Captive insurance companies, while recently under regulatory scrutiny, have historically provided significant financial benefits including improved profitability, tax savings, and the ability to accumulate wealth for company owners.

At a high level, a captive insurance company is a mechanism for self-insuring through a separately owned insurance company. The operating company pays insurance premiums to the captive insurance company, generating an ordinary tax deduction. The captive insurance company only pays tax on the investment income earned since the premiums received are not taxable.

Once the policies mature, the captive insurance company makes cash distributions to owners in the form of qualified dividends, which are taxed at preferential rates. Captive insurance companies are particularly popular in the dealership industry as most savvy dealers use captive reinsurance companies in conjunction with sales of financing and insurance (F&I) products, such as extended warranties or GAP coverage.

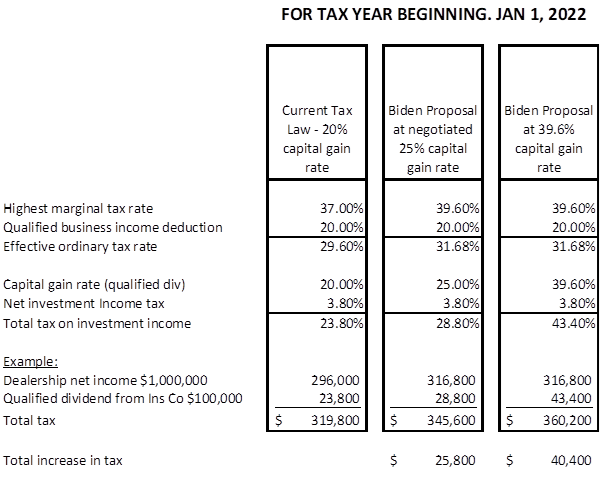

According to President Biden’s proposed tax plan, the tax benefits of captive insurance company arrangements may be altered or could potentially become non-existent. President Biden’s tax proposal will increase the individual top marginal tax rate beginning January 1, 2022 to 39.6% for individuals with taxable income over $509,300. The long-term capital gains and qualified dividend tax rate would be increased to 39.6% (plus the 3.8% net investment income tax) for taxpayers with over $1 Million in adjusted gross Income.

It is still unclear whether Biden’s tax proposal will be retroactive to April 2021 or what the final preferential tax rates will be, but it is important for companies and dealerships to start preparing themselves for these potential tax changes.

- Consider accelerating distributions from the reinsurance company before December 31, 2021

- Consider termination of the current reinsurance company

- Consider deferring distributions until the next change in administration comes along and reduces tax rates

Author: Kristin Reese-Scalabrino, CPA | [email protected]