One of the changes ushered in by the 2017 Tax Cuts and Jobs Act (“TCJA”) was the repeal of IRC Section 958(b)(4).

Prior to the repeal, if a non-US corporation owned the shares of a US corporation and the shares of a non-US corporation, 958(b)(4) prevented the US corporation from being attributed ownership of the non-US subsidiary. The repeal of 958(b)(4) was intended to prevent a US corporation (that owned a CFC) that underwent an inversion, from escaping US shareholder status post-inversion. However, the ramifications of the repeal went far beyond those stated intentions.

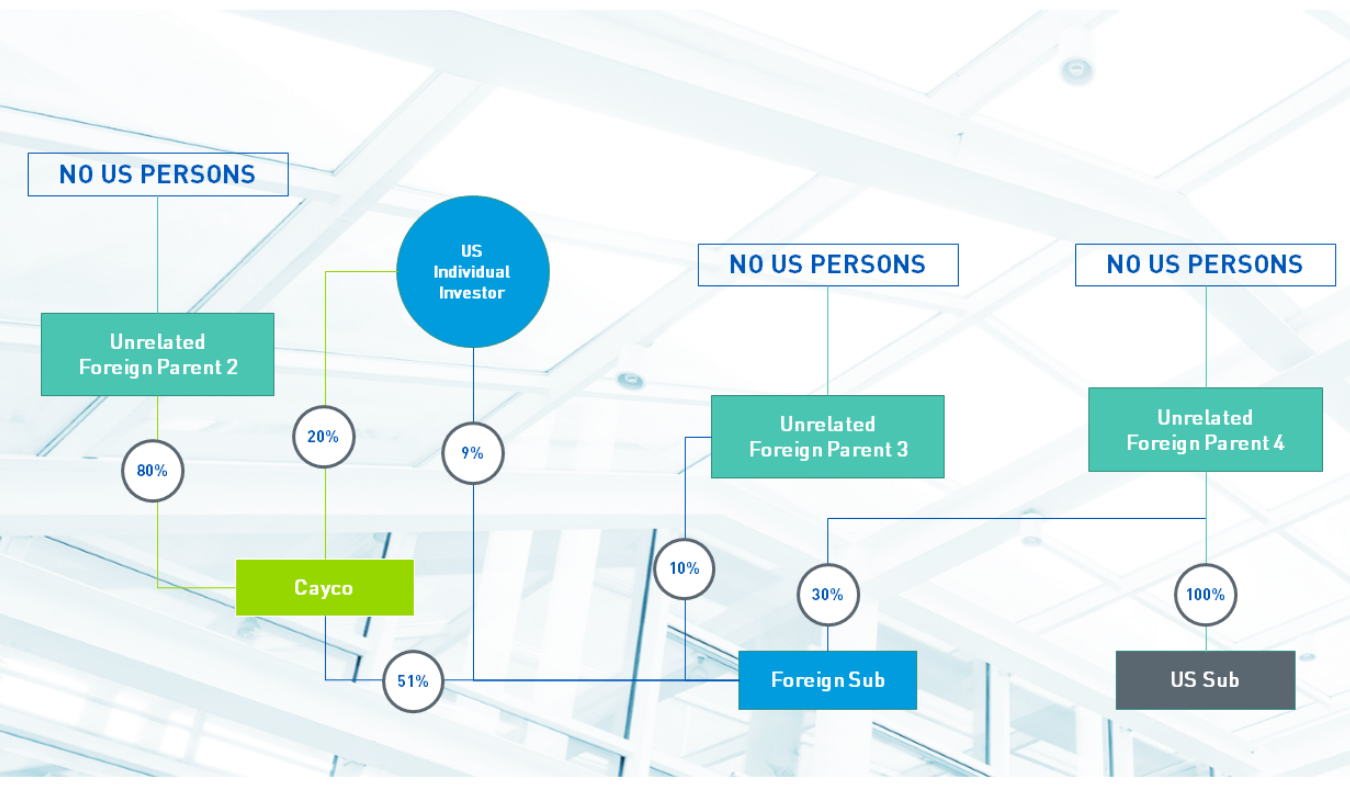

Previously, we discussed the following fact pattern:

contact a member of the International Services Group.

With the repeal of Section 958(b)(4), Foreign Sub is considered a controlled foreign corporation because unrelated foreign parent 1’s ownership is downwardly attributed to US Sub. However, in situations similar the one depicted in the above, it is virtually impossible for US individual investor to know whether any of the other shareholders of Foreign Sub have U.S. subsidiaries.

This new reality caused a lot of issues for many, especially those in typical private equity structures. Investors, who for years did not have to concern themselves with subpart F income and Form 5471 reporting, all of a sudden had to determine whether, for example, their investment in a master-feeder structure would subject them to CFC reporting rules. It would be impossible for a domestic investor to know about all of the foreign investors in the offshore feeder and whether those foreign investors had U.S. subsidiaries which would be attributed the foreign investors’ ownership.

Rev. Proc. 2019-40 recognizes this reality and contains rules upon which U.S. shareholders can rely when evaluating whether the foreign corporation in which they have invested are controlled foreign corporations.

The Rev. Proc. introduces two new concepts in the realm of international tax: “foreign-controlled CFCs” and “U.S.-controlled CFCs.” Foreign-controlled CFCs are foreign corporations that would not be CFCs but for Section 318 downward attribution of ownership in the aftermath of the repeal of Section 958(b)(4). U.S. controlled CFCs are foreign corporations that would be considered CFCs regardless of the repeal.

A U.S. shareholder of foreign-controlled CFC will not be considered a shareholder of a controlled foreign corporation when the U.S. shareholder does not fulfill the following conditions:

- Has knowledge that the entity is a CFC

- Is in possession of a statement that the entity is a CFC or

- Has access to reliable publicly available information that the entity is a CFC

In the event the U.S. shareholder has a direct interest in the foreign corporation, they must inquire as to the CFC status of that entity or any lower tier entities as well as whether the top-tier foreign corporation owns any domestic entities. If these conditions are fulfilled, the safe harbor provides for the foreign-controlled CFC to not be treated as a CFC with respect to that US person. It is important to note that the requirement is on the shareholder to make the request; the Rev. Proc. does not require the top-tier foreign entity to respond to the request. Accordingly, as long as the shareholder can document that it made the request, he should be able to benefit from the safe-harbor. The U.S. person does not need to inquire of any other shareholder of the top-tier company as to its holdings. Thus, if the U.S. shareholder satisfies these requirements, he will be able to treat the entity as a non-CFC for both substantive tax matters and reporting purposes (of course PFIC rules must still be considered).

One important caveat to the safe harbor is that the Rev. Proc. is silent regarding potential adjustments to the U.S. shareholder’s income in the event the IRS determines that the foreign-controlled CFC is actually a CFC.

In addition to Rev. Proc. 2019-40, IRS and Treasury issued Proposed Regulations that, if finalized, would unwind the repeal of Section 958(b)(4) in some situations by applying pre-repeal Section 958(b)(4) language with respect to certain code sections. Of the Code Sections impacted, the ones that are taxpayer friendly are Section 267 (allowing for deduction of accrued expense (other than interest) where the recipient is not required to include the payment due to the application of a tax treaty) and Section 863 (relating to space and ocean income of a foreign corporation). The Proposed Regulations will also impact the application of the look-through rules and active rents and royalties exceptions in the foreign tax credit limitation context of Section 904. Other areas potentially impacted by the Proposed Regulations are Section 332 (liquidation of certain holding companies), Section 367(a) (triggering events exceptions Treas. Reg. § 1.367(a)-8(k)(14)), Section 672 (CFC’s ownership of a trust) and Section 706 (taxable year of a partnership). All of these impacts are generally expected to favor the government.

Many practitioners and taxpayers had hoped for a complete reinstatement of Section 958(b)(4) but that is not what occurred. Although the Proposed Regulations contain some relief for taxpayers, they fall far short of providing complete respite from the complications brought about by the repeal of Section 958(b)(4). Notably absent from the Proposed Regulations is that foreign corporations will still be treated as CFCs as a result of the repeal of section 958(b)(4) (subject to the application of Rev. Proc. 2019-40), subpart F or GILTI income will still be required to be reported as a result of the repeal of section 958(b)(4) where applicable, and the portfolio interest exemption remains unavailable for foreign corporations affected by the repeal of section 958(b)(4). Although the policy behind the repeal is based on legitimate concerns, the practical application of the rule goes far beyond what was intended and many taxpayers will continue to be faced with complex consequences as a result of the repeal of Section 958(b)(4).

Author: Josh Gelernter | [email protected]

International Services Group