Tools & Techniques 101 – Split Interest Trusts Let You Have Your Cake and Eat It, Too!

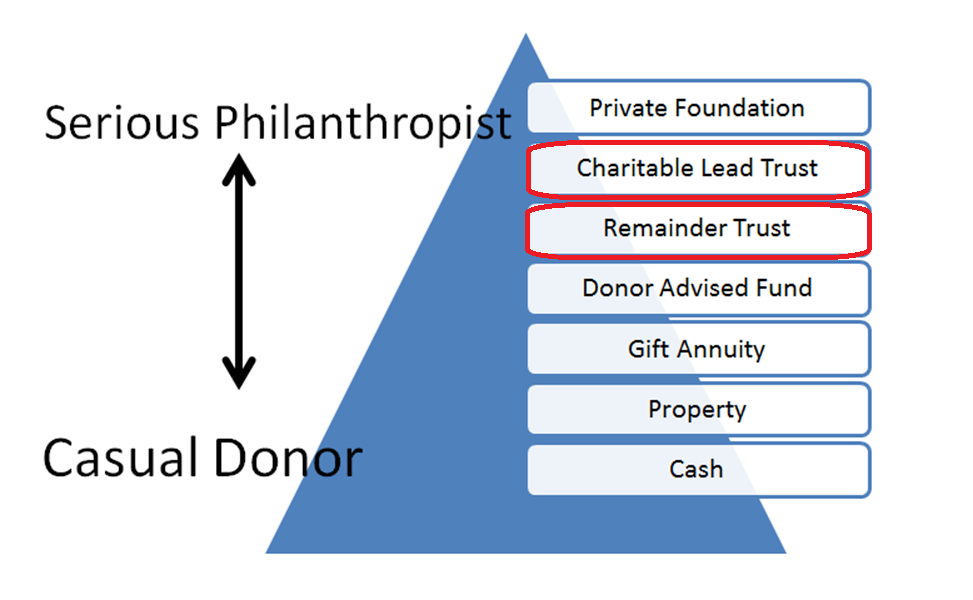

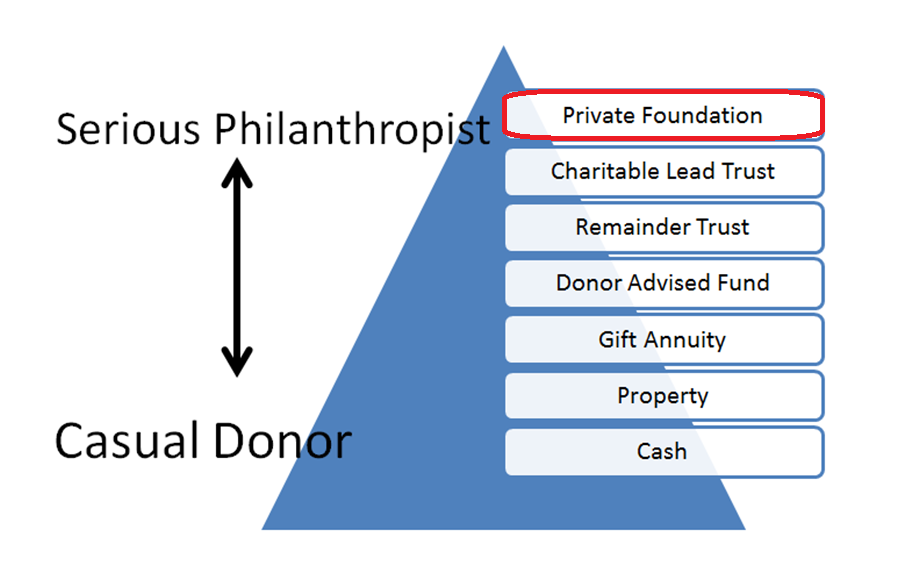

Decidedly not sexy but powerful planning techniques – the charitable remainder trust and the charitable lead trust. Both of these are “split interest trusts” wherein a portion of value is transferred to a “charitable” beneficiary and a portion of value is retained by a “noncharitable” beneficiary. (Keep it straight if you can – a “noncharitable” beneficiary is a beneficiary that is not a charity while a “charitable” beneficiary is… a charity!) Both the CRT and the CLT come in different flavors – annuity trusts, unitrusts, terms of years, etc. but they both serve similar purposes – they enable some value to be retained in the hands of the donor or other “noncharity” while transferring some value into the hands of an appropriate charity. The differences are many, but can be boiled down to when the charity receives its due – during the life of the trust or at its termination.

Charitable Remainder Trust (CRT)

The CRT is a tax exempt trust in which the donor or other noncharitable beneficiary retains the income interest from the trust for a period of years for the life or lives of one or more individuals. The donor transfers cash or other property into the trust and in return, receives periodic payments over the term of the trust. For income tax purposes, in the first year, the donor can deduct the actuarial present value of the remainder interest as a current charitable contribution. Upon termination, any assets remaining in the trust pass to one or more charities. Its best use is for a donor who wants to make a large charitable gift while retaining the income from the property for himself and/or his spouse or other heir. [1] It can also be used to monetize and diversify an asset or asset pool at little or no tax cost to the donor.

Charitable Lead Trust (CLT)

The CLT, in many ways, is the mirror image of the CRT. In a CLT, the CHARITY receives the income stream over the term of the trust with the remainder reverting to the donor or another noncharitable beneficiary at termination. Donors who wish to provide an income stream to charity without actually relinquishing the underlying assets will find this technique appealing, especially as an estate freezing technique. Contributions to “qualified” CLT’s (those in which the donor retains the income tax obligation) yield an income tax deduction while contributions to “non-qualified” CLT’s (those in which the income tax obligation is passed to the trust) do not. Unlike CRT’s, CLT’s are NOT tax exempt.

Variations on a Theme

Because of the split interest nature of these trusts, there are many variations to CRT’s and CLT’s and the planning can become quite complex. Determining if and when such a trust makes sense for you requires careful planning and the advice of experts. Properly designed, however, these trusts make a terrific adjunct to a well-crafted estate and income tax plan. Consult your tax or legal advisor for more details.

|

Charitable Remainder Trusts |

|

|

Advantages |

Disadvantages |

| The CRT is a tax exempt entity. Therefore, it enables you to monetize highly appreciated assets with no tax cost to the trust and little or no tax cost to you. If structured properly, CRT’s can also effectively act as an installment sale vehicle for the disposition of highly appreciated assets. | There is a minimum annual payout rate of 5% set at the time the trust is established and a maximum payout of 50%. Variables include the government-specified §7520 rate and the age(s) of the donor(s) |

| Payments can be made over the life or lifetimes of the beneficiary(ies) or for a fixed period of up to 20 years. | There are legal costs to set up and administer these trusts, possible trustees’ commissions to consider, and the cost of preparing the annual tax return. |

Variations on a theme – CRT’s can be:

|

Work best in a higher interest rate environment. The higher the interest rate, the greater the probability that both the income flow to the noncharitable beneficiary and the eventual remainder interest going to the charity will be meaningful. |

|

Charitable Lead Trusts |

|

|

Advantages |

Disadvantages |

| Enables the donor to provide a charitable benefit of an income stream without giving away the underlying assets | CLT’s are NOT tax exempt trusts:

|

| For the extremely generous donor, the nonqualified, non-grantor lead trust can circumvent the adjusted gross income (AGI) limitation on charitable contributions. Even if you max out on these limits, you can still fund and operate a CLT. | Contributions to non-qualified CLT’s are NOT tax deductible under any circumstances. |

| A contribution to a qualified CLT may generate a charitable contribution at inception. | Contributions to a qualified CLT trust are considered gifts “for the use” of charity rather than gifts “to” charity and the deductibility is therefore limited to 30% of AGI (20% for an appreciated property) |

Variations on a theme – CLT’s can be:

|

Complex compliance: Must comply with many of the private foundation rules (such as the rules against self-dealing, excess business holdings, jeopardy investments, and taxable expenditures) |