Did you buy or sell a piece of real estate? After all the fine details have been worked out, you will receive a real estate closing statement. A closing statement is more than just a piece of paper – it lists the transactions associated with the purchase or sale of a property, including the fees, agent commissions, and sales price. It is an essential document that outlines your basis for depreciating the property, the potential taxability of the sale, and the amounts that will be deposited or withdrawn from your bank account.

Let’s outline the fundamentals of closing statements, including their importance and how to read this document.

The Significance of a Real Estate Closing Statement

Closing statements are crucial because they help you determine how to record transactions on the sale of a property, whether that be for internal recordkeeping or tax purposes. Here are a few ways a closing statement is used:

- Tax Reporting – If you are selling a piece of real estate, the closing statement outlines the gross sale prices and costs you can deduct. This information is essential for calculating capital gains taxes on the sale of a property.

- Prorated Items – Certain expenses, like real estate taxes and HOA fees, may be prorated based on when the property is purchased or sold. Proration ensures property expenses are fairly divided between a buyer and a seller at the point of closing. Calculations are made based on the days each party owns the property. Prorated items are usually not included in the basis of the property. However, these numbers are crucial for accurate tax reporting.

- Depreciation – Real estate investors can depreciate the property over its useful life, such as 27.5 years for residential properties or 39 years for commercial properties. The closing statement outlines your property's cost basis.

- Recordkeeping – Individuals, investors and companies use closing statements to record all the details of the property sale on their financials. Proper recordkeeping is important because this will become your basis for the lifetime of the property until it is sold.

How to Read a Closing Statement

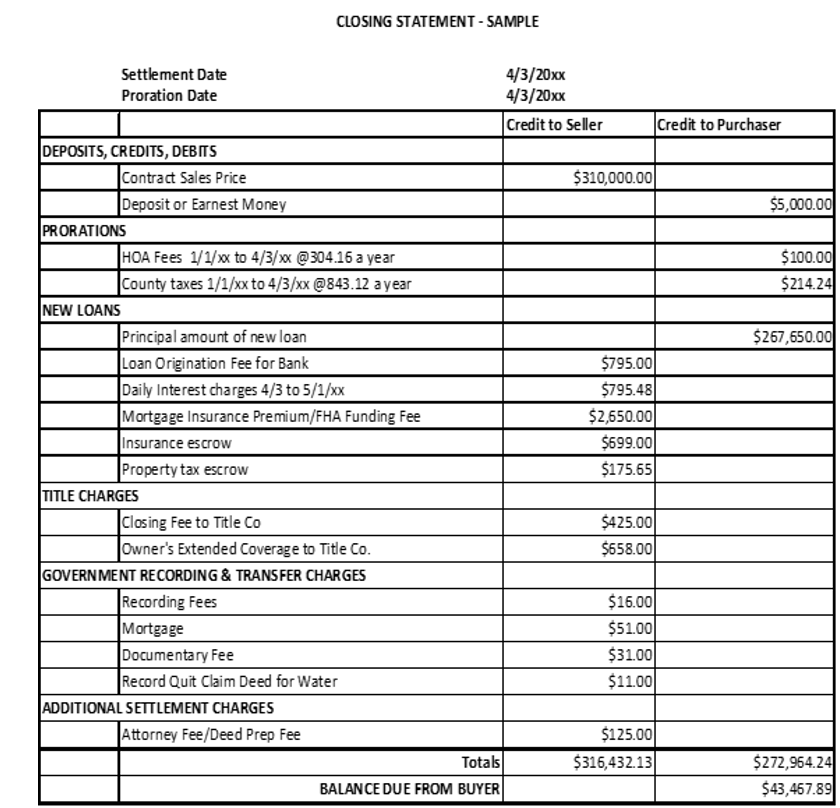

Now that we understand the importance of a closing statement, let’s break down how to read one. A typical closing statement will contain the following sections:

Deposits, Credits, Debits

Here, you will find the gross property sale price and any deposits or credits. In our example, the contract price is $310,000 and the buyer made a $5,000 downpayment.

Prorations

The prorations section will assign costs based on when the bill is paid and what period it covers. The expenses associated with each bill are allocated to the buyer and seller based on the period of ownership. In this example, HOA fees and county taxes have not yet been paid for year-to-date. These are a credit to the purchaser as the purchaser will ultimately pay them for a period during which they did not own the property.

New Loans

Transactions related to the financing of the property will be found in this section, including prepaid interest, mortgage insurance and other fees associated with obtaining the financing.

Title Charges

Before you can close on a property, a title company must verify that the seller has legitimate ownership of the property. These charges are generally the buyer’s responsibility.

Government Recording & Transfer Charges

Depending on the type of loan used, buyers may incur various fees, such as recording fees and quit claim deed charges.

Additional Settlement Charges

Any additional charges will be found in this section, such as attorney fees and agent commissions.

Recording the Transaction

Now that we outlined what each section means, let’s go through how this transaction would be recorded for a real estate investor purchasing the property. Here’s a simplified version of how the transaction will be recorded:

| Account Name | Debit | Credit | Description | |

|---|---|---|---|---|

| Debit | Building* | $310,000 | Sales price | |

| Credit | Deposit on Building** | $5,000 | Deposit or Earnest Money | |

| Credit | Association Expense | $100 | HOA Fees | |

| Credit | County Tax Expense | $214.24 | Credit for County Taxes | |

| Credit | Loan Payable | $267,650 | Principal Amount of New Loan | |

| Debit | Deferred Financing (intangible asset) | $795 | Loan Origination Fee | |

| Debit | Interest Expense | $795.48 | Daily Interest Charges 4/3 to 5/1 @ 28.41 a/day | |

| Debit | Deferred Financing (intangible asset) | $2,650 | Mortgage Insurance Premium / FHA Funding Fee | |

| Debit | Insurance Escrow (asset) | $699 | Insurance Escrow | |

| Debit | Property Tax Escrow (asset) | $175.65 | Property Tax Escrow | |

| Debit | Building* | $1,083 | Title Charges – Closing Fee and Owner’s Extended Coverage | |

| Debit | Building* | $109 | Government Recording & Transfer Charges | |

| Debit | Building* | $125 | Attorney Fees | |

| Credit | Cash | $43,467.89 | Balance Due From Owner | |

| Total | $316,432.13 | $316,432.13 |

**This assumes the buyer’s original $5,000 deposit was recorded to a deposit account. This entry will effectively reverse that transaction.

Understanding closing statements is essential for those ready to purchase or sell an investment property. It marks the beginning of the end of a real estate transaction. Be sure to examine the statement carefully and recognize what is being captured.

Author: Chelsea Magliore | [email protected]

Contact Us

Withum can assist you with properly recording your real estate transactions. If you need accounting and finance support, contact our Outsourced Accounting Systems and Services Team.