Concentrated Stock Positions – Update

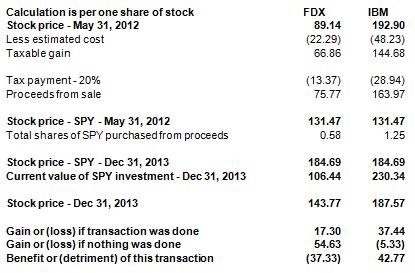

On June 5, 2012, I posted a blog presenting a strategy to reduce risk on a concentrated stock position. This involved selling the stock, paying the tax and reinvesting the proceeds in SPY, the exchange traded S&P 500 index stock. Here are the results through December 31, 2013 if this advice was followed.

For this illustration, I assumed the cost basis was 25% of the current value of the stock, that there was a combined federal and state tax rate of 20% and the transaction was done on May 31, 2012. One of my clients had Federal Express (FDX) and the other IBM. The illustration is for one share of stock.

The client with Federal Express would have not done as well; the client with the IBM would be much better off. If done, the FDX client would have $106.44 for each original share of stock instead of $143.77. The IBM client would have $230.34 for each original share instead of $187.57. This is strictly the mathematical calculation and does not take into account the other factors for following this strategy and you are referred to the June 5, 2012 blog for the reasons to consider this strategy. Also, the capital gains rates were much lower than now. The full results should properly be evaluated after at least seven years since this is a long term strategy.

Any strategy has risks and needs to be carefully considered along with all the ramifications and consequences. Doing nothing is a choice to remain as you are. The risks of this also need to be considered as carefully as doing something.

Comment: Neither client did anything, preferring to stay “married” to their stock. There were other clients in similar circumstances during the year, but these two happened to see me a day apart precipitating the blog. Fortunately, we were in a strong bull market and neither stock tanked.

Nicole Lorenc from our New Brunswick office assisted in the research and calculations for this blog.

How Can We Help?