A Case for Stock Diversification

The Dow Jones Industrial Average (DJIA) closed on December 31, 2013, at its all-time high.

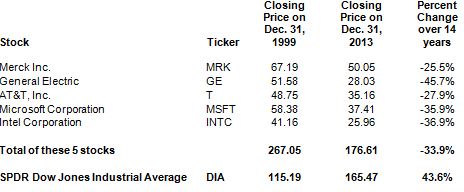

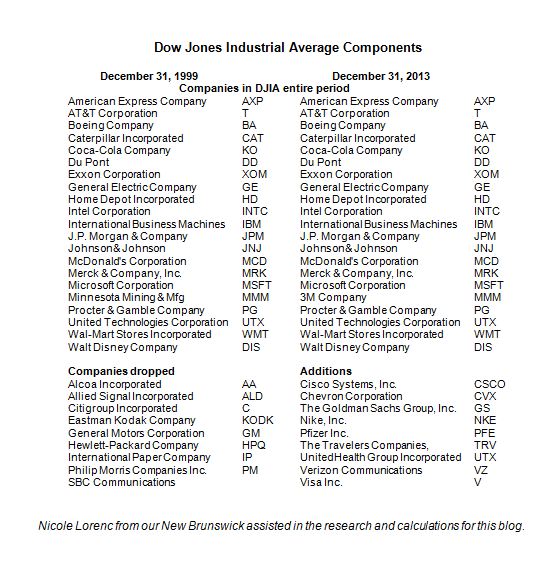

This index is comprised of 30 stocks that are considered the bluest of the blue chips. While the index closed at its all-time high, five of the stellar stocks that were in the index since December 31, 1999, closed down varying percent’s from 25% to 45%, while the DJIA was up over 43%! Actually, these five were a drag because without them the DJIA increase would have been much greater. The prices were adjusted for splits but dividends were not figured in. See the top table.

This is a clear illustration of the importance and benefits of diversification. While the five stocks dropped, the other twenty-five as a group had respectable gains. Also, a point of interest is that two of the stocks added since December 31, 1999, had losses during this 14 year period – Cisco and Pfizer ((losses of 58% and 5%). Diversification is a sound strategy!

The Dec 31, 1999 and 2013 DJIA components appear in the table shown below.

Nicole Lorenc from our New Brunswick assisted in the research and

calculations for this blog.

How Can We Help?