Why Investors Say No

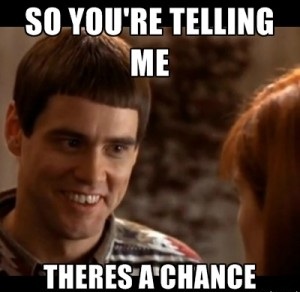

Lloyd: Hit me with it! Just give it to me straight! I came a long way just to see you, Mary. The least you can do is level with me. What are my chances?

Mary: Not good.

Lloyd: You mean, not good like one out of a hundred?

Mary: I’d say more like one out of a million.

[pause] Lloyd: So you’re telling me there’s a chance… *YEAH!* Lloyd Christmas – Dumb and Dumber

So being in this space, I hear a lot of stories (too many, unfortunately) about how some startup crashed and burned a la Tom Cruise in Top Gun at an investor presentation. Some have gotten the polite – “come back when you are further along” and some just the “we will get back to you.” With hindsight, when you then ask some pointed questions to these teams, you realize they might have been a tad optimistic based upon how they approached the fund raising process. Like old Lloyd Christmas, they thought they had a chance, but did they?

So, boys and girls, what lessons can we learn that will perhaps make us have a better chance with a financing source? What are the reasons investors say no? Here are my top five.

- Right pitch; wrong investor. Two big errors here. The first is talking to the wrong investor for your stage of development. This is most common with early stage companies – they wrangle a meeting with a VC when what they need is an angel or seed-funding source. Make sure you talk to an advisor to get in the right pew. Second, don’t assume because they did one deal in your space (you should know your investors’ portfolio) they are interested in your deal. Like all smart investors, diversification is part of their strategy.

- Wrong or incomplete team. You do not need your organization dance card filled, but two or three key slots should be hired or known. And, as much as I love CFO’s, that is not a key role at this juncture.

- No sustainable business model. I love my daughter but her model is selling a device to veterinary practices that only need one or two units, has no replacement parts and lasts forever. The good news is she wanted a “franchise” business – the type that just provides some additional income – and this fits the bill. But, she will never go beyond that stage of growth. If this is your model, think again about approaching investors.

- Too “me too.” You need to cure a pain and if someone else has done that and your differentiator is that you can do the same thing with one less step, think again about your model. If you always describe your product as “it’s just like a Xerox” (dating myself badly here) well then…

- No traction. This happens especially with multi-channel revenue streams. Concepts are not enough – the “build it and they will come” syndrome is not a winner. If you are getting less traction than bald tires on an icy road, solve that problem first. Money is not going to help you.

While there have been many entrepreneurs who have failed with investors, perhaps you can learn from their mistakes and improve your chances of being successful. Stay positive and keep innovating!