QSBS owners are exempt from capital gains up to a point. This article will discuss how to tell if your shares qualify for QSBS status, what your obligations are as a QSBS owner to achieve those benefits, and how QSBS can be a powerful estate planning tool that you can use to maximize the tax advantaged nature of QSBS ownership.

Business Qualifications

Company’s whose stock can qualify for QSBS status must meet five criteria (on or after July 4, 2025):

- The total adjusted gross assets (net of depreciation and amortization) of the business are less than $75 million (indexed for inflation) at all times before and immediately after issuance of the stock.

- The company must be a C-corporation

- At least 80% of the business’ assets are used to conduct a qualified trade/business

- The business did not purchase stock from the taxpayer for four years beginning two years before the issuance of the existing stock

- The business did not purchase greater than 5 percent of the value of its stock for a two-year period beginning one-year before the stock issuance date

The third criteria is typically the most complex to understand and where people wonder if they qualify.

What Is a Qualifying Trade?

To understand what a qualifying trade is let’s start with what is not a qualifying trade. Below is a list of non-qualifying businesses:

- Healthcare

- Law

- Engineering

- Architecture

- Accounting

- Actuarial Science

- Performing Arts

- Consulting

- Athletics

- Financial Services

- Brokerage services

- Banking

- Insurance

- Financing

- Leasing

- Investing

- Farming

- Any business where the principal asset is the reputation or skill of its employees (think if a singer like Taylor Swift were to make their own music company)

- Hotel, motel, restaurant or similar business

- Businesses related to the extraction of raw materials (as it relates to the 613 and 613a deduction)

This is the defined list of disallowed companies. This list is non-comprehensive and bullet 18 sets the standard where businesses not defined but similar in nature are similarly disallowed such as bookkeeping, a paralegal service, recruitment and staffing firms, outsourced CFOs etc. Now let’s talk about some businesses that would be allowable:

- Software/tech companies

- Manufacturing companies

- Car dealerships

- Grocers

- Waste disposal

- Delivery and logistics companies (not including logistics consulting)

- Biotech companies

- Construction companies

- Packaging companies

- PEO companies

The key to these businesses is that they are not relying on the workers unique knowledge to sell their services and instead rely on systems and capital investments for the majority of their value.

So now that we have a good concept of what types of business activities are and are not allowable, here are some common actions that can disqualify an otherwise qualifying business:

- More than 10% of the business’ assets net of depreciation and amortization are invested in stock (excluding subsidiaries)

- More than 10% of the total value of its assets consist of real property not used in the active conduct of the qualified trade

So now that you have a qualifying business, what are your obligations as an owner to maintain QSBS status on your ownership stake?

Understanding the Owner’s Obligations

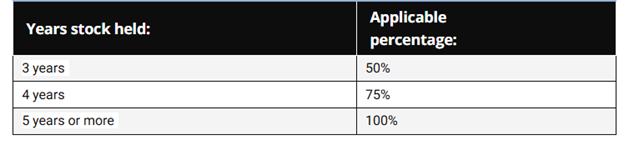

You can realize the benefits of QSBS based on the holding periods described below with a 50% exclusion of capital gains for a three-year hold period up to a 100% exclusion of capital gains for a holding period of five years or more.

However, if you have not held the stock for the required minimum holding period, you can still avoid capital gains tax if you have held it for at least 6-months by rolling the proceeds into either a replacement purchase of new QSBS or as a contribution to a new QSBS eligible enterprise. This works in tandem with the percentages above where if you held the stock for 3 years, you would only need to roll 50% of the total proceeds into replacement QSBS to avoid paying capital gains tax.

As discussed previously you must also have not had the company purchase your stock for a four-year period beginning two-years prior to the issuance date of your stock, and the company must also not have purchased greater than 5% of the aggregate value of its stock beginning one-year prior to the issuance date for a two-year period.

At this point, you might be thinking these rules sound like a pain and asking why you would go through the hassle.

Why QSBS Matters

QSBS allows you to sell your stock without incurring capital gains – aka you can sell your stock tax free. However, there are limits, and with those limits comes work arounds.

The current rules allow you to exclude capital gains up to the greater of 10x your basis (what you paid for the stock), or $15 million. Everything beyond that is taxed at normal capital gains. However, the caveat to this rule is that its per taxpayer. That creates some interesting estate planning dynamics. For stock acquired before July 4, 2025 the table above does not apply and there is only a 100% benefit after 5-years of ownership up $10 million per taxpayer.

QSBS and Estate Planning

Let’s say I started a lawn mowing business after July 4, 2025, and my stock qualifies under QSBS and I’ve done a great job with this business. I own 100% of it and now it’s worth $18 million, but in five years it will be worth $150 million. I have five kids and on January 1, 2026 I plan to gift each child $3 million worth of stock to reach my lifetime unified credit of $15 million. The basis in the gifted stock is a carryover basis, meaning my children will have the same basis as if it were in my hands prior to the gift.

Instead of paying capital gains on $135 million five years from now (total gain less the $15 million exclusion), the gifting of stock to each of my kids or a trust in their name will provide a $15 million exclusion for myself plus each child.

Scenario one – I own 100% of the business. The first $15 million is tax free with the remaining $135 million being taxed at 23.8% (plus applicable state taxes) resulting in $32.1 million of taxes.

Scenario two – I gift $3 million of stock to each of my children. Each child can exclude up to $15 million in capital gains with the remainder being taxed at a maximum rate of 23.8%. Assuming basis is zero for this calculation, myself along with my five children each have $3 million worth of stock so we would split the total gain of $150 million equally. In this example, each of us will be allocated $25 million in total gain. Once we subtract the allowable exclusion of $15 million, that will leave us with $10 million as taxable capital gains resulting in each person having a balance due of $2.38 million of capital gains tax totaling $14.28 million.

In comparing scenario one to two, I will save approximately $17.85 million in tax by gifting the stock to my children prior to the sale.

Conclusion

The QSBS exemption from capital gains is a powerful wealth building tool especially as an increasing number of heirs do not want to inherit the business. This tool is made even more powerful through estate planning techniques that allow taxpayers to stack the $15 million exclusion. Additionally, as a QSBS qualifying business, it makes it easier to sell since other QSBS owners are incentivized to reinvest the proceeds into your company. Now you just need to make sure you follow the rules and work with a trusted tax professional.

Authors: Ross Slutsky, ASA | [email protected] and Brett Mikulec, CPA | [email protected]

Contact Us

For more information on this topic, please contact a member of Withum’s Founders and Tech Executive Services Team.