One question real estate developers are faced with is when to capitalize and when to expense costs incurred before, during and after production.

As a result of the Tax Cuts and Jobs Act (“TCJA”), additional analysis may be required to determine the appropriate recognition of costs, depending on whether the taxpayer is considered a large business taxpayer or a small business taxpayer.

As part of the TCJA, the threshold in determining whether small business taxpayers meet the exception for following real estate capitalization guidelines under Section 263A was increased to $25 million. This provides an opportunity for those small business taxpayers to potentially deduct certain indirect expenses related to the production of real property in the year the deductions are incurred. In determining whether a taxpayer is considered a small business taxpayer, it must meet the gross receipts test under Section 448(c) and not be considered a tax shelter. The gross receipts test under Section 448(c) is met if the taxpayer’s average annual gross receipts for the past three taxable years does not exceed $25 million (this amount is adjusted for inflation). However, when performing this calculation under Section 448(c), the taxpayer must consider the aggregation rules and include other entities that meet those rules in determining the gross receipts figure.

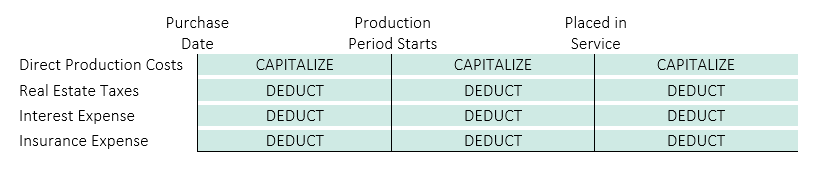

If an entity is under the $25 million gross receipts threshold, only costs directly associated with the production of real property are required to be capitalized. Other costs such as interest, real estate taxes and insurance may be expensed as incurred and not capitalized in the basis of the real property. If the entity now meets this exception threshold as a small business taxpayer (and previously did not under the prior regulations), the taxpayer is required to file Form 3115 to elect a change in accounting method to apply these regulations. If a taxpayer does not file for the change in accounting method it will be required to capitalize costs as a large business taxpayer as explained below.

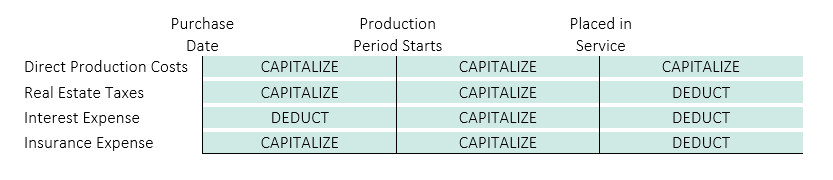

For those entities exceeding the gross receipts threshold of $25 million, the recording of costs are not as straight forward. These entities are required to follow the regulations under code Section 263A which requires capitalization of certain indirect costs related to the production of real property. Below is a useful guide to how those costs should be recorded before, during and after the production period.

Production Period

The production period for real property begins the date that any physical production activity takes place with respect to the unit of real property. The following is a partial list of examples that may indicate whether physical production activity has occurred:

- Clearing, grading, or excavating of raw land;

- Demolishing a building or gutting a standing building;

- Engaging in the construction of infrastructures, such as roads, sewers, sidewalks, cables, and wiring;

- Undertaking structural, mechanical, or electrical activities with respect to a building or other structure; or

- Engaging in landscaping activities.

- In the case of real property constructed by the taxpayer for use in a trade or business, the production period ends when the property is placed in service. In the case of property developed for sale, the production period ends when the property is ready to be held for sale.

Direct Production Costs

All direct production costs of the property must be capitalized.

Real Estate Taxes

Real estate developers must capitalize real estate taxes paid, even if no development has taken place if it is reasonably likely when the taxes are incurred that the property will be subsequently developed.

Interest Expense

Interest incurred before the production period begins may be deducted as investment interest expense. Once the production period begins, interest expense should be capitalized using the avoided cost method. Under the avoided cost method, any interest that theoretically would have been avoided if production expenses had been used to repay or reduce outstanding debt must be capitalized. At the end of the production period, interest would again be deductible.

If there is a suspension in the production period for 120 consecutive days (without regard to normal delays for weather, etc.), capitalization of interest is not required and interest incurred may be retroactively deducted.

Insurance Expense

Any insurance expense properly allocable to the production activity must be capitalized and included in the basis of the asset when production is complete. These costs should be capitalized during the pre-production period if it is reasonably likely at the time the costs are incurred that production will occur at some future date.

Small Business Taxpayer (gross receipts less than $25M)

Large Business Taxpayer (gross receipts exceed $25M)

Contact Us

If you have any questions on real estate capitalizing, whether an entity meets the exception, filing for the change in accounting method or how your costs should be recognized, please contact a member of Withum’s Real Estate Services Team.