My contention is that it is very difficult to beat the market and that the nonprofessional investor is best sticking to index funds. There are a lot of reasons for this and also a lot of “definitions” about which index is the right or most appropriate in a given situation. Today I do not want to discuss indexing but rather want to provide information about the performance of the S&P500 index sectors. By deviating from the index as a whole and drifting into sectors, you are trying to “beat” the market. If not, then why digress? You can review this data and use it to come to your own conclusions.

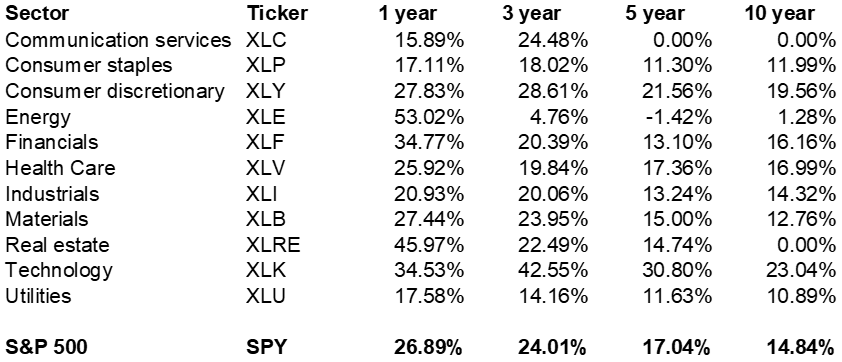

Shown is a chart showing the 1-year, 3-year, 5-year and 10-year annualized performance of the sector spiders exchange traded funds compared to the S&P500 SPY exchange traded fund. I provided the name of the sector and the ticker symbol. If you want to see what makes up the components of each sector spider, you can look up the ticker symbol to get a quote and see its top ten holdings. Every stock in the S&P500 index is included in the sector they rank it in. Some definitions might not be clear, but you can see for yourself what makes up the sector. Some examples are Apple which is included in the Technology sector along with Microsoft; Amazon.com is in Consumer Discretionary with Tesla, McDonalds and Target; and Berkshire Hathaway is in Financials along with JPMorganChase, Bank of America and Wells Fargo. I suggest looking up what is in it before investing in any sector. Note that some stocks for some sectors did not exist for the entire 10-year period and that occasionally the composition changes.

Anyway, my belief is that investing is a long-term endeavor where the goal should be to share in the growth of the American economy as reflected in a well-diversified stock portfolio. For that purpose, I suggest that no one should invest in the stock market unless they have at least a seven-year time horizon and, more ideally, ten years. So, when I evaluate performance, I tend to look at the ten-year results. One, three or even five years is too short a period for me. This advice or suggestion does not apply to stock traders who have a much different purpose for investing. My comments are directed to clients and readers who have the goal of securing their long-term future and not the goal of making a killing, outsmarting everyone else or beating the market.

The ten-year results shown in this chart seem to show that not many sectors did better than the S&P500 index over the last ten years. Actually, only technology and consumer discretionary sectors did better and that was due to an explosion in technology and Amazon.com and Tesla’s huge increases. At some point, I believe most things will tend to revert to the norm [but I never know when that point will come]. Picking to go all-in in one of these two sectors ten years ago would have had you doing better than the S&P500, but if you did not go all-in, then what are the chances you would have picked the other outperforming sector? Further, just because these did well the past ten years does not mean they will do better in the next ten years.

Many investors think they have a strategy that can outperform the market. Some do and hooray for you. However, on balance, these results indicate that a broad-based portfolio might be a better way to go.

Next week I will present some of my opinions and an analysis of the 2021 market performance and what trends might be indicated.

Contact Me

If you have any tax, business, financial or leadership or management issues you want to discuss please do not hesitate to contact me.