After an incredible tight race, it has become evident that the Georgia state runoff election has tilted in favor of the Democrats. The Democratic party will have unified control of the government, widening the scope for further stimulus spending and tax legislative agenda.

The 117th session of Congress will be the 21st session of Congress where Democrats have full control, albeit by a very slim margin. With this 50/50 split, Vice president elect Kamala Harris will cast the tie- breaking vote. A 50-50 senate has happened three times in Senate’s history 1881, 1953 and 2000 election (which did not last long as a member of the Republican party switched party lines to give the Democrats a 51-49 majority).

This very narrow Democratic majority means that the Democrats will be able to bring bills up for votes on popular issues ranging from increasing the minimum wage to infrastructure to passing additional fiscal support. We would not be surprised if corporate rates rise to say 28% and individual rates for top earners touch 39.6% again. Any changes to the tax code could be punted to 2022 as part of a negotiated settlement. We suspect the incoming President’s preference of the elimination of stepped up basis is DOA (dead on arrival). Ambitious or progressive legislation like the Green New deal will be far from easy.

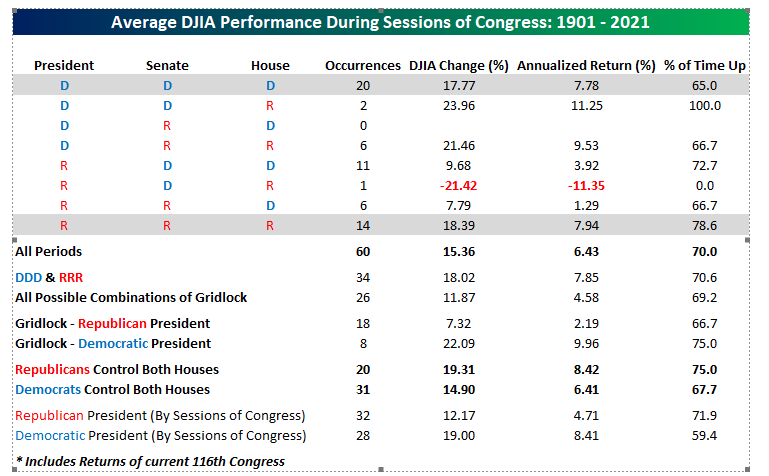

It is said that for markets gridlock in politics is good, as it sets a system of checks and balances between parties. We believe this can be true, but as the grey lines in chart below depict, market performance (as illustrated by the Dow Jones Industrial Index) has also been positive when there been a unified government either Republican or Democrat. Obviously, market valuations, investor sentiment, monetary and fiscal environment of the time frames cited are not captured and do matter. Nonetheless, the fact that one party has full control albeit by the narrowest margin may not rise to the level of concern certain investors/commentators feared it could or would be.

Source: Bespoke Investment Group

No action should be taken without advice from a Withum professionals because tax law changes frequently, which can have a significant impact on this guide and your specific planning possibilities. Reach out to discuss your individual situation as year-end approaches.

Withum Wealth Management