How the Tax Cuts and Jobs Act Compares to Current Law

On Friday afternoon, representatives from the House and Senate completed a week-long conference committee in which tax bills previously passed by each chamber were married into one final piece of legislation. The Tax Cuts and Jobs Act now moves to a final vote in the House scheduled for this Tuesday, with the Senate slated to vote on the bill hours later.

If the bill passes both chambers, it moves to the President’s desk for signature and paves the way for the most comprehensive changes to the tax law in over three decades to take effect on January 1, 2018.

What follows is an overview of the provisions contained in the final version of the Tax Cuts and Jobs Act and how those provisions compare to current law. It is important to note, that in order to comply with budgetary restrictions, every change to the individual tax law described below will expire on December 31, 2025, with the rules simply resetting to those that exist under current law at that time.

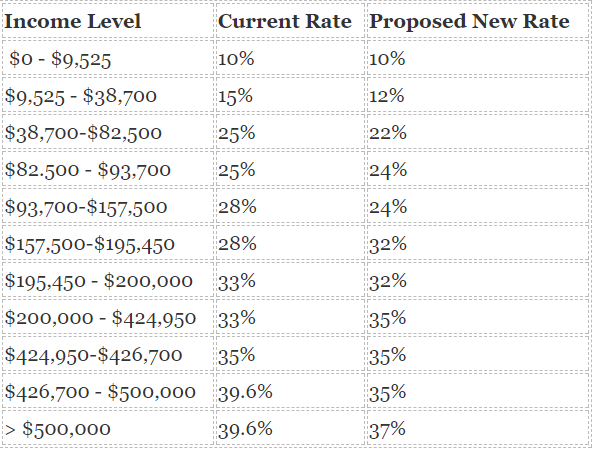

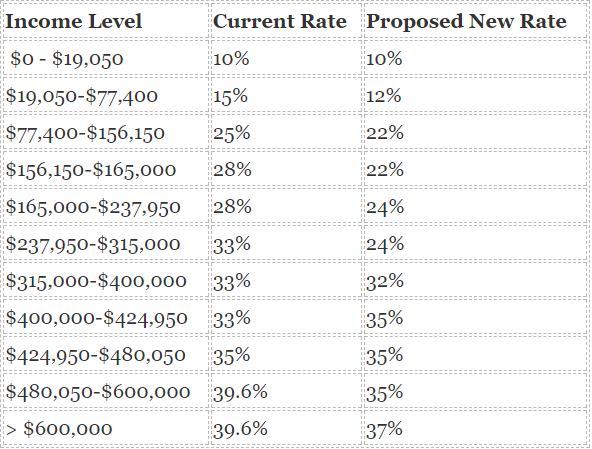

Individual Ordinary Income Tax Rates

Current Law

Ordinary income — items like salaries, interest income, and business income — is subject to a seven-bracket progressive system. Those rates are 10%, 15%, 25%, 28%, 33%, 35% and a top rate of 39.6%.

Proposed Law

The final bill preserves the seven-bracket structure, but reduces most of the tax rates, including the top rate from 39.6% to 37%.

Here are the current and new rates for single taxpayers:

And here are the rates for married taxpayers filing jointly:

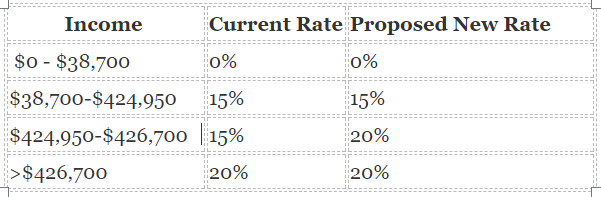

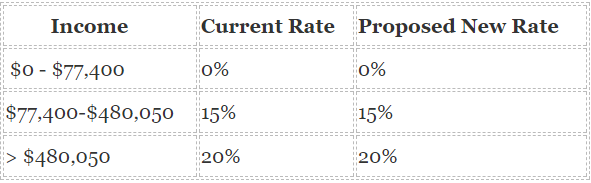

Long-Term Capital Gains/Qualified Dividends Rates

Current Law

Under current law, those in the 10% and 15% brackets generally pay a 0% tax on qualified dividends and gain from the sale of capital assets held longer than one year. Above those income limits, taxpayers pay at a 15% rate until income reaches the start of the 39.6% bracket ($420,000 if single, $480,000 if married). For those in that top bracket, the rate on capital gains and dividends is 20%.

Proposed Law

The final bill leaves the preferential rates on capital gains and dividends unchanged, not just from previous versions of the House and Senate bills, but also from current law.

Here are the rates for single taxpayers:

And here are the rates for married taxpayers filing jointly:

Standard Deduction

Current Law

All taxpayers are entitled to deduct the greater of:

- The “standard deduction,” or

- The sum of itemized deductions.

Under current law, the standard deduction is $6,350 for single taxpayers and $12,700 for married taxpayers.

Proposed Law

The final bill increases the standard deduction to $12,000 for single taxpayers and $24,000 for those married filing jointly.

Personal Exemptions

Current Law

Each taxpayers is entitled to a $4,100 deduction for oneself, one’s spouse, and any dependents. The exemptions are phased out for high-income taxpayers.

Proposed law

Personal exemptions are eliminated. To soften the blow a bit, however, the Child Tax Credit — which is generally available for any child under the age of 17 — will be increased from $1,000 to $2,000, and the refundable amount of the credit increased from $1,100 to $1,400. In addition, a new $500 credit will be allowable for non-child dependents, such as an elderly parent. And finally, the income limits at which a taxpayer starts to lose the two credits will be increased from $75,000 to $200,000 for single taxpayers and from $110,000 to $400,000 for married taxpayers.

The Rate on Business Income of Sole-Proprietors, S Corporation Shareholders, and Partners in a Partnership

Current Law

Taxpayers may operate a business in their individual capacity — as a sole proprietorship — or through a partnership or S corporation. The latter two business types do not pay tax at the business level; rather, the income of the business is allocated among the owners, who pay the corresponding tax on their individual returns. As a result, the individual owners are at the mercy of their respective individual rates, which as stated above, rise as high as 39.6% under current law%.

Proposed Law

The foundation of both the House and Senate bills is the drop in the corporate tax rate from 35% to 21%. But if you reduce the corporate rate without a corresponding incentive being given to partners, shareholders and sole proprietors, those business types would suddenly become disadvantaged relative to their corporate brethren. As a result, both the House and Senate sought to give a tax break to these business owners, though they went about it in very different ways.

In the conference committee, the Senate approach won out. As a result, sole proprietors, S corporation shareholders, and partners in a partnership will be entitled to a deduction equal to 20% of their allocable share of business income.

The deduction comes with numerous caveats, however:

- Generally, the deduction cannot exceed 50% of your share of the W-2 wages paid by the business.

- Alternatively, the limitation can be computed as 25% of your share of the W-2 wages paid by the business, plus 2.5% of the unadjusted basis (the original purchase price) of property used in the production of income.

- The W-2 limitations do not apply if you earn less than $157,500 (if single; $315,000 if married filing jointly).

- Certain “personal service businesses” — i.e., accountants, doctors, lawyers, etc… — are not eligible for the deduction, unless their taxable income is less than $157,500 (if single; $315,000) if married.

The exception to the W-2 limit and the general disallowance of the deduction to personal service businesses is phased out over a range of $50,000 of income for single taxpayers and $100,000 for married taxpayers filing jointly. Thus, by the time income reaches $207,500 (if single; $415,000 if married filing jointly), the W-2 limitation will apply in full, and owners of personal service businesses will receive no portion of the 20% deduction.

In previous versions of the House and Senate bills, trusts were not eligible for the 20% deduction. The final bill reverses that stance.

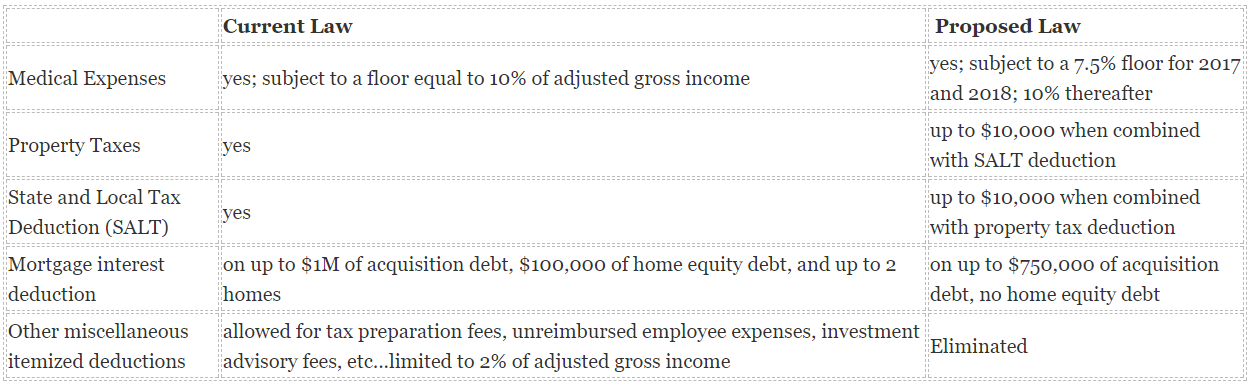

Itemized Deductions

Current Law

As stated above, each taxpayer is entitled to deduct the greater of: 1. a “standard deduction,” or 2. the sum of itemized deductions. Here’s a look at the some of the more popular itemized deductions, and their fate under the final tax bill.

Proposed Law

The final bill makes several important changes from previous iterations of HR 1.

First, taxpayers are entitled to deduct up to $10,000 of a combination of property taxes and state and local income taxes. Previous bills would have permitted only up to $10,000 of property taxes.

In addition, the final bill makes clear that taxpayers will not be permitted to deduct any prepayments of 2018 state and local income taxes in 2017. Thus, using these next two weeks to prepay 2018 state taxes in order to claim a deduction for those taxes prior to their disallowance in 2018 will not be permitted. Taxpayers are generally still entitled to claim a deduction for any prepaid 2018 real estate taxes, however. Please consult your Withum tax advisor for further guidance.

Alimony Deductions

Current Law

Alimony is deductible by the payor, and includible in income of the payee.

Proposed Law

For divorce or separation instruments executed after December 31, 2018, alimony will no longer be deductible by the payor, nor will it be includible in income of the payee.

Education Incentives

Current Law

Under current law, a taxpayer who pays tuition to a college or university may be eligible for a Lifetime Learning Credit, a Hope Credit, or an American Opportunity Tax Credit, depending on the facts and circumstances. In addition, the following education incentives are sprinkled throughout the Code:

- Employers may pay up to $5,250 on behalf of an employee to obtain work-related education without the payment being included in the taxable income of the employee.

- PhD candidates may receive tax-free tuition waivers.

- Dependents of college or university employees may also receive tax-free tuition waivers

- A deduction is permitted for student loan interest of up to $2,500.

- K-12 teachers may deduct up to $250 of their out-of-pocket supplies.

Proposed Law

The final bill preserves all of the education incentives under current law. This is noteworthy because the House bill would have eliminated each one.

Exclusion on Sale of Primary Residence

Current Law

A taxpayer who sells his or her home may exclude up to $250,000 of gain ($500,000 if married filing jointly), provided the taxpayer has owned and used the home as his or her primary residence for two of the previous five years.

Proposed Law

The final bill retains the current law. This is welcome news to many, because both the House and Senate bills would have extended the ownership and use requirements to five out of eight years, with the House also eliminating the exclusion for high-income taxpayers.

Estate Taxes

Current Law

When you die, each taxpayer is entitled to an exemption from the estate tax of nearly $5.5 million, which translates to an $11 million exemption for married couples.

Proposed Law

The final bill would immediately double the estate tax exemption to $11 million for single taxpayers ($22 million for a married couple). Unlike the previous House bill, however, the estate tax will not be fully repealed.

Alternative Minimum Tax

Current Law

Each taxpayer must compute their liability twice: once under the regular rules, and then a second time under the “alternative minimum tax” rules. The taxpayer must then pay the higher of the two taxes.

Proposed Law

The AMT is retained, but with a much higher exemption amount ($109,400 for married taxpayers as compared to $84,500 under current law). In addition, with the deduction for state and local income taxes largely eliminated, as well as the deductions for unreimbursed employee expenses and personal exemptions, the AMT should ensnare far fewer taxpayers then it does under current law.

Individual Insurance Mandate

Current Law

Any individual who doesn’t maintain “minimum essential health care coverage” during the year must pay a penalty of $695 to the IRS.

Proposed Law

The final bill would fully repeal the individual mandate effective January 1, 2019. This is the one individual change that will not expire on December 31, 2025.

Corporate Tax Rate

Current Law

Under current law, the top corporate rate is 35%.

Proposed Law

The final bill would drop the corporate rate to 21%.

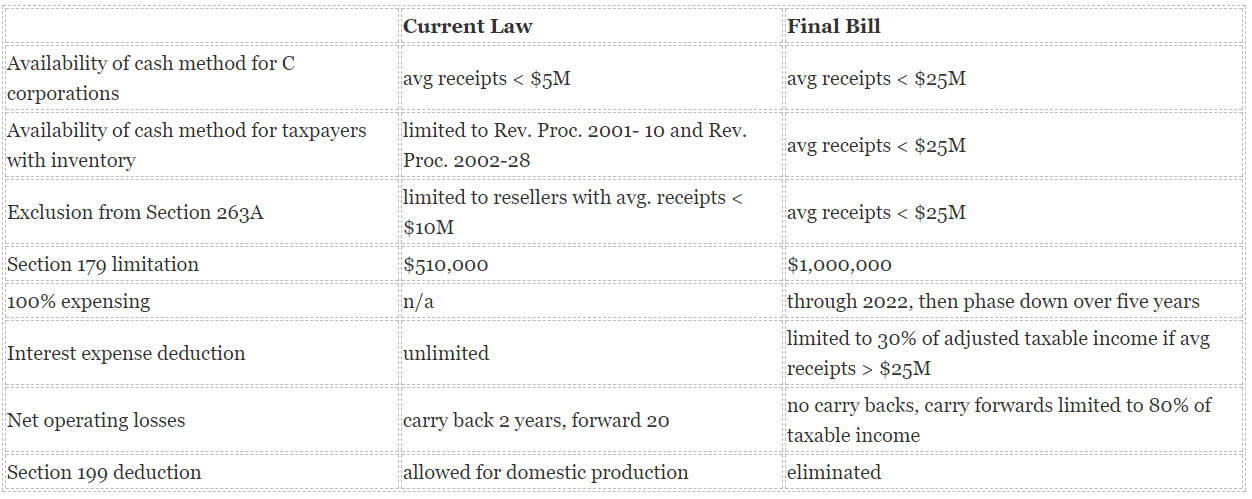

Other Business Changes

Below is a quick look at other business changes under the final bill, as they compare to current law:

It is important to note that the ability to deduct 100% of the cost of qualifying assets is effective retroactive to September 27, 2017. Thus, businesses needn’t wait until 2018 to benefit from these rules.

The Tax Cuts and Jobs Act runs over 500 pages in its entirety; this was intended merely as a summary. Please reach out to your Withum advisor with any additional questions or concerns.

Author: Tony Nitti, CPA

How Can We Help?