Privately held medical practices have continued to attract more attention from outside investors (e.g., private equity) due to their highly fragmented and under-scaled nature relative to the broader healthcare industry. Their attraction as a potential investment class has given rise to an increasingly ubiquitous joint venture known as the MSO-PC Model, or simply, the MSO Model.

The Outsourced Back Office

At its core, the MSO Model is a contractual relationship between two parties: a physician-owned professional corporation (hereafter, the “PC”) and a non-professional corporate entity known as a Management Services Organization (hereafter, the “MSO”). Typically structured as an LLC, the MSO provides managerial and administrative support services to a physician-owned PC (hereafter, the “Captive PC”) in exchange for a fee. This arrangement is beneficial for the Captive PC’s physicians as it allows them to remain focused on patient care while the MSO handles the non-clinical operational aspects. In other words, the MSO functions as the outsourced back office of the Captive PC.

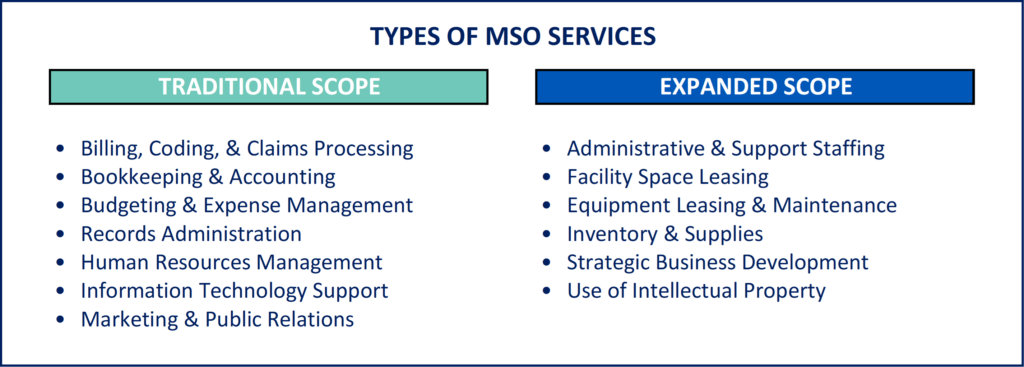

Rather than a one-size-fits-all approach, MSOs are able to provide services that are tailored to the specific needs of the Captive PC. These may range from basic services such as such as bookkeeping, records administration, billing functions, and IT support to a more expanded scope that includes facility and equipment leasing, administrative staffing, and use of the MSO’s intellectual property (e.g., brand name). For example, the inclusion of asset leasing in an MSO’s service offering is particularly common when the Captive PC’s physicians also hold some level of ownership in the MSO. By transferring their equipment and other high-dollar assets to the MSO and entering into a leaseback arrangement, the physician owners can effectively shield those assets from the liabilities of the Captive PC.

A Solution to CPOM Concerns

The MSO Model has been around for decades and is frequently employed to provide physicians with back-office support, streamline administrative processes, mitigate certain business risks, and create points of access for additional investors—all without running afoul of existing laws prohibiting the involvement of non-physician professionals in the practice of medicine. These laws, which arose from a century-long history of regulatory and ethical controls on the practice of medicine, are part of what is now known as the Corporate Practice of Medicine (“CPOM”) doctrine. Restrictions under the CPOM doctrine are predicated on three concerns:

- Physician employment by layperson-controlled corporations reduces physician autonomy over medical decisions.

- Employed physicians face divided loyalty between their profit-seeking employer and treatment-seeking patients.

- Investors in for-profit medical entities will, in the pursuit of maximum profit, place too much pressure on employed physicians to promote the sale of medical services and prioritize profitability over patient care quality.1

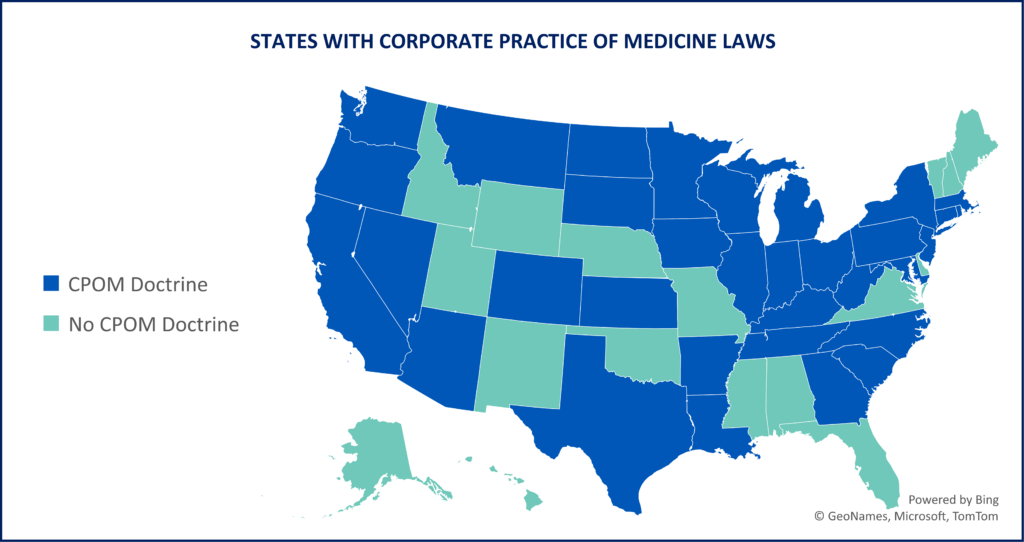

These laws, which exist at the state level with varying degrees of rigidity, include restrictions on the direct employment of physicians by hospitals, prohibitions on professional fee splitting, and requirements that the entities providing direct patient care be majority-owned by physicians licensed to practice medicine in that state. As of 2024, 33 states have some form of CPOM laws in place.

CPOM violations can have serious consequences including fines, revocation of medical licenses, and criminal charges. The MSO model is primarily designed to navigate the applicable laws and provide a pathway to a CPOM-compliant pursuit of profits when non-physicians are involved.

The Importance of a Compliant MSO Fee

The cornerstone of any MSO Model is the Management Services Agreement (“MSA”). The MSA is the founding document that outlines the scope of services, formalizes the fee structure, and establishes a clear separation between clinical and administrative duties—reiterating that the MSO and the Captive PC are two separate entities with distinct responsibilities. The MSA, when properly structured, enables outside investors to participate in, and profit from, the operations of the MSO.

The most critical component of a properly structured MSA is a compliant fee that will withstand scrutiny if ever reviewed or challenged by regulators, legal professionals, and/or commercial insurers. This is especially important if the Captive PC receives federal funds (e.g., reimbursement from Medicare or Medicaid) since, in that case, the fee structure would also need to comply with the federal Anti-Kickback Statute (“AKS”) and the Stark Prohibition on physician self-referrals (“Stark”).

To ensure compliance, the MSA must establish a fee structure that is consistent with the Fair Market Value (“FMV”) of the services being provided. The FMV standard is a critical concept in healthcare transactions and is defined as “the price at which property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts.”2

A fee structure commensurate with FMV helps demonstrate that the MSO Model is fair, reasonable, and does not result in undue influence on medical decision-making. It also helps ensure that the arrangement is free of improper financial incentives and is not structured to induce patient referrals—a violation of AKS and Stark.

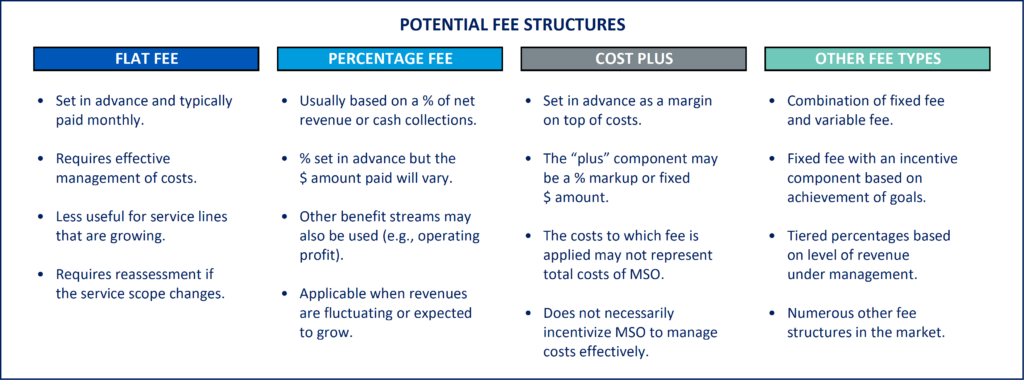

Depending on the state, the MSO may have some leeway as to how it can structure its fee. Common fee structures include a fixed monthly fee (based on an agreed upon budget), a percentage of the Captive PC’s revenue, a “cost plus” approach (where an agreed upon margin is applied to the MSO’s cost of services), or some combination of a fixed and variable amount.

However, different CPOM states have different restrictions on how fees are structured. Some states allow fees to be based on a percentage of the Captive PC’s net revenue while others strictly prohibit fee-splitting. For arrangements that include marketing services (which can often be viewed and scrutinized as a generator of patient referrals), a fixed fee may also be required. The options available to an MSO Model will depend therefore on its local jurisdiction(s).

How Withum Can Help

Consulting with trusted valuation professionals who have expertise in healthcare transactions can help parties maintain a compliant MSA fee and alleviate concerns in the face of scrutiny. Having an independent FMV opinion rendered by a third party adds credibility to the fee structure and helps demonstrate good faith efforts to comply with legal and regulatory standards. Withum’s Healthcare Valuation Services Team can assist parties with FMV guidance both at the beginning stages of structuring an MSA and when there is an existing MSA in place.

Once a compliant fee is in place, it is still important to ensure that it does not run afoul at a later date. FMV is not static and may change over time due to market dynamics, industry trends, or changes to the scope of services provided by an MSO. Withum therefore advises a periodic assessment and, if necessary, adjustment to the fee structure to ensure ongoing compliance with FMV.

In addition to the valuation of MSA fees, Withum offers in-depth consulting and valuation services for transactions and arrangements across the broader healthcare industry. Whether you require a valuation for regulatory compliance, strategic advisory, tax planning, financial reporting, or litigation support, Withum’s Healthcare Valuation Services Team is equipped with the requisite knowledge and experience to provide guidance that you can trust.

- Sara D. Mars, The Corporate Practice of Medicine: a Call for action, 7 Health Matrix 241 (1997) ↩︎

- IRS Revenue Ruling 59-60. ↩︎

Contact Us

For more information on this topic, please contact a member of Withum’s Healthcare Valuation Services Team.