One of the most significant changes stemming from the Inflation Reduction Act of 2022 is the ability for C corporations to purchase discounted clean energy credits to offset their income tax liability and for not-for-profit and governmental entities to receive cash in relation to their clean energy investments.

For-profit entities can apply clean energy credits against their federal income tax due. If no federal income tax is due, most clean energy credits can be carried back three taxable years or forward 22 taxable years. However, for-profit entities that would like to monetize a credit quickly can conduct a one-time transfer (i.e., sale) of select clean energy credits to an unrelated party for cash under section 6418.

While in previous taxable years, not-for-profits were limited to capturing the cash benefits related to clean energy credits only up to their unrelated business income tax, under the Inflation Reduction Act of 2022, all not-for-profits are incentivized to invest in clean energy infrastructure through the direct payment program regardless of tax liability. The newly created direct payment option under section 6417 generally allows tax-exempt entities and state or political subdivisions to receive a cash tax refund for applicable credits.

The OBBBA did not make any significant changes to the section 6418, transfer or section 6417 direct payment provisions.

The OBBBA modified a variety of clean energy credits, including:

- Qualified Commercial Clean Vehicles (NEW) – A credit can be claimed for clean vehicles acquired prior to October 1, 2025. A vehicle is “acquired” as of the date a written binding contract is entered into and a payment has been made. A payment includes a nominal downpayment or a vehicle trade-in. The amount of the credit cannot exceed $7,500 per vehicle (with a gross vehicle less than 14,000 pounds) or $40,000 (for all other vehicles). For clean vehicles purchased for a trade or business, the critical mineral and battery component is not applicable.

- Alternative Fuel Vehicle Refueling Property/Charing Stations (MODIFIED) – A credit can be claimed up to 30% (providing prevailing wage and apprenticeship requirements are met) of the cost basis for qualified clean-fuel vehicle refueling property located in an eligible census tract. The maximum credit increased from $30,000 to $100,000 and is now applied on a per-property basis under the modified law (as opposed to per-project basis). The credit will no longer be allowed for any property placed in service after June 30, 2026.

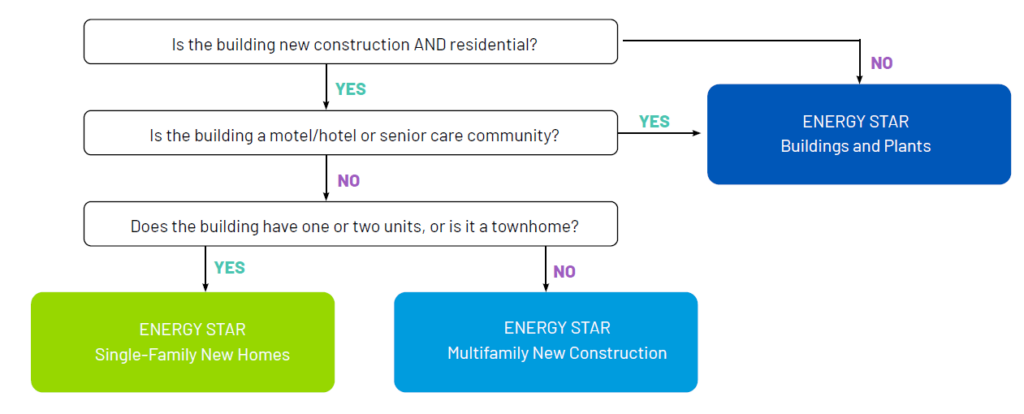

- Contractor Energy Efficient Home Credit (MODIFIED) – The maximum credit allowable to contractors for the construction of new energy-efficient homes is $5,000. In addition, the law was modified to allow a credit for the construction of Energy Star multifamily new construction. Under the OBBBA, the credit will now terminate for homes acquired after June 30, 2026.

- Energy Tax Investment Credit (MODIFIED) -

- For a clean energy credit to be claimed under section 48, construction of the project generally must start prior to December 31, 2024, with an exception existing for geothermal heat pumps. For the 2025 taxable year, energy credits are available for energy facilities and energy storage technology (EST). A qualified facility is a facility which is used for the generation of electricity, placed in service after December 31, 2024 and which the anticipated greenhouse gas emissions rate is not greater than zero. EST property includes property which receives, stores and delivers energy for conversion to electricity and has a nameplate capacity of not less than 5 kilowatt hours and thermal energy storage property. The qualified facility and EST generally have to be placed in service by December 31, 2033, to receive 100% of the section 48E credit. However, for wind and solar facilities which begin construction after July 4, 2026, the wind and solar facility must be placed in service by December 31, 2027, in order to claim the section 48E credit.

- The prevailing wage and apprenticeship requirements are still required for facilities with a maximum net output of 1 MGW or greater in order to achieve an applicable percentage of 30%, and additional bonus percentages are still available for location in an energy community and meeting domestic content.

- The OBBBA contains additional Foreign Entity of Concern provisions effective for calendar year taxpayers in 2026 imposed at the ownership level, preventing a prohibited foreign entity from claiming the section 48 credits, and at the project level, prohibiting material assistance (sourcing) from a prohibited foreign entity.

- Advanced Manufacturing Production Tax Credit (NEW) -

- The IRS provides a credit for eligible components related to solar energy, wind, inverters, qualifying batteries and applicable critical minerals if produced in the U.S. The amount of the credit varies based on the component being manufactured. For-profit businesses can elect for this credit to be refundable over a five-year period, even when no federal tax liability exists (i.e., start-up companies). Alternatively, manufacturing companies can delay the election to receive a refund, and instead sell the credit, until the manufacturing of eligible components is optimal.

- The OBBBA includes additional Foreign Entity of Concern provisions effective for calendar year taxpayers in 2026 imposed at the ownership level, preventing a prohibited foreign entity from claiming the section 45X credits, and at the project level, prohibiting material assistance (sourcing) from a prohibited foreign entity.

Your Year-End Tax Strategy Simplified

With recent tax policy changes, individuals and businesses should take proactive steps now to maximize deductions and minimize liabilities. Withum’s Year-End Tax Planning Resource Center provides timely insights, planning tips and compliance reminders tailored to your needs.

Purchase of Discounted Clean Energy Credits Applied Against Federal Tax Liability

The purchase of clean energy credits by an unrelated party for the utilization against their own federal tax liability was a significant change in tax law provided under the Inflation Reduction Act of 2022, that is often utilized as a tax planning opportunity for C corporations and high net worth individuals.

The sales industry for clean energy credits continues to experience significant growth, with the market for transferable tax credits booming. The total value of U.S. clean energy tax credit transactions is estimated to be between $55 and $60 billion in 2025, which is an increase from $52 billion in 2024.

The purchase of clean energy credits from a seller must be made in cash, and will not result in taxable income or expense for the seller or purchaser respectively.

Credits that are available to purchase include:

- Energy Credit (48)

- Clean Electricity Investment Credit (48E)

- Renewable Electricity Production Credit (45)

- Clean Electricity Production Credit (45Y)

- Advanced Manufacturing Production Credit (45X)

- Clean Hydrogen Production Credit (45V)

- Clean Fuel Production Credit (45Z)

- Carbon Oxide Sequestration Credit (45Q)

- Credit for Alternative Fuel Vehicle Refueling/Recharging Property (30C)

The purchase of clean energy credits generally ranges from $0.91 to $0.96 per $1 of credit received. In addition, the purchase, or intended purchase, of clean energy credits can be utilized when determining cash payments related to federal estimated tax payments.

For example, C corporation has a federal income tax liability of $10,000,000 and is seeking to identify $7,500,000 of clean energy credits for purchase in the 2025 taxable year. A calendar year C corporation generally must make estimated tax payments by April 15, June 15, September 15 and December 15 during the taxable year. As the C corporation only expects to pay a tax liability of $2,500,000 in cash, the quarterly estimated tax payments made on the applicable dates can be lowered to $625,000. C corporation identifies the clean energy tax credit in June of 2025 that would be applied amongst the earlier federal estimated tax payment dates. C corporation purchases half of the desired credit, or $3,750,000 credit in August of 2025 and the remaining $3,750,000 in January of 2026. C corporations pay $0.94 for the credit, or only $7,050,000 for a $7,500,000 credit, saving $450,000 in federal tax payments, in addition to having more cash on hand for operations during the 2025 taxable year as the estimated federal tax payments due earlier in the year were less.

Contact Us

For more information on this topic, reach out to Withum’s Business Tax Services Team to discuss your situation as year-end approaches.

Disclaimer: No action should be taken without advice from a member of Withum’s Tax Services Team because tax law changes frequently, which can have a significant impact on this guide and your specific planning possibilities.