Secondment in Perth, Western Australia – Another Busy Season Bites the Dust

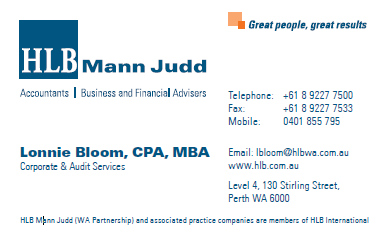

This summer I had the amazing opportunity to work in Perth, Western Australia for four months as a secondee for HLB Mann Judd. My role as senior auditor included planning, conducting and finalizing all aspects of new and reoccurring audits. I also assisted managers with substantive testing and additional procedures necessary to complete their jobs.

This summer I had the amazing opportunity to work in Perth, Western Australia for four months as a secondee for HLB Mann Judd. My role as senior auditor included planning, conducting and finalizing all aspects of new and reoccurring audits. I also assisted managers with substantive testing and additional procedures necessary to complete their jobs.

Even though I was using new audit software (CaseWare) and worked on clients in a new industry (Exploration & Mining), I felt a sense of similarity when setting up workpapers, documenting analytics and completing long checklists and audit programs. The biggest change for me was getting familiar with the exploration industry and Australian accounting standards. Some interesting facts I noted during my experience were the following:

- Mining is huge part of Western Australia’s economy. The major commodities include Iron ore, petroleum, gold, alumina, and other various minerals

- During the mining boom, the mining and the petroleum industry accounted for almost 90 percent of the State’s income from total merchandise exports. In 2009, the industry had a value of $A61 billion. During this time, mining companies held large amounts of cash to pay their employees and on any given mining site, janitors, cooks, and bookkeepers could easily earn over $100k per year

- Those that have to fly into their mine site are considered Fly in Fly out (FIFO) workers. These miners would fly to their work site for the duration of their roster then fly home when they are off duty. This is typical in the mining industry.

- The mining industry has been on the decline for the past few years due to unstable resource prices and has caused job cuts and increased unemployment rates. This has also led many companies to seek additional funding and capital raisings to continue their exploration activities

- An entity is considered a “Mining” company when an exploration and evaluation asset has reached a point when the technical feasibility and commercial viability of extracting a mineral resource are demonstrable. Companies that have not reached this point of technical feasibility but maintain rights to explore the land are considered exploration companies

- Mostly all of the clients I dealt with were exploration companies listed with the Australian Stock Exchange (ASX). All of my clients were unique but generally had some similar characteristics. Some activities these companies were facing include the following:

- Revenue – since these exploration companies have yet to “strike gold”, they only reflected minimal revenue (i.e. interest revenue)

- Capital raisings – exploration companies listed on ASX are selling shares for pennies. It is common to see companies issue millions of shares in order to raise funds which they would use to continue their exploration. Larger companies and wealthy individuals would purchase these shares also in hopes to “strike gold”

- Large balance sheets – money spent on these exploration sites (tenements) would be capitalized according to the standard, which would be reflected on their balance sheets

- Impairment – exploration and evaluation assets are assessed for impairment when facts and circumstances suggest that the carrying amount may exceed its recoverable amount. Triggers for impairment include expiration of their rights to explore, substantive expenditure on further exploration is not budgeted or planned, or the entity has decided to discontinue operations since the exploration of specific areas has not led to the discovery of commercially viable quantities of mineral resources. Large impairments were common with my clients

- Going concern – all exploration clients I dealt with had going concern issues. I grew used to reviewing cash flow forecasts and documenting that the companies would need to seek additional funding in the coming year in order to meet its planned exploration expenditure

Working with new faces and learning the quirks of each manager and partner reviewing your work made things interesting. HLB Mann Judd welcomed me with open arms and made me feel like I’ve been working with the team for years. I am forever grateful for the opportunity and will always remember my experience with a new firm in a foreign country.

The industry was different and the work was challenging at times, but my experience in Australia extends beyond the cubicle walls at HLB Mann Judd, as you will hear about in my next few blog posts.

By Lonnie Bloom, MBA | 609.520.1188 | [email protected]