You’re selling a piece of real estate, land, or other appreciated capital asset and a promoter pitches the perfect tax play: The Monetized Installment Sale (for the sake of this article’s word count, “M453”). M453’s are complex transactions sold by aggressive promoters who are more than comfortable operating within the IRS’ crosshairs.

Recently released IRS Chief Counsel Advice 202118016 (“CCA”) provides our first insight into the IRS’ beef with M453 transactions, foreshadowing a grim future for unsuspecting promoters and ill-informed taxpayers alike. In short: M453 transactions don’t work. To fully understand the shade thrown by the recent CCA, we must first answer the question: “What the heck is a Monetized Installment Sale?”

“Ok, So Answer the Question, Already!”

M453 promoters claim you can sell an appreciated capital asset, collect the proceeds and have use of said proceeds, tax-deferred, for 30 years; it’s a time-value of money play. The ability to grow wealth pre-tax for 30 years is substantially more attractive than paying the tax now and investing post-tax dollars, even if tax rates increase.

M453’s are basically traditional installment sales on steroids: you sell an asset, get cash now, pay the tax in 30 years. It’s the classic “too good to be true” scenario, combined with a pushy promoter presenting some perplexing PowerPoint peppered with purposely vague references to the Internal Revenue Code. Taxpayers, especially those close to retirement, are understandably vulnerable to M453 promoters.

M453 Mechanics: How It “Works”

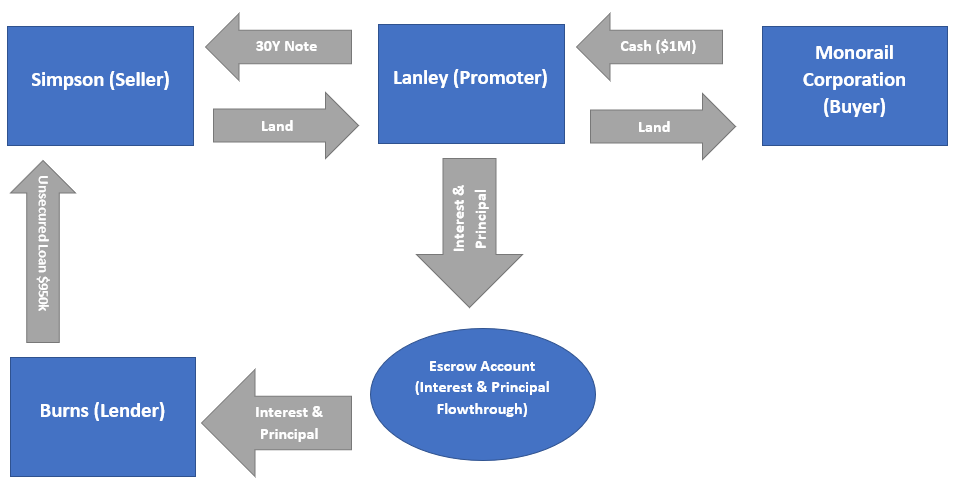

M453’s are complicated transactions, but most follow a similar structure. In extremely limited cases (namely, farm property) they can work, but for virtually all transactions being sold by unscrupulous promoters, they will not withstand IRS scrutiny. To understand the mechanics, let’s look at a hypothetical M453 transaction:

Simpson (taxpayer) sells land for $1M, to intermediary/promoter Lanley, in exchange for a 30-year installment loan (interest only with balloon payment). Lanley conveys the property to Monorail Corporation (buyer), in exchange for $1M cash.

Because individual taxpayers report income on the “cash-basis”, Simpson does not recognize the taxable gain on the land sale until he receives the proceeds in Year 30 (unless he elects out of installment sale reporting, which he wouldn’t do because it would eliminate the benefits of M453).

Simpson sold the land and deferred his tax; however, there’s a problem: Simpson won’t have the $1M in proceeds for another 30 years. Thus far, from the IRS’ perspective, this is all on-the-level, but who can wait 30 years before accessing their cash? This is where the promoters get a bit too creative…

Lanley partners with Burns to loan Simpson 95% of the proceeds ($950,000), structured as an unsecured, nonrecourse loan. Because the loan is unsecured, Simpson isn’t deemed to have “constructive receipt” of the original sale proceeds (according to his promoter friend, Lanley). Further, the interest income on the 30-year installment note is directed to an escrow account, which is then used to make interest payments on Burns’ loan, netting the account to $0 each month. Simpson then deducts (on his tax return) the interest payments to Burns, offsetting the interest income received from Lanley, rendering the transaction tax-neutral for the next 30 years.

Assuming a 7% rate of return, the following calculation illustrates the potential value:

| Cash Sale | M453 | ||

| Proceeds: | $ 1,000,000 | $ 1,000,000 | |

| Less Tax Basis: | (150,000) | (150,000) | |

| Capital Gain: | $ 850,000 | $ 850,000 | |

| Proceeds Received Year 1: | $ 1,000,000 | $ 1,000,000 | |

| M453 Transaction Fee | – | (50,000) | |

| Taxes Paid Year 1 (assume 20% rate): | (170,000) | – | |

| Net Proceeds Available for Investment | 830,000 | 950,000 | |

| Future Value Assuming 7% Growth | 6,318,172 | 7,231,642 | |

| Taxes Paid Year 30 (assume 25% rate): | – | (212,500) | |

| Net Investment: | $ 6,318,172 | $ 7,019,142 | |

| Savings: | $ 700,971 | ||

| Note: For illustrative purposes, only. Does not factor tax expenses on investment earnings in either scenario. | |||

“Ok, I Love M453s, Now Ruin It For Me!”

As mentioned, CCA 202118016 provides insight into the IRS’ developing opinion of M453 transactions: They Don’t Work. The CCA went on to state “we generally agree that the theory on which promoters base the arrangements is flawed.” The CCA cites several reasons supporting its conclusion. In plain English, the most convincing arguments are as follows:

- Unsecured Nonrecourse Loan = Taxable Income: The Loan (from Burns, in our example) allows Simpson to receive the cash and maintain his 30-year tax deferral, but it is structured as an unsecured, nonrecourse loan. If the $950,000 loan is truly an unsecured, nonrecourse loan, Simpson is not personally liable and there’s no reason to pay-back the loan (Woo-Hoo!); however, this also means there’s no genuine debt and the “loan” is income to Simpson (D’oh!), rendering the M453 transaction useless.

- Security & Pledging Rules: As seen in many M453 transactions, Burns, the unsecured lender, can look towards the escrow account for payment (interest and principal). Because Burns maintains a lien on this escrow account, with a right to collect interest and principal on the $950,000 “unsecured” loan, the escrow account itself can be considered security. Essentially, Simpson has indirectly pledged his installment note receivable to Burns. Under the Internal Revenue Code, if you defer taxes under the installment loan reporting method, and you then pledge said loan to secure a cash/monetization loan, you have a deemed payment and triggered income tax, again rending the M453 transaction useless.

- Promoter’s Pretext: The supporting IRS document (a Chief Counsel Memorandum from 2012), most often used by promotors to legitimize M453 transactions, relates to farm property, which is exempt from the pledging rule!

It’s clear the IRS’ latest CCA foreshadows a dark future for M453 transactions. If the monetized loan is truly unsecured nonrecourse debt, the loan is income. If the loan is secured by way of the escrow account, or pledging of the original installment note, the transaction is disqualified under the pledging rules and the sale is accelerated into income. Unless you are dealing with farm property, the IRS has you trapped no matter how you structure the deal. If you defer tax under the installment sale method, you pay tax when you receive the cash. If you then use said installment note to monetize the sale, you’ve cheated the system and triggered the tax because you have the cash.

Eventually the IRS will drop the hammer on everyone involved in these deals. If you are considering an M453 transaction, or have already completed one, call us. We can help you dismantle the transaction, or avoid it all together, so you aren’t caught in the IRS’s crosshairs.

Business Tax Services