Captive Insurance Companies

Captive insurance company defined

The use of captives is one of the best-defined strategies for closely-held and middle-market companies. They can provide a wide array of benefits for clients including lower insurance costs, improved risk management, diversified profits and tax planning opportunities.

Captives have generated much attention due to recent legislation allowing their formation in many states. In addition, captives have been the subject of favorable rulings from regulatory agencies such as the Internal Revenue Service.

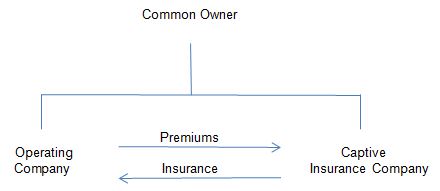

A captive is a legally bona fide insurance company. It insures the risks of operating companies with which it shares common ownership.

Benefits of implementing a captive insurance company

Improved Insurance Program

The ability to customize a program to the operating company’s needs can result in (i) reduced costs; (ii) better claims management; (iii) stabilization of insurance rates; and (iv) the purchase of insurance at “wholesale” rates.

Enhance Tax Planning Opportunities

- Income Tax. The operating company receives a deduction for bona fide insurance premium paid. The captive receives this premium as income, but does not pay tax on it under the Code, provided those premiums are less than $1.2 million annually per captive. The net result is that the captive converts taxable income to non-taxable income, less associated expenses and claims.

- Estate and Gift Tax. The captive is not subject to estate or gift tax when properly structured. Consequently, the value can pass to heirs without those taxes.

Improve Financials.

The captive has appreciable expense and tax management benefits. Provided the structure is compliant with any bank covenants, the overall financial solvency of Client should be improved.