IC-DISC: Tax Savings for International A/E Firms

Engineering and architectural firms providing services to projects outside the U.S. have a tax savings opportunity under the current U.S. tax structure at their fingertips which can provide significant benefits to firms and their shareholders.

An IC-DISC (Interest Charge-Domestic International Sales Corporation) is great tax savings strategy for engineering and architectural firms that provide qualified services for a project located, or proposed for location outside the United States. Although the project is located outside the U.S. the qualified services performed for these projects can be within the United States.

Engineering services would include consultation, investigation, evaluation, planning, design or supervision of construction for purpose of compliance with plan specifications and design. Architectural services include consultation, planning aesthetic and structural design, drawings and specifications, or supervision of construction or erection in connection with a construction project. These services include a feasibility study for proposed sites even if the project is not initiated.

An IC-DISC is generally a non-taxable entity. An entity elects IC-DISC status through the filing of Form 4876-A, Election to be Treated as an Interest Charge DISC. The IC-DISC does not pay tax on the income it generates if certain conditions are met. These conditions include, but are not limited to the entity being a domestic U.S. corporation, having minimum capital of $2,500, a single class of stock, maintaining a separate set of books and records and the 95 percent test is met with respect to the IC-DISC’s qualified export receipts and assets. If these conditions are met, the income generated by the IC-DISC is not subject to corporate tax and the IC-DISC shareholder(s) enjoy tax favored qualified dividend rates when the income is distributed by the IC-DISC.

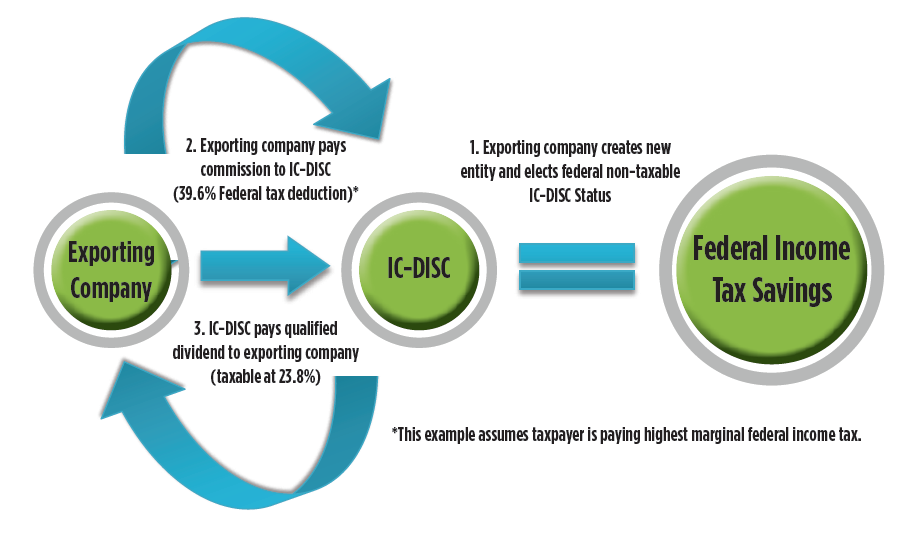

So how does the IC-DISC strategy work?

- Owner-managed engineering/architectural firm qualifies for and creates a tax-exempt IC-DISC

- The firm pays the IC-DISC a commission on the sale of qualified services

- The firm deducts commission from ordinary income taxed at rates up to 39.6%

- IC-DISC pays no tax on the commission income

- Shareholders of IC-DISC must pay income tax on dividends at qualified rates up to 23.8%

- Results in a 15.8% permanent tax savings

If your company has export receipts of $1M and you have positive taxable income, an IC-DISC strategy may be an opportunity for you. To take advantage of this tax-savings opportunity, a new entity must be formed and the IC-DISC election made within 90 days from the start of the entity’s fiscal year. For assistance in forming the IC-DISC or additional information on the topic please contact:

|

Michael Yarrow, CPA, CGMA 609-520-1188 [email protected] |

Ask Our Experts

The information contained herein is not necessarily all inclusive, does not constitute legal or any other advice, and should not be relied upon without first consulting with appropriate qualified professionals.