As states continue to adapt to the post-Wayfair landscape, the initial focus on establishing economic nexus thresholds has largely stabilized. With these standards now firmly in place, many jurisdictions are shifting their attention toward expanding the sales tax base or adding other indirect taxes or fees. This includes broadening the scope of taxable items and services, particularly in areas such as software, professional services and digital advertising.

Although the U.S. Supreme Court’s decision in Wayfair specifically addressed sales tax nexus, many states have extended the concept of economic nexus to include income tax obligations as well.

In 2023, New Jersey became the first state to officially adopt the economic nexus standard (i.e., $100,000 sales or 200 transactions) for both corporation business taxes and sales taxes.

While a business may establish economic nexus in a given state, strategic planning – particularly through a thorough sales sourcing analysis – can play a critical role in mitigating state income tax liabilities. As more states transition to single-factor apportionment formulas based solely on sales and adopt market-based sourcing rules, accurately allocating sales across jurisdictions has become increasingly vital. The evolving landscape of economic nexus presents both challenges and opportunities for multistate businesses, especially as states continue to apply diverse sourcing methodologies. In response, many companies are proactively reassessing their sales sourcing approaches to ensure compliance and to optimize their state tax positions.

One Big Beautiful Bill Act (OBBBA) State Implications

- With the passing of the OBBBA, federal conformity states will be directly affected by the new tax provisions.

- The manner in which a state conforms to the Internal Revenue Code determines whether a state automatically adopts all of the new provisions or selectively conforms. Taxpayers will need to assess whether their state taxes are affected by the changes.

- Some of the changes that will most likely impact state income taxes are changes to depreciation, interest expense deductions and a change back to immediate expensing for R&E expenses.

SALT Deduction Limitation Workaround

- The majority of states have now passed legislation to circumvent the $10,000 state and local tax (SALT) deduction limitation (36 states in total including New Jersey and New York). In addition, New York City is allowing eligible entities to circumvent the SALT deduction limitation for taxable years beginning on or after January 1, 2022.

- The IRS has confirmed that pass-through entity tax (PTET) elections are effective workarounds to the SALT deduction limitation and allow businesses to fully deduct state and local taxes from their taxable income.

- State income tax refunds related to PTETs may create taxable income at the federal level. Careful consideration and planning should take place when electing PTET payments and the impact of individual withholding and estimated tax payments.

- In addition, the implementation of these new provisions by the states has not been smooth. For example, New York has been sending out Notices to taxpayers disallowing the taxpayer’s credit for taxes paid to other states because, according to the Notice, the PTET tax that was imposed in the other state was not substantially similar to the New York PTET. Taxpayers receiving these Notices should examine them carefully because they may have been issued in error.

- The OBBBA raised the SALT cap from $10,000 to $40,000, which could impact the importance of SALT cap workarounds in the future.

State Tax Credits

- State and local governments offer a wide range of tax credits and incentive programs designed to attract new businesses, encourage capital investment and retain existing operations within their jurisdictions. If your business is expanding or considering relocation, it is essential to evaluate the potential benefits of these programs – particularly when making significant capital investments or increasing your workforce in a given state. A thorough analysis of available incentives can lead to substantial tax savings and support long-term strategic growth.

- Determining the best market for your business to incorporate and/or operate is a critical decision – do not overlook the tax credits and incentives that may be available. The credits may result in sufficient tax savings to sway the determination of whether to stay in a current location or move to a new one.

- Common opportunities from states and/or localities may target:

- Small and mid-size businesses

- Job creation

- Geography, such as distressed zones, enterprise zones or tax-increment finance districts

- Angel investors

- Not-for-Profits

- Innovative businesses

- Capital investments

- Specifically targeted industries, such as technology, manufacturing, agriculture or film

Your Tax Strategy Simplified

With continued shifts in tax policy, staying proactive with your tax planning can help you take advantage of new opportunities and avoid unexpected liabilities. Withum’s Tax Planning Resource Center provides timely insights, planning tips and compliance reminders tailored to your needs.

Sales and Use Tax Planning Considerations

In today’s post-Wayfair landscape, economic nexus is no longer a temporary concern – it’s a permanent fixture in the tax environment. For multi-state businesses, sales and use tax compliance can pose a substantial financial risk if not proactively managed. Key areas such as taxability reviews, marketplace facilitator rules and exemption certificate management have become critical focal points, demanding deeper analysis and strategic oversight to ensure compliance and minimize exposure.

Companies should regularly review their sales and use tax process and procedures.

Nexus

Regularly assess physical presence and economic nexus throughout the year to proactively identify jurisdictions where your business may have new or evolving sales tax collection and self-assessment obligations.

- Understanding where your business has sales tax nexus is critical for staying compliant with state and local tax laws. Failure to collect and remit the correct sales tax can lead to substantial liabilities, penalties and legal complications.

- Lack of nexus awareness can result in unexpected tax exposure across multiple jurisdictions. By identifying nexus-creating activities, businesses can accurately calculate and collect sales tax, ensuring proper remittance and avoiding costly penalties and interest. Many states now have dedicated nexus units actively seeking out non-compliant businesses.

- Pinpointing sales tax nexus streamlines operations. It enables the implementation of precise tax collection procedures, reduces administrative overhead and helps catch errors before they become costly.

- Sales tax audits are a reality. Knowing where your business has nexus and maintaining accurate records makes the audit process significantly smoother and less disruptive.

- Digital businesses must stay vigilant. States are increasingly targeting digital goods and services – like SaaS, digital advertising and online platforms – as new revenue sources. Monitoring these developments is essential for compliance.

- Remote sellers, marketplace sellers and facilitators must ensure compliance with evolving state and local tax laws. States are aggressively enforcing marketplace facilitator rules and using new tools to identify and tax these transactions.

Regularly reviewing sales and use tax reserves and disclosures under ASC 450 is more than just a compliance exercise – it’s a critical component of financial risk management and strategic planning. Ensuring that potential liabilities are properly identified, assessed and disclosed helps maintain the integrity of financial statements and supports transparent, compliant reporting.

A proactive approach to evaluating tax exposures not only reduces the risk of unexpected assessments and penalties, but also prepares the organization for scrutiny during key financial events – particularly due diligence in mergers, acquisitions or financing transactions. Unrecorded or under-analyzed sales and use tax liabilities can quickly become red flags, potentially delaying deals, impacting valuations or leading to costly indemnifications.

By embedding regular tax reserve reviews into financial close processes and leveraging cross-functional collaboration between tax, finance and legal teams, companies can better manage uncertainty, demonstrate strong governance and position themselves for successful outcomes in both day-to-day operations and strategic transactions.

Trending Sales Tax Topics

- Many state sales tax statutes were written long before the digital age. As a result, they often fall short in addressing the complexities of today’s digital economy. States are actively modernizing these laws. Texas, for example, recently updated its data processing rules to better reflect the nature of computerized services.

- State definitions of taxable digital goods, services and cloud-based products are evolving rapidly. Items once considered exempt are now taxable in several jurisdictions.

- Co-streaming platforms are subject to sales tax or similar levies in several jurisdictions. That includes Washington, Maryland, Kentucky and Chicago, which impose a 10.25% amusement tax on streaming content.

- States are increasingly conducting audits that span multiple tax areas. That includes information reporting, payroll and sales/use tax – resulting in broader and more complex audit scopes.

- Tax authorities are leveraging third-party data sources. Tax Authorities are using 1099-Ks, vehicle title records and alcohol/tobacco reports to estimate sales tax liabilities and initiate audits, even when businesses have filed correctly.

- Penalties are becoming more difficult to waive. Many states are requiring detailed justification and limiting relief for repeat requests.

- States are intensifying their scrutiny of bundled and mixed transactions. This is particularly true when taxable and non-taxable components are sold for a single, non-itemized price. To assess taxability, many jurisdictions are more assertively applying the “true object” and “de minimis” tests to determine the transaction’s primary purpose. In certain situations, the entire transaction can be taxable if any part of it is taxable.

- Rhode Island Declaratory Order 2025-01 states that genealogy services accessed via vendor-hosted software are now considered taxable digital services, even when bundled with physical kits.

- Tariffs are being passed on to customers. Whether embedded in price or separately stated, these tariffs are often included in the sales tax base in several states, which can inflate taxable sales and trigger nexus thresholds.

- Maryland expanded its sales tax base. It now includes data or information technology services and software publishing services effective July 1, 2025.

- Washington expanded its tax base. As of October 1, 2025, it now includes advertising services, live presentations, information technology services, custom website development services, investigations, security, and armored car services, temporary staffing services and sales of custom and customization of prewritten software. The new law also removes exclusions from the definition of digital automated services (DAS) including services involving primarily human effort, live presentations, advertising services and data processing services. A new exclusion for DAS was created for telehealth and telemedicine services.

- New York has considered imposing sales tax on streaming services and digital goods. While this change has been considered in the past, it could resurface in 2026.

As the year comes to a close, it’s an ideal time for businesses to review the tax implications of any new products or service lines introduced or planned for the upcoming year. Conducting a thorough taxability analysis is essential, especially as many states continue to broaden the definitions of taxable software and digital services – including areas such as information services and data processing. Staying up to date on these evolving state tax laws helps ensure accurate compliance and reduces the risk of unexpected tax liabilities heading into the new year.

Sales and Use Tax Compliance: Key Considerations

- Review People, Processes and Technology: Companies should assess internal operations to ensure compliance with sales tax obligations across multiple states and local jurisdictions.

- Implement Third-Party Tax Software: Consider using automation tools to maintain accurate sales tax rates and apply correct tax amounts to invoices.

- Verify Tax Code Accuracy: Ensure proper tax codes are selected in third-party software to avoid incorrect sales tax calculations on customer invoices.

- Manage Compliance Burden: The volume of state and local tax forms and deadlines can be overwhelming. Errors may result in penalties, interest or liens on responsible officers’ properties.

- Consider Outsourcing: Outsourcing sales and use tax compliance can reduce risk and allow employees to focus on higher-value activities.

- Prepare for Strategic Events: Sales tax compliance is critical during mergers, acquisitions or funding requests. Unreviewed tax functions may reveal exposures during due diligence.

- Conduct Periodic Reviews.: Regularly evaluate sales and use tax procedures to identify and mitigate potential risks before they escalate.

Sales and Use Tax Refund Review

As 2025 comes to a close, we recommend conducting a comprehensive review of purchases to identify potential sales and use tax refund opportunities. This exercise can uncover significant savings and ensure compliance going forward.

Key Considerations

- Vendor Tax Practices: Many vendors may take a conservative approach to charging sales tax to remain competitive. This can result in under-collection or over-collection of tax.

- Exemption Opportunities: Certain purchases may qualify for exemptions (e.g., manufacturing, resale, R&D). Reviewing these transactions may reveal taxes paid in error that are eligible for refund.

- Annual Purchase Review: A year-end review helps identify instances where vendors failed to charge tax or charged it incorrectly. This is a prime opportunity to correct errors and recover overpayments.

- Legal Developments: Recent state tax court decisions may have changed the interpretation of taxable vs. exempt purchases. These changes could open new refund opportunities.

State and Local Income Tax Planning Considerations

A business should be considering state and local income tax nexus and sales sourcing assessment if:

- Revenue streams are derived from multi-state customers/clients.

- Sales could be subject to special industry sourcing rules, such as financial services, publishing, broadcasting, technology (e.g., SaaS, data processing), advertising and transportation.

- The business has significant tax in any out-of-state jurisdiction.

- Business receipts are sourced due to varying state rules, based on the following:

- Location where services benefit the customer

- Location of customer’s billing address

- Location of customer’s headquarters

- Location of customer’s primary interaction/contacts with the business

- Location of customer’s order location

- Location of the customer’s customer (i.e., ultimate customer)

- Other metrics (e.g., IP address analysis) that could result in a varied sourcing approach

States Are Generally Lowering Tax Rates

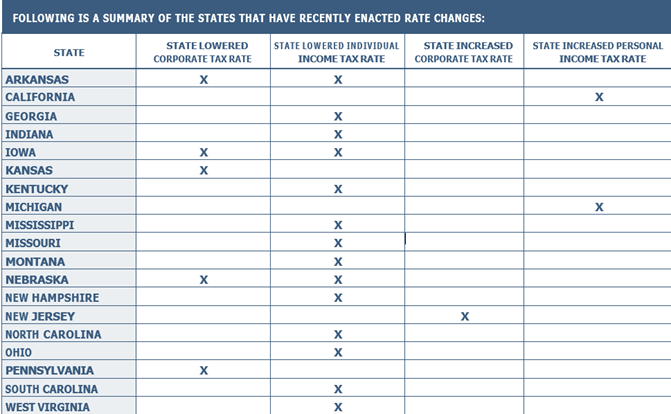

Several states have recently enacted corporate or personal income tax rate changes. While the majority of state statutory rate changes have lowered tax rates for individuals and businesses, California enacted the nation’s highest personal income tax rate (14.4%) and New Jersey enacted the nation’s highest corporate income tax rate (11.5%). Companies should review Deferred Tax Asset estimates to determine if state income tax rate changes will affect those calculations.

Recent Income/Franchise Tax Nexus Developments

In the aftermath of Wayfair, the Multistate Tax Commission (MTC) has targeted one of the remaining legal barriers that businesses have to shield themselves from state assertions of income tax economic nexus – P.L. 86-272.

On August 4, 2021, the MTC voted to adopt a revision to its “Statement of Information” whereby a business could lose P.L. 86-272 protection solely by engaging with customers through the internet. In 2022, New York and California issued guidance stating that they were adopting the MTC’s revised Statement of Information. Currently, there are legal challenges to the adoption of the MTC guidance in both states. The taxpayer was recently successful in overturning the state’s adoption of the MTC guidance in California; however, the case was decided on procedural grounds and the court did not reach the question of whether the MTC guidance violated federal law. New York’s appellate division recently upheld the regulations adopted by New York to implement the MTC ‘s P.L. 86-272 rules. Other legal challenges are sure to follow.

Effective July 31, 2023, New Jersey adopted the MTC’s P.L. 86-272 revisions. It is expected many other states may adopt the MTC’s guidance implicitly through their MTC conformity provisions. The loss of P.L. 86-272 protection may result in additional income tax filing obligations for many businesses. The federal law known as P.L. 86-272 was passed more than 60 years ago, and it prohibits a state from imposing a net income tax on businesses that only sell tangible personal property (TPP) and whose activities in a respective state do not exceed the solicitation of orders. For many years, even preceding the Wayfair case, for income tax it has been generally accepted that economic nexus has been the law of the land unless a business was otherwise protected by limiting its activities to those outlined in P.L. 86-272.

The MTC’s Guide provides examples of when the use of an interactive website will exceed P.L. 86-272 Protection, including:

- Providing post-sale customer assistance via an electronic chat or website email.

- A career or employment page that accepts applications for non-sales positions.

- The use of “cookies” on a customer’s device to gather information on shopping trends or to track inventory.

- Transmission of remote product patches, upgrades or updates via the internet.

- The offering of extended warranty plans.

- Use of marketplace facilitators, such as the fulfillment center, which maintains inventory.

- Other interactive internet-related activities.

The MTC’s revised statement adoption by multiple states could result in significant income tax liabilities for many remote businesses, as many of these businesses use a website or app to interact with their customers. Even if businesses have performed a nexus or P.L. 86-272 review in the past, they should consider having such studies refreshed, considering many of the developments over the last several years. Furthermore, the state application of the MTC rules is certain to be challenged. It is important to stay abreast of developments in this area. The MTC’s guidance greatly expands the list of activities that are not protected by P.L. 86-272 and it is likely that some state courts will reject the MTC’s interpretation of the federal statute.

State and Local Tax Workarounds

The OBBBA expanded the $10,000 cap on state and local taxes (SALT) to $40,000 for 2025 through 2029, subject to income phaseouts. Pass-through entity taxes (PTETs) remain viable s a workaround to mitigate the impact of the SALT deduction limitation.

Prior to making a pass-through entity election, there are several key issues that businesses need to consider:

- IRS APPROVAL: The IRS indicated in Notice 2020-75 that it intends to allow PTETs. However, the IRS has not issued any further guidance on the issue.

- FEDERAL TAX BENEFIT IMPLICATIONS: It is possible that the PTET benefit may be limited if some taxpayers are subject to the federal tax benefit rule.

- RESIDENT CLIENTS: Resident partners/shareholders participating in a PTET (elective or mandatory) may not receive a credit for taxes paid to another state on their resident state income tax return.

- DUAL ESTIMATE PAYMENT REQUIREMENTS: In some states, a passthrough entity needs to make estimated payments against the PTET. This may not alleviate the owners’ obligations to make estimated payments in their personal capacity. While the tax only gets paid once, this may cause cash flow issues from having to make two estimated tax payments.

- REFUNDABILITY ISSUES: In most states, the PTET becomes a fully refundable credit on the owners’ personal income tax returns. However, in some states, the credit is not fully refundable, and/or excess credit is carried forward to future years, where it may expire if not fully used.

- OTHER CONSIDERATIONS: Business owners should keep in mind that the election to pay tax at the entity level is subject to each business’s facts and circumstances and may vary depending on specific state provisions. Additionally, the administrative cost of making a PTET (e.g., additional filings) may consume some of the savings.

Telecommuting

As the economy continues to evolve, widespread remote working and state budget shortfalls have increased the focus on state and local taxes.

Although telecommuting raises many concerns, some of the central issues put into focus are:

- Income and Sales

- Tax Nexus Income Tax Apportionment

- State Payroll Withholding

Nexus, with respect to telecommuting, is generally straightforward. An employee’s presence in a state creates nexus unless the company is engaged in activities that are protected by P.L. 86-272. For income tax apportionment, in some states, the consequence of an employee working from a different state could affect sales sourcing, payroll and the property factor. For example, the New York City UBT (for non-corporate entities) uses cost-of performance sourcing, which can lower taxes if employees leave New York to telework in nearby states. Such sourcing is generally determined based on where the services are performed.

Payroll withholding also presents challenges. Most states source employee wages to the state where the employee performs the services; however, with “Convenience of the Employer” rules, such as those in New York, there is added complexity. These rules, some of which preceded the pandemic, essentially require non-resident wages to be sourced to the state’s office where the employee is assigned, even if the employee works remotely in another state. The New York Division of Tax Appeals recently upheld the state’s implementation of the convenience of the employer rule but there will likely be more litigation to come on this issue. This could result in double withholding requirements for the employer.

Some of the key issues impacting payroll withholding decisions include:

- Temporary versus permanent employee relocations.

- States that employ reciprocity agreements.

- States with convenience of the employer rules.

Employee mobility and telecommuting are here to stay, and businesses must adapt and plan for the many tax issues that arise.

Considerations for Changing Residency

Now that working from home has become more common, are you considering a move to another state? Perhaps to a low-tax or no-tax state? If so, you are not alone, and there are several things you should be considering for income tax purposes.

In order to change one’s domicile, an individual must physically move to a new jurisdiction with the concurrent intent to make the new jurisdiction their fixed and permanent home. Individuals domiciled in a state are subject to that state’s taxing authority on all their income. An individual who is required to pay tax as a nonresident in a state, even though they are domiciled elsewhere, is only subject to tax on income derived from sources originating outside his or her state of domicile (e.g., wages earned while working in a nonresident state, pass-through entity income).

Domicile is the place you regard as your permanent home – the place to which you intend to return after a period of absence (e.g., a vacation, a short-term business relocation, educational leave). As a practical matter, you can only have one domicile at any point in time, although you may have multiple residences. Once established, domicile continues until you affirmatively establish a new domicile.

Determining where an individual is domiciled requires a subjective analysis of several factors, including, but not limited to:

- The individual’s home (considering the size, nature, value and use of the residences) when an individual maintains more than one home

- Active involvement in a trade or business in a state

- Where the individual spent the majority of their time (which is different than spending less than 183 days in a state)

- Location of “near and dear” possessions

- Family connections

Additional factors demonstrating an intent to permanently move include voter registration and obtaining a driver’s license and vehicle registration in the new state. The burden of proof is upon the person asserting a change of domicile. They must maintain sufficient records to demonstrate an intention to abandon their previous domicile and establish a fixed and permanent home in a new one.

Proper planning and understanding of the residency rules in the states the taxpayer is leaving and the state they are moving to are critical for individuals contemplating a change of domicile.

Additional considerations when planning a change of domicile include:

- Whether an individual will remain subject to tax on their wages in the state they left pursuant to an Office of Convenience rule.

- Modeling potential tax savings by relocating to a low or no-tax state.

- Analyzing other costs associated with moving to a new state (e.g., real estate taxes, homeowners’ insurance premiums).

- Implementation of proper domicile planning, considering the facts and circumstances, documentation requirements and other rules when putting in place a plan to mitigate audit risks.

State Tax Authorities in high-tax states are aggressively examining taxpayers’ claims that they broke their domicile and demanding substantial documentation to back up the taxpayer’s assertions. Failing to prepare for a tax examination at the outset of a move jeopardizes the ability to ultimately prevail at the audit. Failing to plan is planning to fail.

Contact Us

Reach out to a member of Withum’s State and Local Tax Services Team for guidance as year-end approaches.

Disclaimer: No action should be taken without advice from a member of Withum’s Tax Services Team because tax law changes frequently, which can have a significant impact on this guide and your specific planning possibilities.