorities may audit your business to ensure compliance. Knowing your nexus and having accurate records of collected taxes makes the audit process smoother and less stressful.

Determining where your business has established nexus is the first step towards identifying what actions you should take to become compliant with sales tax.

Changing Tax Laws and Definitions

- Most state sales tax codes were written decades ago, prior to the advent of the internet. These tax codes are no longer adequate to address the digital economy. States are addressing these inadequacies by updating regulations and statutes.

- State definitions of taxable digital goods and services and cloud-based products are constantly evolving — and digital goods and services that were previously exempt are now taxable in several states.

- Any time a business launches a new product or service line, it should perform a taxability analysis.

Compliance

- Companies should review their people, processes, and technology to identify how to comply with sales tax responsibilities in multiple states and localities.

- It may be necessary to implement third-party software to help maintain accurate sales tax rates.

- The volume of state and local tax-related forms and deadlines can require significant time for employees to properly manage the sales and use tax functions. Errors could lead to significant penalties, interest, or even liens on the responsible officer’s properties. As such, companies should consider outsourcing their sales and use tax compliance to reduce risks and concentrate on higher-value activities.

- Please note sales tax could be a significant factor in the event of a merger, acquisition, or request for funding. If the sales tax function is not reviewed periodically, a due diligence review may uncover exposures. Therefore, companies should periodically perform a review of their sales and use tax procedures.

Refunds

- Exemptions for certain purchases may provide opportunities for significant recoveries of sales and use taxes erroneously paid to vendors or accrued and remitted to a jurisdiction. An annual review of purchases should be conducted to identify potential refund opportunities and future cost savings.

State and Local Income Tax Planning Considerations

A business should be considering state and local income tax nexus and sales sourcing assessment, if:

- Revenue streams are derived from multi-state customers/clients

- Business receipts per state would vary based on possible different sourcing rules, such as:

- Location where services benefit the customer

- Location of customer’s billing address

- Location of customer’s headquarters

- Location of customer’s primary interaction/contacts with the business

- Location of customer’s order location

- Location of the customer’s customer (i.e., ultimate customer); or

- Other metrics (e.g., IP address analysis) that could result in a varied sourcing approach

- Sales would be subject to special industry sourcing rules, such as financial services, publishing, broadcasting, technology (e.g., SaaS,

data processing), advertising, and transportation - It has significant tax in any out-of-state jurisdiction

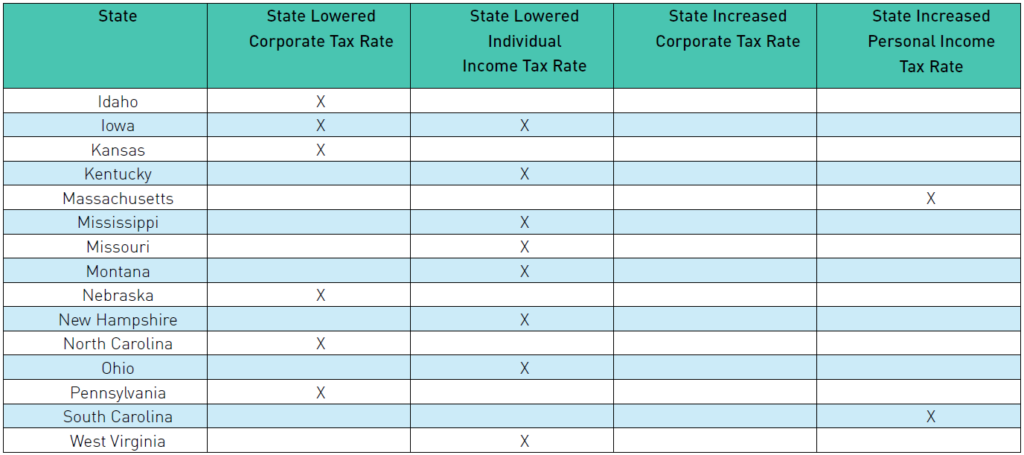

States Are Generally Lowering Tax Rates

In the past two years, 17 states have enacted corporate or personal income tax rate changes. Generally, these changes have lowered the top tax rates for businesses and individuals. Following is a summary of the rate changes enacted:

Recent Income/Franchise Tax Nexus Developments

In the aftermath of Wayfair, the Multistate Tax Commission (MTC) has targeted one of the remaining legal barriers that businesses have to shield themselves from state assertions of income tax economic nexus – P.L. 86-272.

On August 4, 2021, the MTC voted to adopt a revision to its “Statement of Information” whereby a business could lose P.L. 86-272 protection solely by engaging with customers through the internet. In 2022, New York and California issued guidance that they were adopting the MTC’s revised Statement of Information. Effective July 31, 2023, New Jersey adopted the MTC’s P.L. 86-272 revisions. It is expected many other states may adopt the MTC’s guidance implicitly through their MTC conformity provisions. The loss of P.L. 86-272 protection may result in income tax filing obligations for many businesses. The federal law known as P.L. 86-272 was passed over 60 years ago, and it prohibits a state from imposing a net income tax on businesses that only sell tangible personal property (TPP) and whose activities in a respective state do not exceed the solicitation of orders. For many years, even preceding the Wayfair case, for income tax, it has been generally accepted that economic nexus has been the law of the land unless a business was otherwise protected by limiting its activities to those outlined in P.L. 86-272.

AMTC’s guide provides examples of when the use of an interactive website will tarnish P.L. 86-272 protection, which activities include:

- Providing post-sale customer assistance via an electronic chat or website email

- A career or employment page that accepts applications for non-sales positions

- The use of “cookies” on a customer’s device to gather information on shopping trends or to track inventory

- Transmission of remote product patches, upgrades, or updates via the internet

- The offering of extended warranty plans

- Use of marketplace facilitators, such as the fulfillment center, which maintains inventory

- Other interactive internet-related activities

- The MTC’s revised statement adoption by multiple states could result in significant income tax liabilities for many remote businesses, as many of these businesses use a website or app to interact with their customers. Even if businesses have performed a nexus or P.L. 86-272 review in the past, they should consider having such studies refreshed, considering many of the developments over the last several years.

State and Local Tax Workarounds

One of the centerpiece provisions of the 2017 TCJA was the $10,000 cap on state and local taxes (SALT) that individuals (including pass-through businesses) could claim as an itemized deduction on their federal income tax returns. The SALT deduction limitation profoundly impacted many business owners and residents in high-tax states such as NJ, NY, CA, CT, and MA.

States responded by enacting pass-through entity taxes (PTETs) as a workaround to mitigate the impact of the SALT deduction limitation for the owners of pass-through entities. As of October 2023, 36 states have enacted PTETs, making the availability of PTETs the rule rather than the exception. In theory, the utility of PTETs will cease on January 1, 2026, when the $10,000 SALT deduction limitation expires, but we anticipate that some states may retain their PTET elections in the event the SALT deduction limitation is extended or to bring AMT relief.

Prior to making a pass-through entity election, there are several key issues that businesses need to consider:

- IRS Approval: The IRS indicated in Notice 2020-75 that it intends to allow PTETs. However, the IRS has not issued any further guidance on the issue.

- Federal Tax Benefit Implications: It is possible that the PTET benefit may be limited if some taxpayers are subject to the federal tax benefit rule.

- Resident Clients: Resident partners/shareholders participating in a PTET (elective or mandatory) may not receive a credit for taxes paid to another state on their resident state income tax return.

- Dual Estimate Payment Requirements: In some states, a passthrough entity needs to make estimated payments against the PTET. This may not alleviate the owners’ obligations to make estimated payments in their personal capacity. While the tax only gets paid once, this may cause cash flow issues from having to make two estimated tax payments.

- Refundability Issues: In most states, the PTET becomes a fully refundable credit on the owners’ personal income tax returns. However, in some states, the credit is not fully refundable, and/or excess credit is carried forward to future years, where it may expire if not fully used.

- Other Considerations: Business owners should keep in mind that the election to pay tax at the entity level is subject to each business’s facts and circumstances and may vary depending on specific state provisions. Additionally, the administrative cost of making a PTET (e.g., additional filings) may consume some of the savings.

2023 Year-End Tax Planning Resources

Withum’s Year-End Tax Planning Resource Center is a one-stop-shop for annual tax planning tips for individuals and businesses, legislative and regulatory changes and other tax-saving opportunities.

Telecommuting

As the economy continues to evolve, widespread telecommuting, the looming economic downturn, and state budget shortfalls have increased the focus on state taxes. Although telecommuting raises many concerns, some of the central issues put into focus are:

- Income and Sales Tax Nexus

- Income Tax Apportionment

- State Payroll Withholding

Nexus, with respect to telecommuting, is generally straightforward. An employee’s presence in a state creates nexus unless protected by P.L. 86-272. For income tax apportionment, in some states, the consequence of an employee working from a different state could affect sales sourcing, payroll, and the property factor. For example, the New York City UBT (for non-corporate entities) uses cost-of-performance sourcing, which can lower taxes if employees leave New York to telework in nearby states. Such sourcing is generally determined based on where the services are performed.

Payroll withholding also presents challenges. Most states source employee wages to the state where the employee performs the services; however, with “Convenience of the Employer” rules, such as those in New York, there is added complexity. These rules, some of which preceded the pandemic, essentially require non-resident wages to be sourced to the state’s office where the employee is assigned, even if the employee works remotely in another state.

This could result in double withholding requirements for the employer. Some of the key issues impacting payroll withholding decisions include:

- Temporary versus permanent employee relocations

- States that employ reciprocity agreements

- States with convenience of the employer rules

Employee mobility and telecommuting are here to stay, and businesses must adapt and plan for the many tax issues that arise.

Considerations for Changing Residency

Now that working from home has become more common, are you considering a move to another state? Perhaps to a low-tax or no-tax state? If so, you are not alone, and here are some of the things you should be considering for income tax purposes.

In order to change one’s domicile, an individual must physically move to a new jurisdiction with the concurrent intent to make the new jurisdiction their fixed and permanent home. Individuals domiciled in a state are subject to that state’s taxing authority on all their income. An individual who is required to pay tax as a nonresident in a state, even though they are domiciled elsewhere, is only subject to tax on income derived from sources originating outside his or her state of domicile (e.g., wages earned while working in a nonresident state, pass-through entity income).

Domicile is the place you regard as your permanent home — the place to which you intend to return after a period of absence (e.g., a vacation, a short-term business relocation, educational leave). As a practical matter, you can only have one domicile at any point in time, although you may have multiple residences. Once established, domicile continues until you affirmatively establish a new domicile.

Individuals establish a new domicile by moving to a new location with the concurrent intent to establish a fixed and permanent home there. However, moving to a new location, even for a substantial period of time (e.g., a multi-year work assignment), does not create a change of domicile if the move is not intended to be permanent. Individuals who move outside the country face additional scrutiny as to whether their immigration status in the foreign country allows them to remain there permanently.

Individuals who moved out of their primary homes during the pandemic with the ultimate intention of moving back generally remain domiciled in their original home states. However, some moves that were originally intended to be temporary have now become permanent, and these individuals need to determine when they severed their old domicile and established a new one – which is as much art as it is science. Individuals with multiple homes may also find that they are statutory residents of a state if they spent substantial time (e.g., 183 days) in a state other than their domicile where they have a residence.

Determining where an individual is domiciled requires a subjective analysis of several factors, including, but not limited to:

- The individual’s home (considering the size, nature, and use of the residences) when an individual maintains more than one home

- Active involvement in a trade or business in a state

- Where the individual spent the majority of their time

- Location of “near and dear” possessions

- Family connections

Additional factors demonstrating an intent to permanently move include voter registration and obtaining a driver’s license and vehicle registration in the new state. The burden of proof is upon the person asserting a change of domicile. They must maintain sufficient records to demonstrate an intention to abandon their previous domicile and establish a fixed and permanent home in a new one. Proper planning and understanding of the residency rules in the states the taxpayer is leaving and moving to are critical for individuals contemplating a change of domicile.

Additional considerations when planning a change of domicile include:

- Whether an individual will remain subject to tax on their wages in the state they left pursuant to an Office of Convenience rule.

- Modeling potential tax savings by relocating to a low or no tax state.

- Implementation of proper domicile planning, considering the facts and circumstances, documentation requirements, and other rules when putting in place a plan to mitigate audit risks.

- State Tax Authorities in high-tax states are aggressively examining taxpayers’ claims that they broke their domicile and demanding substantial documentation to back up the taxpayer’s assertions. Failing to prepare for a tax examination at the outset of a move jeopardizes the ability to ultimately prevail at the audit. Failing to plan = planning to fail.

State and Local Tax – Items to Consider

- Review existing and pre-Wayfair Nexus footprint including inventory held by marketplace facilitators

- Assess post-Wayfair filing obligations

- Evaluate income tax, sales and use tax, and other indirect tax nexus

- Determine potential tax exposure for prior periods

- Consider options to limit exposure (e.g., Voluntary Disclosure Agreements, amnesty, etc.)

- Assist with communication to stakeholders in the organization

- Review product and service mix

- Analyze sales sourcing on a state basis for determining income tax nexus

- Develop nexus and taxability matrix

- Review purchases to identify potential sales tax refund opportunities

- Review and consider automation needs

- Prepare and file registrations as necessary

- Develop SALT processes to meet compliance requirements

- Prepare for tax audits

- Address changes in the organization (e.g., new lines of business, modified sales force activity, marketplace facilitator/provider inventory locations etc.)

- Continue to monitor changes to economic nexus and tax laws

Authors: Jim Bartek, CPA | [email protected]; Rebecca Stidham, CPA | [email protected]; and Jonathan Weinberg, JD, LLM | [email protected]

Contact Us

Reach out to a member of Withum’s State and Local Tax Services Team for guidance as year-end approaches.

Disclaimer: No action should be taken without advice from a member of Withum’s Tax Services Team because tax law changes frequently, which can have a significant impact on this guide and your specific planning possibilities.