The Passive Bubble?

By Anthony DiLorenzo, MS, Staff II Accountant – WithumSmith+Brown, PC

Passive investing led by ETFs (exchange traded funds) have become the go-to investment vehicle for many average investors over the last 10 years. Investopedia defines an ETF as:

A marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund. Unlike mutual funds, an ETF trades like a common stock on a stock exchange. ETFs experience price changes throughout the day as they are bought and sold. ETFs typically have higher daily liquidity and lower fees than mutual fund shares, making them an attractive alternative for individual investors.[1]

ETF benefits are highly touted on almost every financial website; even the definition above offers plenty of praise. The question is: can too much of a good thing become a problem in the aggregate? The answer may very well be yes.

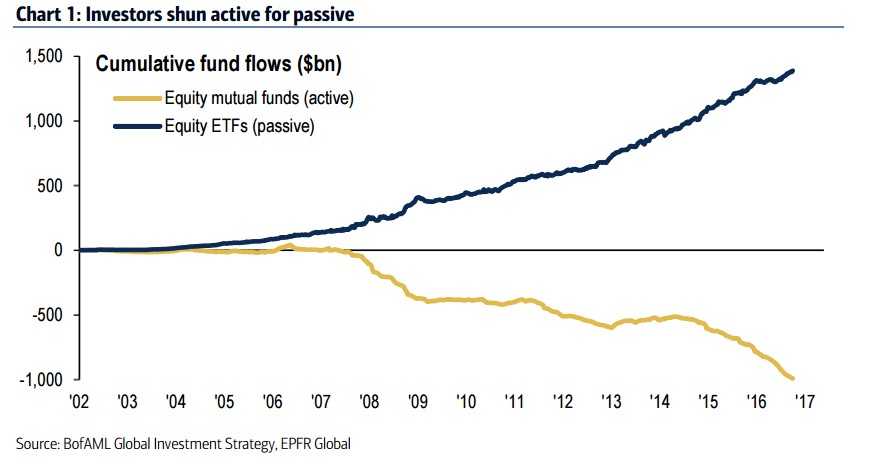

Since the last financial crash we have witnessed a sizable shift in the way the average American invests. Americans no longer tend to buy individual stocks in their personal account. The trend instead has been to buy passive ETFs. In theory, this helps diversify their holdings and adds flexibility for a fraction of the cost. Moreover, this passive style has become even more popular in long-term accounts such as IRAs and 401(k)s. Professionally managed funds (which carry more fees) are being shunned for cheaper passive investment alternatives instead. This trend has rapidly accelerated over the last few years. Large flows of cash has been leaving managed funds while at the same time cash is being pushed into equites because of the historically low rates.

The investing environment today is more about buying and forgetting vs fundamentals or value. The average investor now seems to thinks you can buy some ETFs or passive funds and forget about your money for an extended period of time. It also seems more and more of the public has bought into this notion. According to data from Thomas Reuters, the ETF market is growing by nearly 30% a year. We have also seen the rise of Robo-advisors in recent years. This shift has largely been fueled by the bad press and a negative view of Wall Street. The public perception of fund managers is that they are greedy and pointless. They believe managers are taking their hard earned money due to a slightly larger fee and cannot seem to even outperform the S&P 500. In an article titled “Bad times for active managers” posted on CNBC, the author explained:

Active funds stumbled through another brutal year, with barely 1 in 3 large-cap managers able to beat the S&P 500, according to figures released Wednesday by S&P Dow Jones Indices. The news got worse farther down the scale, with 89.4 percent of mid-cap managers falling short and 85.5 percent of small-cap managers missing.

Things didn’t get better over longer time frames either, with most managers falling short over 1, 3, 5, 10 and 15 year spans. [2]

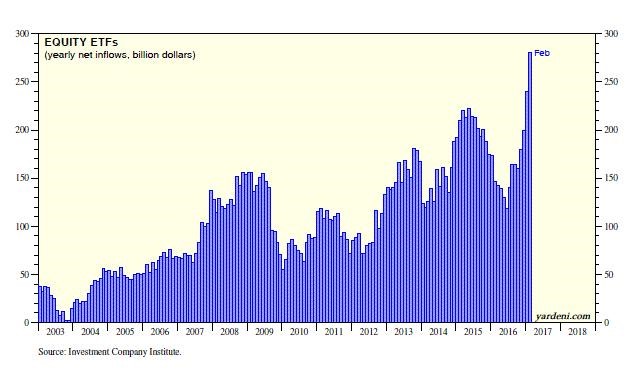

If we look deeper, however, the market itself may actually be the anomaly here. With the massive inflow we have seen over the last few years, any stock in an ETF or passive fund will almost automatically catch a bid. ETFs will buy all the stocks they are holding as long as the inflows keep pouring in. Stocks with exposure to many ETFs and or large percentages of ETFs will have an invisible hand forcing them higher, as long as the inflows continue. Therein lies the problem: everything will be fine only as long as inflows continue. The below chart shows how inflows into equity ETFs have reached an excessive level in 2017:

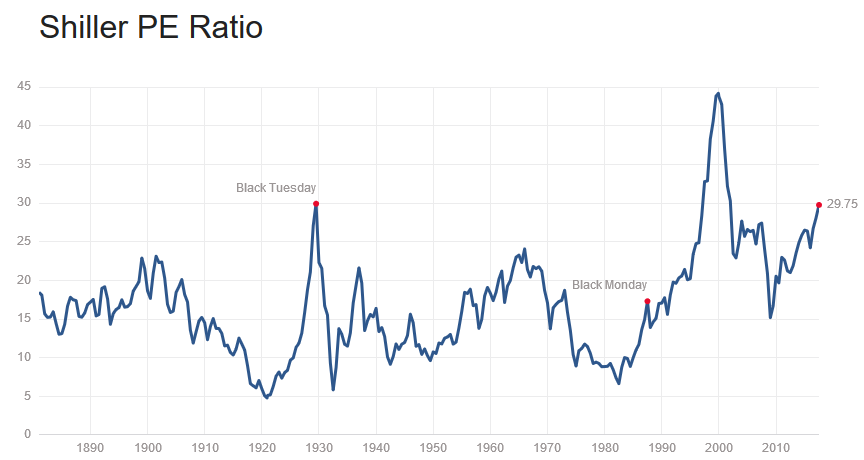

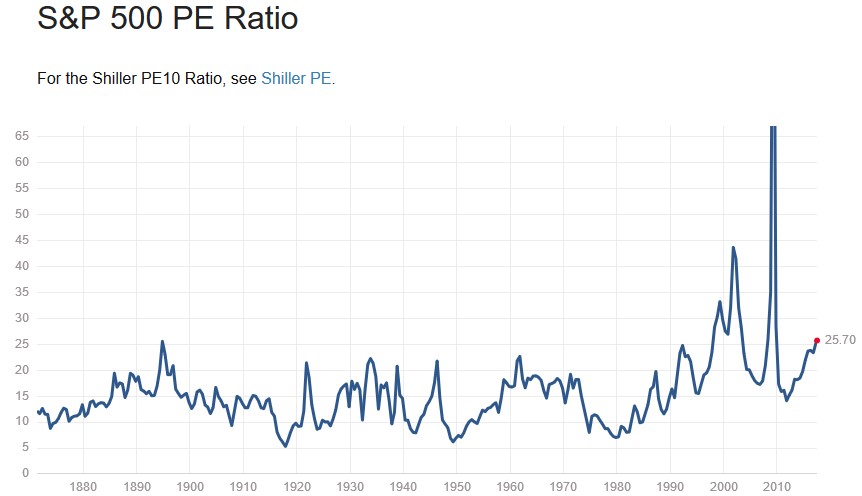

Investors have reached the point where the on the average they do not seem to care if an individual stocks is overvalued, has management problems, or is just falling out of favor. Instead they just buy the ETFs or the fund with the best return over the last year and keep adding to that position without much regard. In fact, it is likely that most retail investors have no idea regarding their actual holdings after purchasing a passive investment vehicle. This type of investing has led to the entire market becoming overvalued using some of the most common metrics. Below is the Shiller PE Ratio a Price earnings ratio based on average inflation-adjusted earnings from the previous 10 years as well as a normal PE ratio chat [3]:

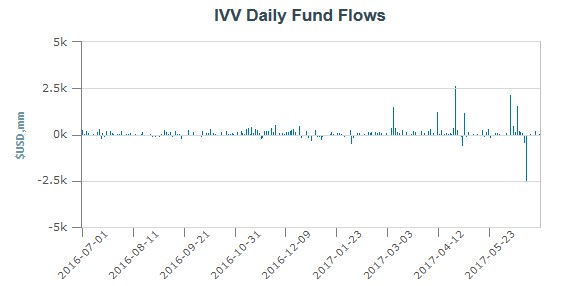

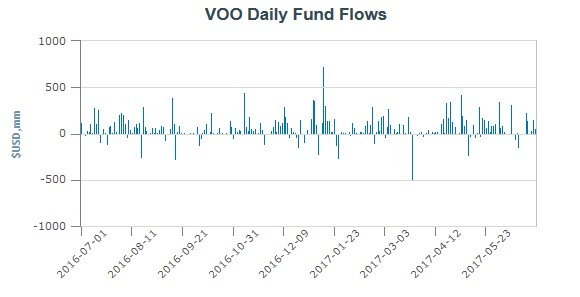

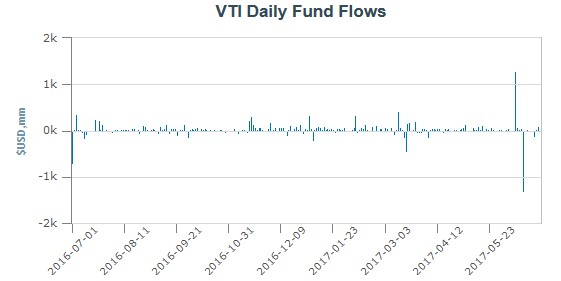

To dive deeper, we can take a look at the daily fund flows of some of the most common passive ETFs traded today – IVV (ishares Core S&P 500 ETF), VOO (Vanguard S&P 500 ETF), and VTI (Vanguard Total Stock Market ETF). Overwhelmingly, we have seen that inflows have vastly outnumbered outflows. As evidenced by the charts below from ETF.com, we are also able to see the amount of inflows has significantly increased as we moved into 2017:

A great example of the distortion that the inflows from passive investing has unleashed can be seen in some of the most popular mega cap stocks. These stocks have rallied significantly and in lockstep with the increase in ETF inflows as shown in the fund flow charts above. They are in numerous ETFs and passive-type funds, which has helped create a very large tailwind from the large group inflows. These specific stocks account for much of the gains in the S&P 500. These large percentage moves have exaggerated the herd mentality which triggers other types of inflows mainly from active investors chasing gains. This is why every negative pullback has been getting bought almost immediately in these types of stocks, as well as the in the broader market. The ETFs inflows are keeping a constant bid under prices which is leading to excessive valuations of individual stocks. The type of movement we have seen in some of the stocks listed in the chart below is very abnormal and consistent with prior bubble behavior.

To further the point, these stocks have some of the largest ETF exposure in the entire market:

- There are 51 ETFs that have McDonald’s Corp (MCD) as a Top 15 holding, as displayed in the table below. However, there are 201 ETFs with exposure to McDonald’s Corp (MCD).

- There are 135 ETFs that have Apple Inc (AAPL) as a Top 15 holding, as displayed in the table below. However, there are 239 ETFs with exposure to Apple Inc (AAPL).

- There are 105 ETFs that have Amazon.com Inc (AMZN) as a Top 15 holding, as displayed in the table below. However, there are 177 ETFs with exposure to Amazon.com Inc (AMZN).

- There are 91 ETFs that have Facebook Inc (FB) as a Top 15 holding, as displayed in the table below. However, there are 185 ETFs with exposure to Facebook Inc (FB).

- There are 133 ETFs that have Johnson & Johnson (JNJ) as a Top 15 holding, as displayed in the table below. However, there are 222 ETFs with exposure to Johnson & Johnson (JNJ). [4]

Once again, on an individual level, there is nothing wrong with passive investing. The problem seems to be stemming from the aggregate. The seismic shift to passive investing seems to be causing a large distortion of the market. The issue here is money is finite and the river of inflows into passive investments will eventually dry up. Even more disturbing is the possibility that the inflows will turn into extensive outflows. In such a scenario the opposite of what we have seen over the last few years will occur, and every equity with a large ETF exposure will see extensive selling pressure. There will be no hiding with diversification as many major stocks in every sector will feel the gravity of investors pulling their money out of the market with no regard for the individual stocks encompassing the ETF. The exuberance of passive investing may very well turn into a panic for the exits as the herd mentality takes over, as it has so many times throughout history.