What Makes Us Tick Is More Important Than How We Get There

Every so often we have to sit back and assess our own performance – am I accomplishing what I set out to and, if not, why? When I first conceived of this blog, Charitable Nation, I envisioned a freewheeling discussion of all things philanthropic, from the motivation of particular philanthropists and success stories of certain charities to the nuts and bolts of the tax law affecting philanthropy. I believe that this wide ranging discussion is necessary because, frankly, my colleagues in the accounting, legal, and wealth management professions typically do only half the job in advising their clients in the field of philanthropy. Don’t get insulted – you all do a fine job in advising on the tools and techniques of planning but you often get lost when dealing with the clients’ “touchy-feely” motivations in pursuing certain estate planning and philanthropic strategies.

So looking at Charitable Nation, I realized that in recent weeks I too was falling prey to the technicians’ trap of focusing too intently on tools and techniques and ignoring the second part of the blog’s title “From Success to Significance.” In fact, daydreaming in the clouds on what could be is probably the most crucial first step in philanthropic planning. Without inspiration, all else fails.

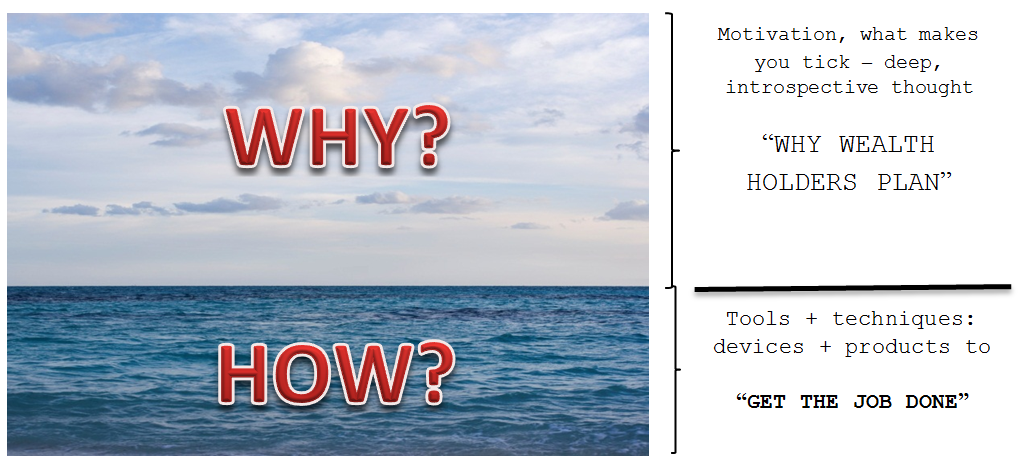

When you think about it, life can really be defined by two separate but interrelated spheres. The first sphere is the overriding one of belief systems, needs, desires, and motivation that points us in the direction of where we want to go. Sometimes, this sphere is crystal clear but more often it is nebulously defined and leaves us scratching our heads and wondering why we do what we do – and why we spend time doing things that clearly do not advance our own goals. In fact, this sphere can be distilled down into that one little word: “Why?” The second sphere is the rock solid, step-by-step, transaction-based set of tools that we use to accomplish our goals, whatever they may be. It, too, can be described in one word: “How?” Combining these two provides us with the motivation to make a difference and the tools to get us there.

There are all kinds of descriptions leading to the same place – the “roadmap” of figuring out where you want to be and then planning the appropriate concrete steps, the use of “mission” and “vision” statements in both the business and not-for-profit worlds to motivate stakeholders, etc., etc. In advising families, particularly with respect to charitable planning, we refer to this approach as the Planning Horizon, depicted graphically below.

The Planning Horizon is a metaphorical horizontal line. Conversations that take place above the horizon deal with the wealth holder’s deepest and most personal goals and objectives for their wealth. Conversations that take place below the horizon focus on strategies, planning devices, and products to achieve those goals. Because most advisors are technically oriented, they tend to spend far more time on the “how?” of planning than the “why?” The adviors are playing to their own strengths. They feel more comfortable in the technical world than in the motivational world but this can be problematic. I submit that they should consider reversing their approach and spend the bulk of their time in getting to really know what makes the wealth holder tick rather than just designing technically competent plans. This “getting to know you” will make the ultimate plan design far easier and will dramatically increase the probability of implementation.

For example, introspective wealth holders definitely spend more time “above the horizon” thinking about what they are trying to achieve and why they want to achieve it. “Below the horizon” is a means to an end which advisors can implement fully only if they completely grasp what drives the wealth holder. Therefore, advisors who ignore the “touchy feely” segment of the planning process do so at their own peril. Their chance of connecting with their introspective clients diminishes and any plans they devise will fall short when they don’t take the client’s true motivations into account.

The same can be said about less introspective wealth holders. Because the wealth holders themselves may not feel completely comfortable confronting their goals and aspirations head on, they need guidance in framing these issues or they will not act. In such a case, if the advisor ignores the “why?” s/he will definitely be setting the client up for a failed plan. The fact is, you can build a truly fine Ferrari for your client but without gas in the tank, it isn’t going anywhere!

So the moral of the story is clear – all of us, wealth holders and advisors alike — need to spend more time thinking about our goals and objectives. What motivates us to act? Who are we trying to benefit and how? How do we truly move from success to significance?