Part 2 of a 5-Part Series of the New DOL Form T-1

- Part 1: Is My Union Required to File?

- Part 3: The “Questions” Page – We’ve Got Answers

- Part 4: Individually Identified Receipts and Disbursements

- Part 5: Who and What – Reporting Officers and Employees

So, you’re an LM-2 filer who’s already visited Part-1, reviewed our flowchart and determined that your union is required to file Form T-1 for a trust. If you’re wondering when the Form T-1 is due, the short answer is ‘it depends’…

First and foremost, Form T-1 requirements apply to unions and trusts whose fiscal years both begin on or after June 4, 2020. Keep this in mind and we’ll see how it applies in an example below.

Unlike your LM-2, which is due 90 days after fiscal year-end and covers the fiscal year just completed, the T-1 considers the fiscal year of the union and the trust.

However, similarly to the LM-2, Form T-1 is due within 90 days of the end of the union’s fiscal year and, as a reminder, is filed by the union. The union is generally required to file Form T-1 for the trust’s year-end that falls within the union’s year-end.

The exception to this rule applies when the trust’s year-end is within 90 days of the union’s year-end. When this happens, the union file the previous year-end for the trust instead of its current year, thus giving the union more time to gather the required information.

During this initial filing period, if the trust meets the 90-day exception and the previous fiscal year of the trust started before June 4, 2020, the union is not required to file the trust’s Form T-1 for an additional year.

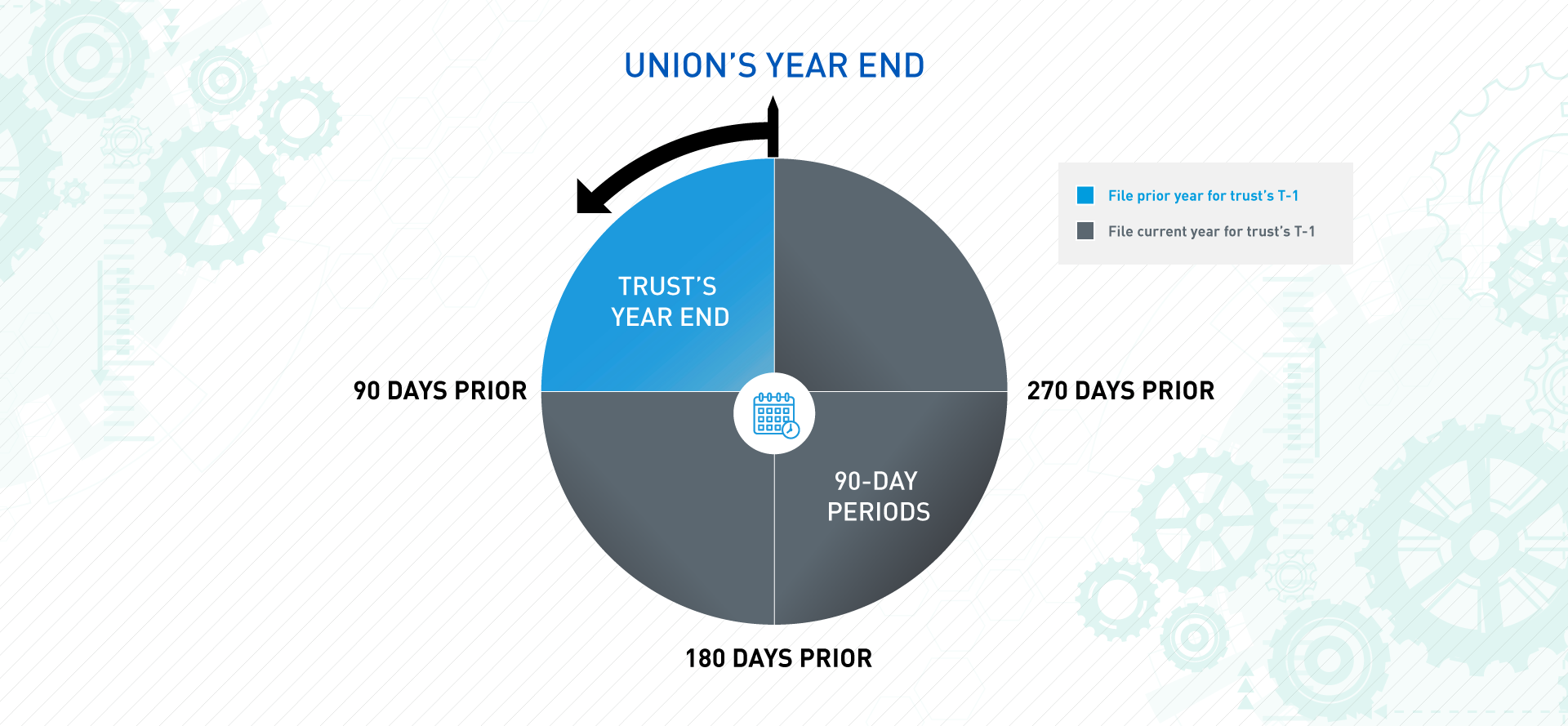

Below is a visual tool to help keep this 90 day exception straight:

Essentially, if the trust’s fiscal year-end falls within the shaded slice of the pie (meaning the trust’s fiscal year-end falls on or 90 days before the union’s fiscal year-end), then the union will file a T-1 covering the trust’s prior fiscal year. For example, if your union’s fiscal year ends on December 31, and the trust’s fiscal year ends on or between October 2 and December 31, then the union will file a T-1 covering the trust’s prior fiscal year with a filing due date of March 31 (90 days after December 31, in a non-leap year).

Adding a hypothetical year to the mix, let’s look at the year 2021. The union’s fiscal year-end is December 31, 2021, and the trust’s fiscal year-end is on or between October 2, 2021, and December 31, 2021. In the case, the union would file by March 31, 2023, a T-1 for the trust covering the trust’s 2021 fiscal year.

Just because your T-1 due date is a year off, don’t automatically assume this shouldn’t have your attention now. Consider a September 30 union and a June 30 trust – this union’s first T-1 filing is due by December 2021 for the trust’s fiscal year ending June 30, 2021. At the time of writing, this trust’s fiscal year is already underway – and this union should be working on a plan to acquire the data needed to complete the T-1.

Also, related to the September 30 union and June 30 trust example, note that those particular calendar quarter-ending dates are more than 90 days apart (92 days to be precise). Remember that the slices in the visual tool represent 90 day periods, not quarters, to accurately reflect the 90-day exception.

All these stipulations can be confusing. Moreover, once you determine the exact date you need to file, you need to prepare the filing. To complete the filing in a timely and accurate way depends heavily on the quality and timeliness of your information. Our team at Withum works with our clients to ensure they are at the intersection of excellence and compliance. Through our partnership with NetSuite, our clients get the right data to support their business decisions and fulfill their compliance responsibilities at just the right time. The result is accurate and real-time financial reporting coupled with time savings and reduced staff frustration; just to mention a few benefits.

Contact us for a no-charge 30-minute discussion that will answer your questions and allow us to share our insights with you.

Author: Jason Edwards, CPA | [email protected]

Labor Organization Practice Group