The 2017 Tax Cuts and Jobs Act (“TCJA”) introduced many new concepts in US taxation of cross-border activity, most notably Global Intangible Low Taxed Income (GILTI), Base Erosion Anti Avoidance Tax (BEAT), and Foreign Derived Intangible Income (FDII). In addition to these provisions which are attracting a lot of attention, there were several smaller in scope provisions that have not received as much focus. However, many of the so-called smaller provisions have far reaching and frankly mind-boggling consequences to the taxpayers they impact.

In this series, we will address the various impacts of the repeal of Section 958(b)(4) or the Downward Attribution rules on the Financial Services Industry.

Prior to the repeal, if a non-US corporation owned the shares of a US corporation and the shares of a non-US corporation, 958(b)(4) prevented the US corporation from being attributed ownership of the non-US subsidiary. The repeal of 958(b)(4) was intended to prevent a US corporation (that owned a Controlled Foreign Corporation – (“CFC”)) that underwent an inversion, from escaping US shareholder status post-inversion. However, the repeal of this statute has far-reaching consequences that, if not addressed by Congress or Treasury, will impact many taxpayers, including those in the financial services area.

Impact on PFICs

An indirect consequence of the TCJA is its impact on whether certain non-US entities will be classified as PFICs. A foreign entity will be considered a Passive Foreign Investment Company if it satisfies either an asset test or an income test. If 75% of the corporation’s gross income is passive, or 50% of its assets produce or are held to produce passive income, then the foreign entity will be deemed a PFIC. There are different ways to value the assets depending upon the type of foreign company being analyzed. For example, if the foreign company is publicly traded, the total value of its assets generally will be treated as equal to the sum of the aggregate value of its outstanding stock plus its liabilities. If the company is a controlled foreign corporation then only the adjusted basis method can be used for measuring assets. Indeed CFCs do not have the option to use fair market value. A foreign corporation that is neither publicly traded nor a CFC, on the other hand has the option to use either the adjusted basis method or the fair market value method..

Many portfolio companies have relied on the fair market value asset test to avoid PFIC designation. For those companies with highly valued intangible assets, these intangible assets have no adjusted basis but a high fair market value. Consequently, this option enables their asset profile to fall below the 50% passive threshold.

However, with the repeal of 958(b)(4), it will be almost impossible for portfolio companies to determine whether they are CFCs under the new rules. This is due to the fact that the portfolio companies will not be able to gain visibility into the organizational structures of all of its investors. In order to definitively determine its status, a portfolio company would first need to know the identity of all of the ultimate owners in the venture capital investment and then would need to know whether these ultimate owners have any interests in US companies.

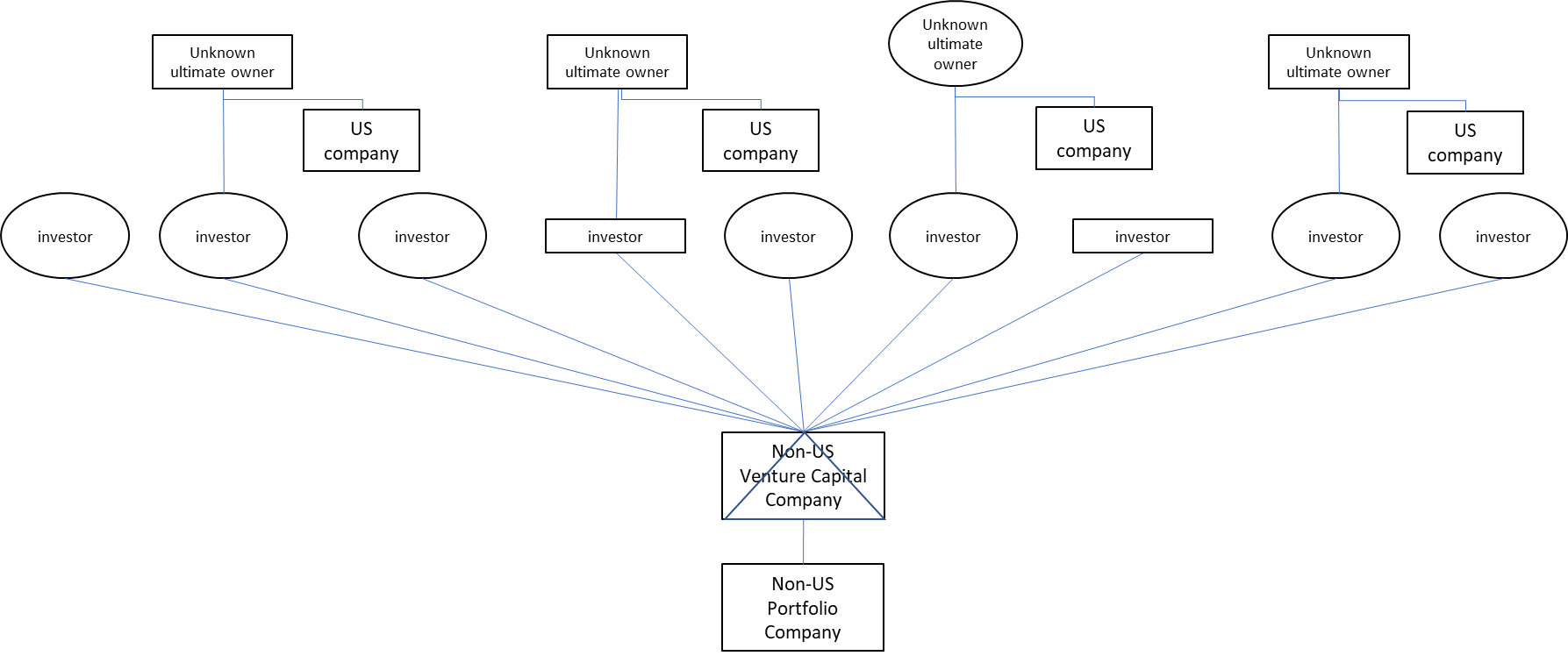

Consider the following hypothetical structure:

There is a possibility that there are several US companies that are owned by unknown investors in the VC. The unknown investors’ indirect ownership in the portfolio company is attributed down to the US companies. If this downward attribution of the unknown investors interest in the portfolio company exceeds 50% or more of the portfolio company ownership the portfolio company will be deemed a CFC.

Since it will be virtually impossible to determine the ultimate ownership, the portfolio companies may be forced to conclude that there is a significant chance that they are CFCs. It appears therefore, that the portfolio company, must use the adjusted basis method for valuing its assets for purposes of determining whether it is a PFIC. This will result in many foreign companies to be deemed PFICs under the TCJA.

In order to comply with tax reporting and regulatory requirements, many VC funds have been sending CFC information requests to their portfolio companies asking them to assert whether or not they are CFCs. Ironically, in order to be able to respond to the request, the portfolio companies would have to get much of the information necessary to make this determination from the very VCs requesting this confirmation. Portfolio companies will have to work with their VC investors to determine the best practical approach to deal with this dilemma.

In the next installment of this series, we will address the impact of the repeal of Section 958(b)(4) on the portfolio interest exemption.

For questions on Section 958(b)(4), please contact a member of Withum’s International Services Group by filling out the form below.

Author: Josh Gelernter, CPA | [email protected]

How Can We Help?