The recent enactment of the One Big Beautiful Bill Act (OBBB) has introduced significant changes to the tax treatment of gambling losses, which are poised to profoundly impact the sports betting industry. Signed into law by President Donald Trump on July 4, 2025, the bill includes a provision that limits the deductibility of gambling-related losses and expenses to 90%. This law will go into effect on January 1, 2026.

Previously, bettors could deduct their gambling losses dollar-for-dollar against their winnings, ensuring they only paid taxes on their net profits. The new provision, however, caps these losses at 90% and is expected to substantially impact professional and high-volume sports bettors.

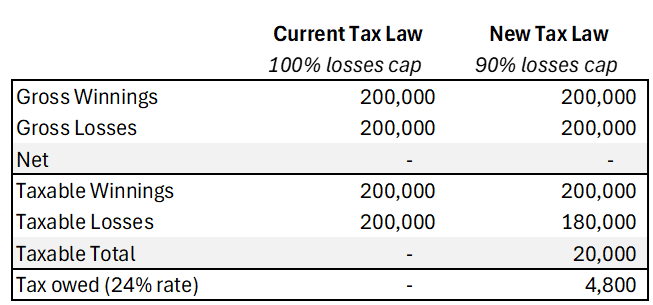

Hypothetical Scenario: Gambling Loss Deductions

Let’s examine a hypothetical scenario:

Consider a professional sports bettor who wins $200,000 in a year but incurs losses amounting to $200,000. Under the current tax law, this gambler would not owe any taxes, as their losses would offset their winnings entirely. However, under the new 90% limitation, they can only deduct $180,000 ($200,000 X 90%) of their losses, leaving $20,000 as taxable income despite this bettor not making any money during the year. Assuming this individual had an effective tax rate of 24%, they would owe $4,800 in taxes for the year.

The sports betting industry has voiced concerns over this new tax provision, which would significantly impact all sports bettors. In response, on July 7, 2025, Rep. Dina Titus (D-NV) announced the FAIR BET Act, which aims to restore the ability for bettors to deduct 100% of their annual losses against their gains.

From a tax planning standpoint, professional gamblers may want to reconsider how they structure their betting activities. For those who treat gambling as a trade or business, operating through a legal entity can offer greater flexibility in managing expenses. This is particularly relevant for costs not directly tied to wagering, such as research tools, data subscriptions, travel and professional services. While the 90% limitation on deducting gambling losses still applies, properly categorizing and documenting these ancillary expenses could help reduce taxable income more effectively. Maintaining thorough records and assessing whether such expenses qualify as ordinary and necessary business deductions will be essential steps for those looking to optimize their tax position.

Get the Latest Tax and Legislative Developments

Withum’s National Tax Policy and Legislative Updates Resource Center is your go-to source for timely updates on tax law and legislative changes. Our team is closely monitoring sweeping tax reform changes, shifting tariffs and tax industry updates, delivering in-depth analysis and actionable insights.

Contact Us

For more information on this topic, please contact a member of Withum’s SportsTech Services Team.